Prices

February 13, 2023

US Steel Exports Declined In December

Written by Becca Moczygemba

US steel exports decreased in December compared to November, according to the latest US Commerce Department data.

December’s exports total stood at 592,060 tons vs. 697,447 tons the previous month. December was the lowest volume month for 2022.

In comparison to recent years, export levels were relatively high for the majority of 2022.

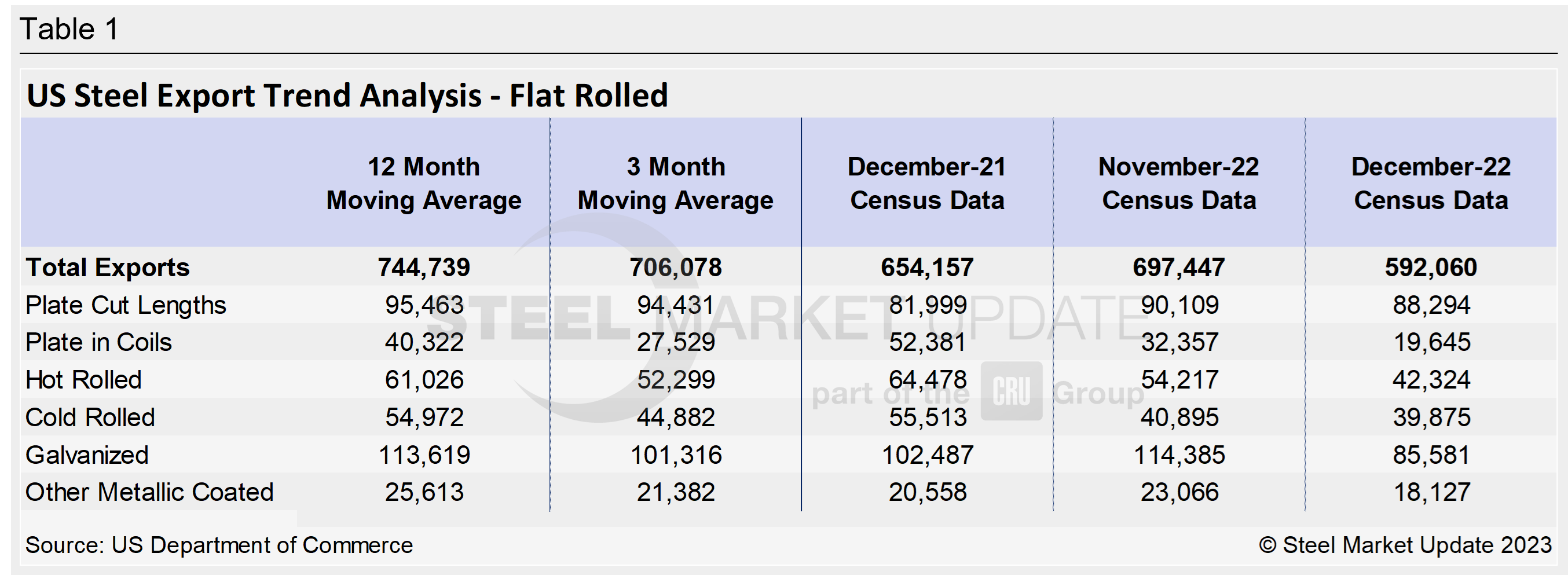

Of our six monitored product groups in Table 1, all six decreased month-over-month (MoM).

On a year-to-date (YTD) basis, total steel exports for 2022 now average 744,739 tons per month. This is up from a monthly average of 654,157 tons in the same period of 2021.

(Figure 2).

Here is a detailed breakdown by product:

Cut-to-length plate exports decreased 2% MoM to 88,294 tons in December vs. November, but increased 7.7% compared to levels one year prior.

Exports of coiled plate were 19,645 tons in December, a significant drop from 32,357 tons in November.

December hot-rolled steel exports decreased 22% from 54,217 in November to 42,324.

Exports of cold-rolled products were 40,895 tons in November and dipped slightly to 39,875 tons in December.

Galvanized exports in December were 85,581 tons, down 25% compared to November and down 16% year over year.

