Prices

February 16, 2023

Mills Less Willing to Negotiate Tags, Steel Buyers Say

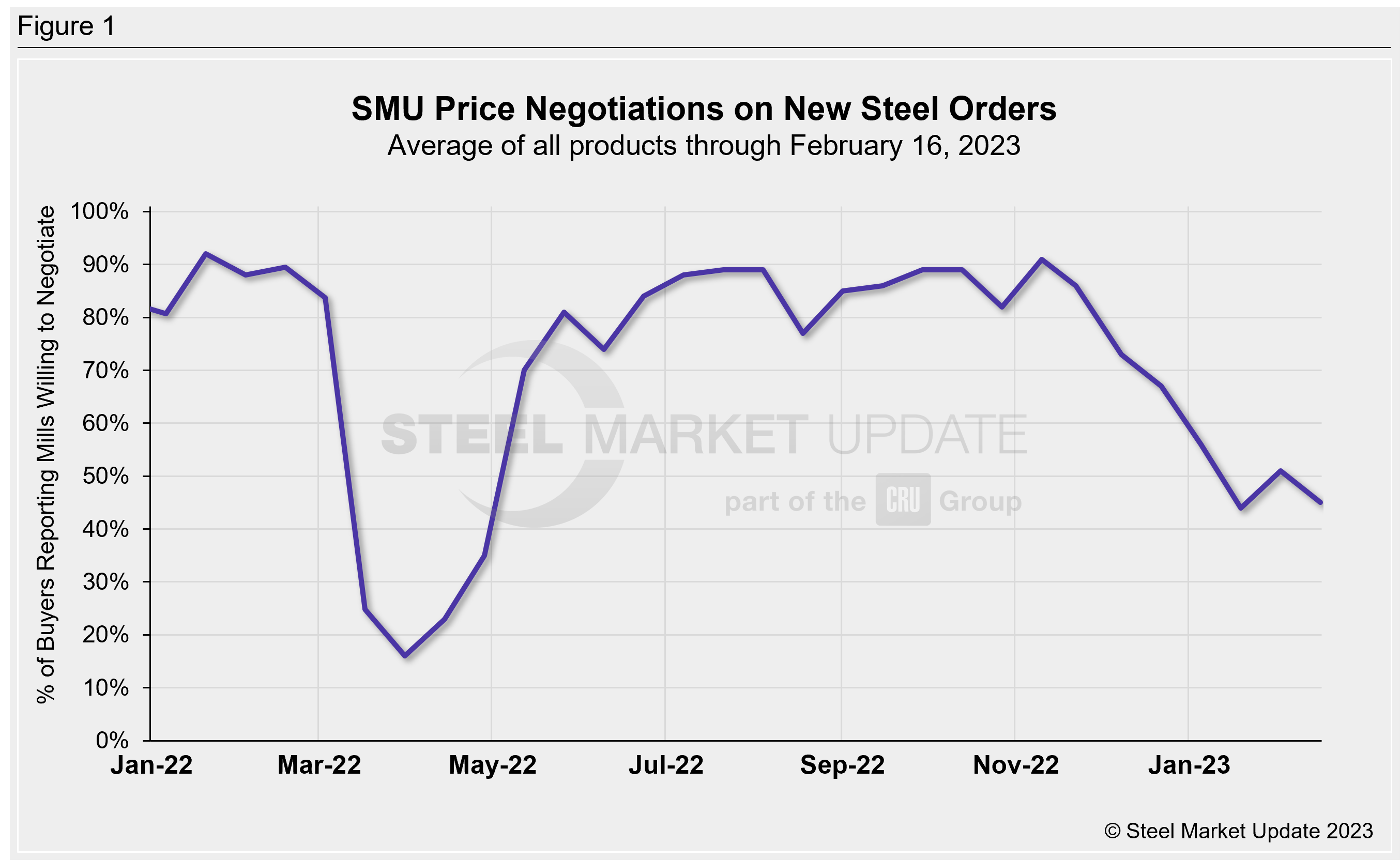

The percentage of steel buyers polled finding mills willing to negotiate prices has sunk back below 50% this week, according to SMU data.

