Analysis

February 21, 2023

Weekly Raw Steel Output Edges Down: AISI

Written by David Schollaert

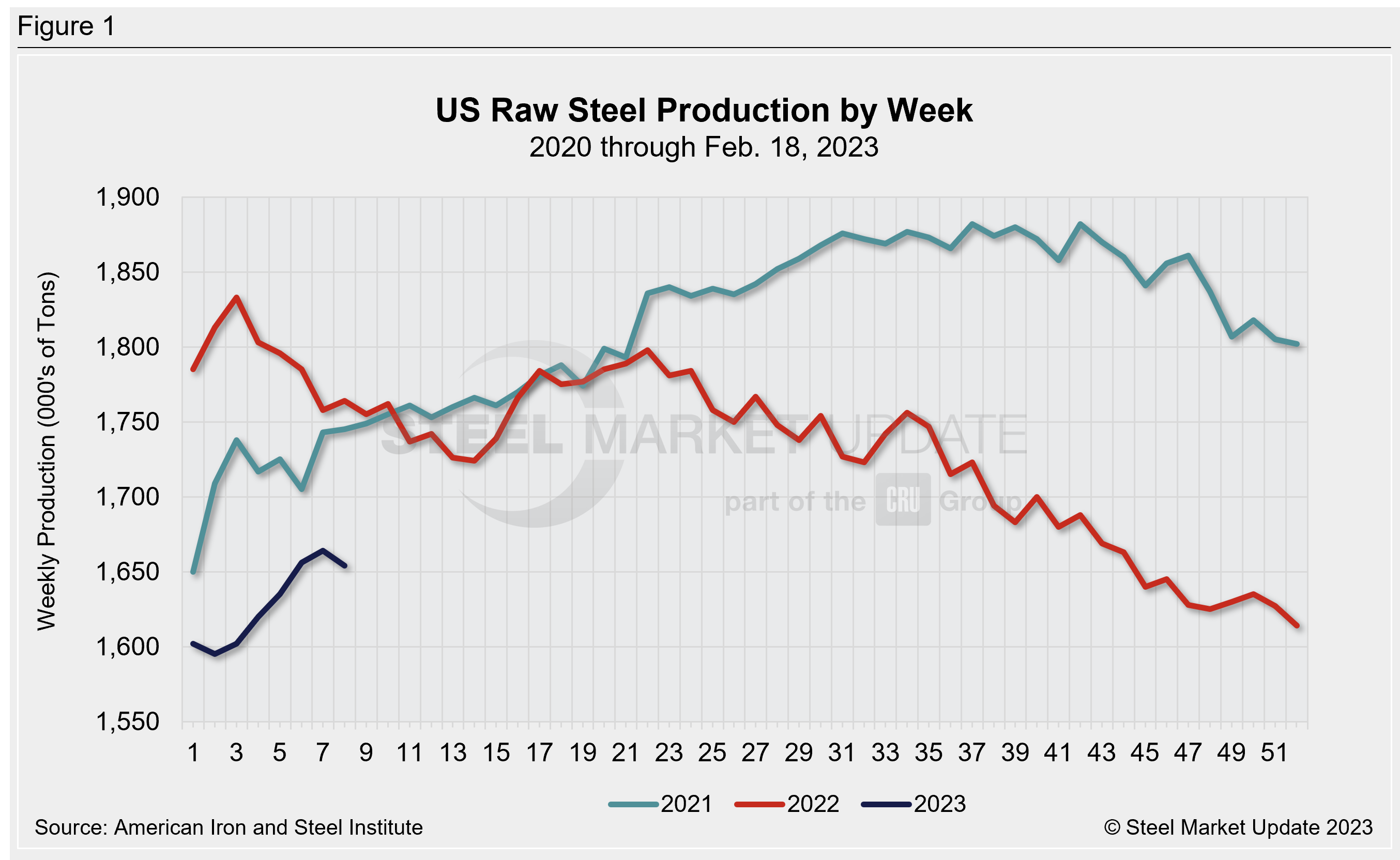

Raw steel production by US mills slipped last week following five straight weeks of increases, according to data released by the American Iron and Steel Institute (AISI) on Tuesday, Feb. 21.

The decline pushed capacity utilization down to 74%, driven by decreases in tons in all regions except for the South. This is down from the prior week’s 74.4%, and down from 80.8% a year ago.

Domestic mills produced 1,654,000 net tons in the week ending Feb.18, down 0.6%, or 10,000 tons, from the previous week, and down 5.8% from 1,755,000 tons in the same week last year.

Adjusted year-to-date (YTD) production through Feb. 18 stood at 11,426,000 tons, with YTD capacity utilization at 73%. That’s 6.3% below the 12,199,000 tons in the same YTD period in 2022 when capacity utilization was 80.3%, AISI said.

Production by region for the week ending Feb. 18 is below. (Note: week-over-week change is in parentheses.)

- Northeast, 154,000 tons (down 2,000 tons)

- Great Lakes, 512,000 tons (down 12,000 tons)

- Midwest, 202,000 tons (down 1,000 tons)

- South, 724,000 tons (up 6,000 tons)

- West, 62,000 tons (down 1,000 tons)

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7,” published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of US production capacity.

By David Schollaert, david@steelmarketupdate.com