Exports of all other metallic-coated products dropped MoM to 18,127 tons.

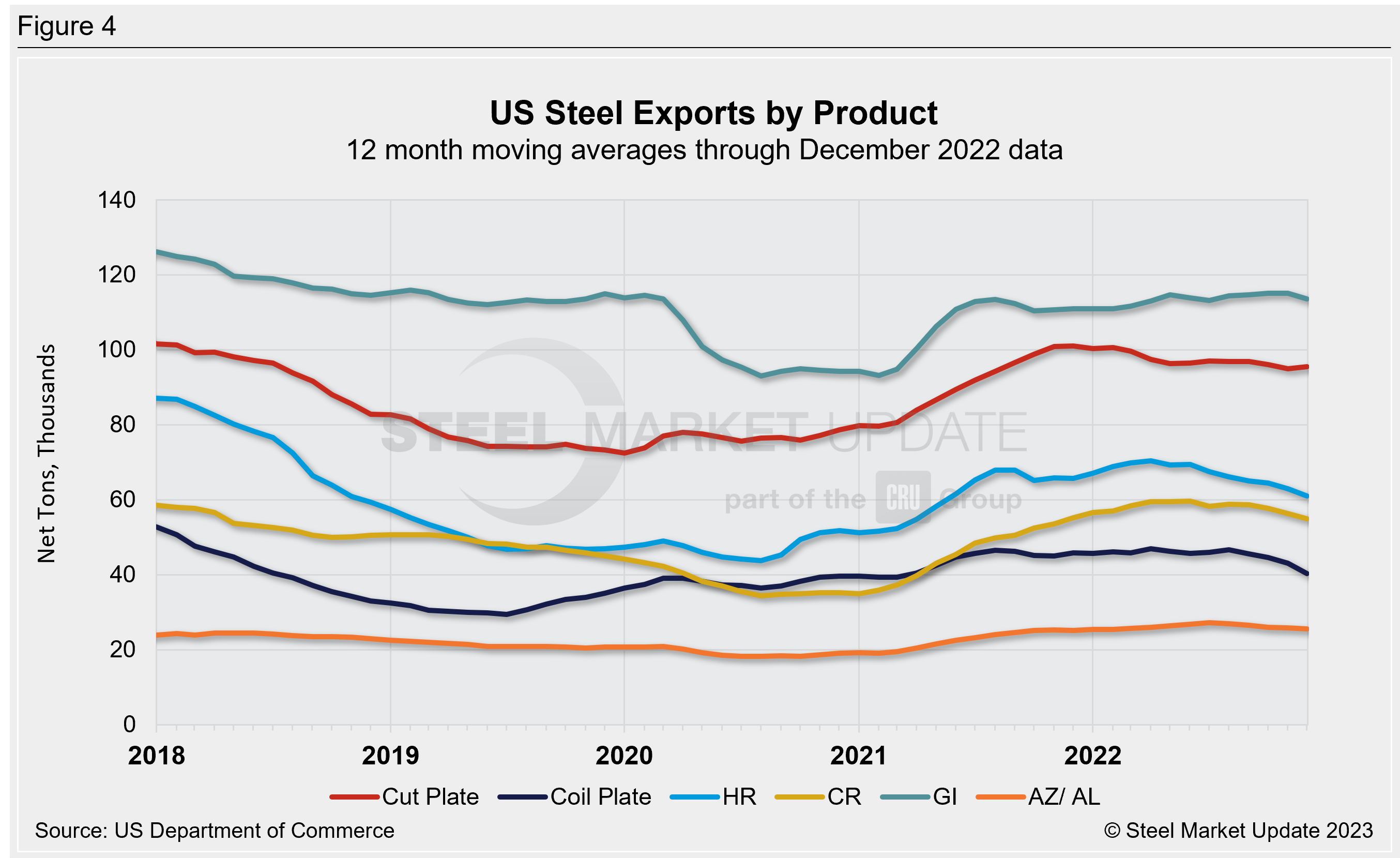

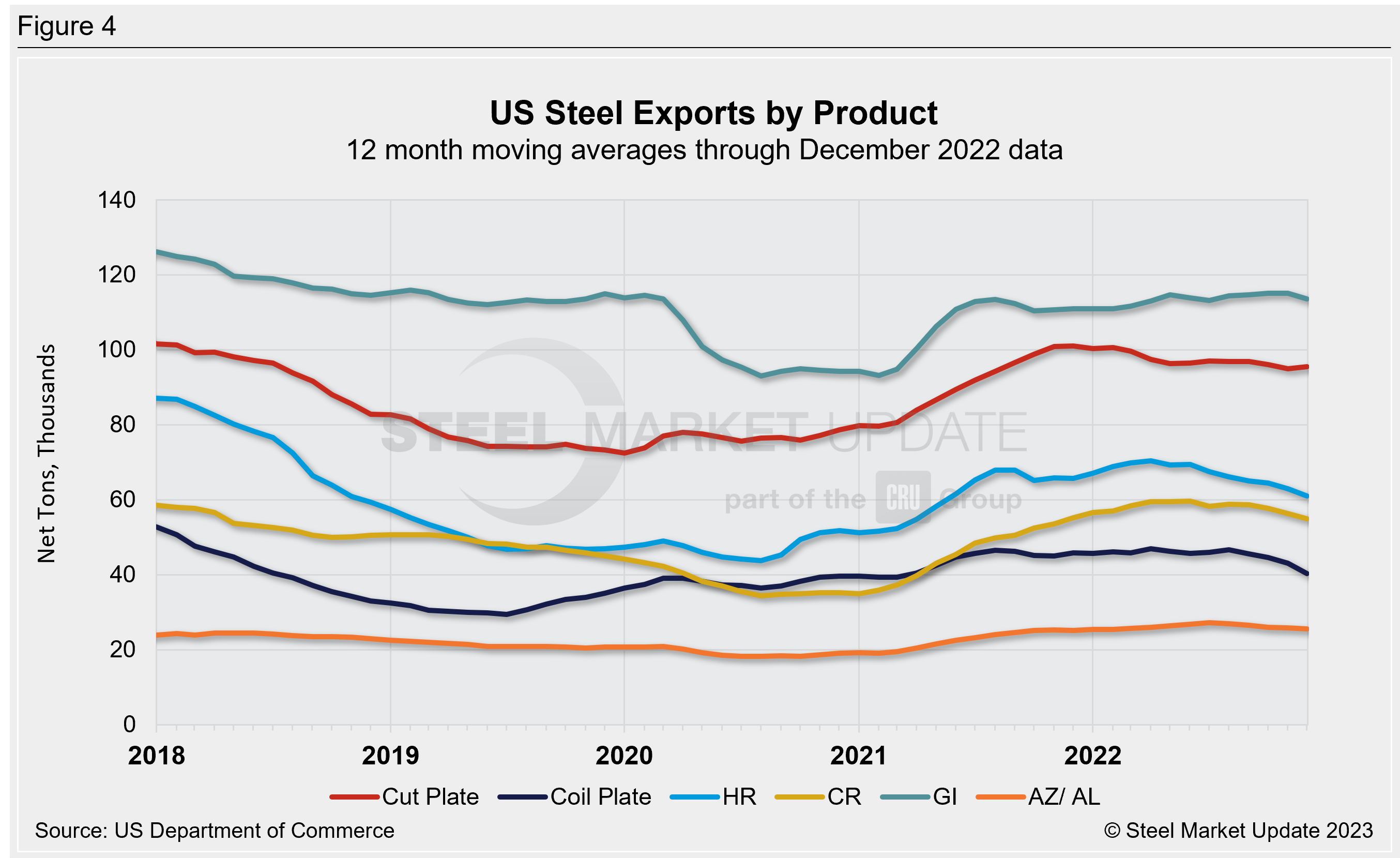

Figures 3 and 4 show US exports by product, both monthly levels and on a 12MMA basis.

We have an interactive graphing tool available on our website here. Readers can further investigate historical export data in total and by product. If you need assistance logging into or navigating the website, contact us at info@steelmarketupdate.com.

By Becca Moczygemba, becca@steelmarketupdate.com