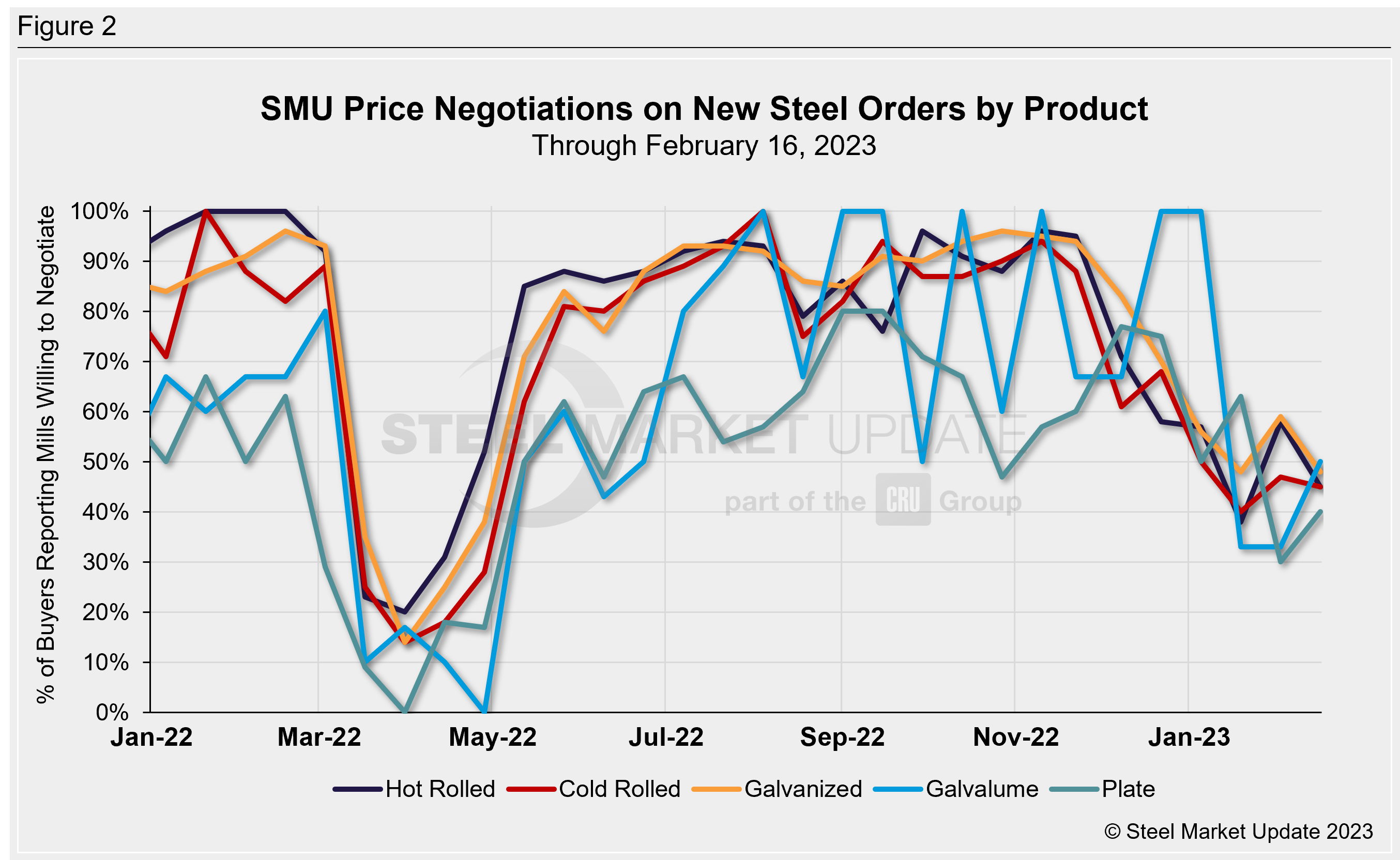

No product surveyed exceeded 50%, with Galvalume the only product to hit the 50% mark.

Every two weeks, SMU asks hundreds of steel buyers: Are you finding domestic mills willing to negotiate spot pricing on new orders? This week 45% of steel buyers polled on average reported mills were willing to negotiate new orders, dropping from an average rate of 51% two weeks ago. This indicates that last survey’s rise above 50% might be more of a blip than indicating a trend. Rates had been creeping down since the end of November.

Figure 2 below shows negotiation rates by various products. This week, plate was up 10 percentage points to 40% of respondents saying mills were willing to talk price compared with the last market check, and Galvalume was up 17 percentage points to 50% in the same comparison. Stil, the Galvalume market is very volatile, with fewer participants. However, hot-rolled fell 13 percentage points to 45% reporting mills willing to negotiate prices on new orders compared with two weeks ago; cold rolled was down 2 percentage points to 47%; and galvanized was off 11 percentage points at 48%.

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Ethan Bernard, ethan@steelmarketupdate.com