Market Segment

February 7, 2023

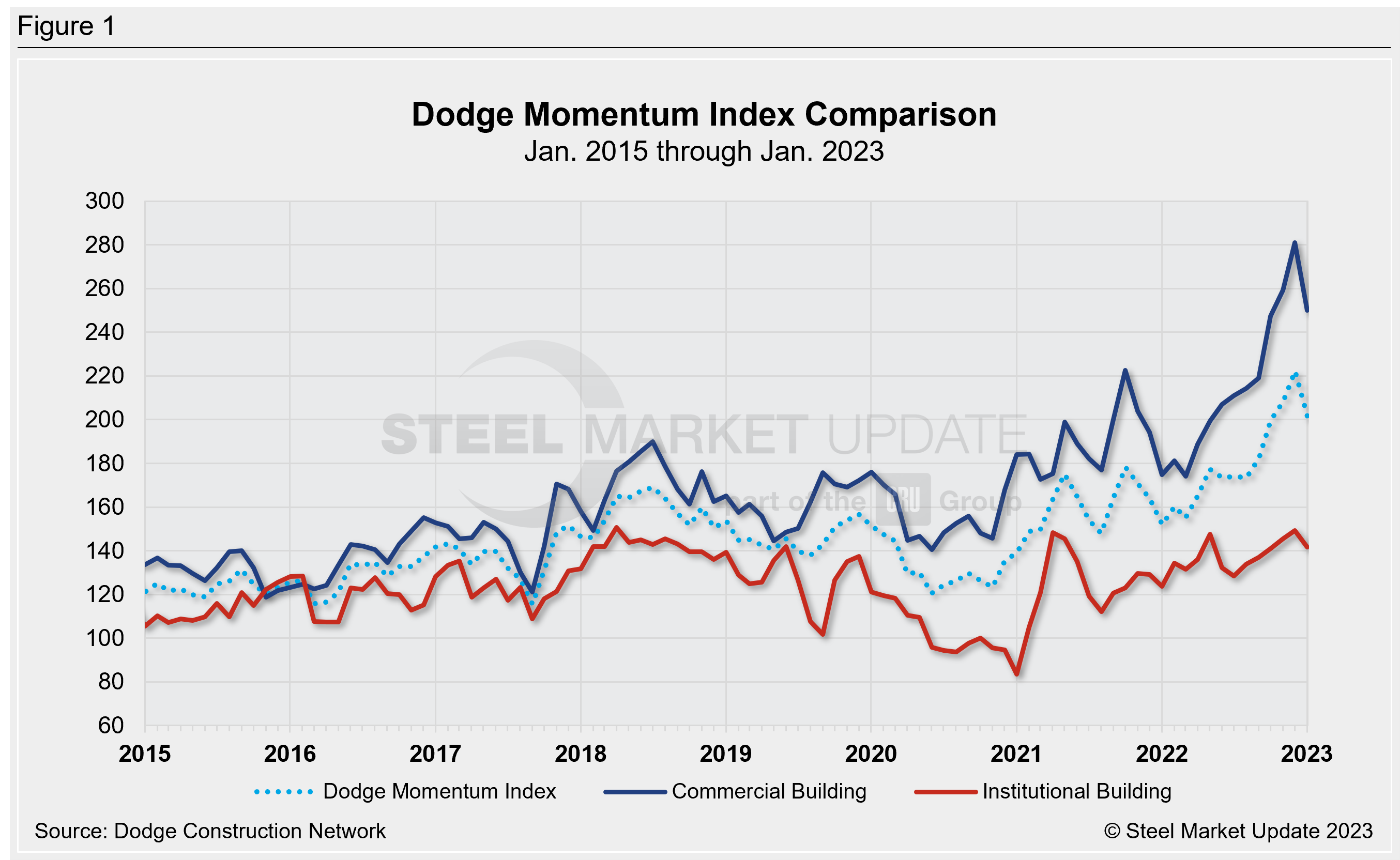

Dodge Momentum Index Down 8.4% in Jan.

The Dodge Momentum Index (DMI) declined 8.4% in January to 201.5 from the revised December reading of 220.0, according to data and analytics from the Dodge Construction Network (DCN).

Additionally, the commercial component of the DMI dropped 10.0% and the institutional component receded 4.7%, respectively, last month.

“The Dodge Momentum Index weakened in January, after 10 consecutive months of gains,” Sarah Martin, associate director of forecasting for Dodge Construction Network, said in a statement. “While planning activity slowed, the Index remains elevated, and the volume of projects remains steady.”

Looking forward, she said DCN expects the index to work its way back towards historical norms this year, “in tandem with weaker economic growth.”

DCN said a total of 26 projects with a value of $100 million or more entered planning in January.

An interactive history of the Dodge Momentum Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com

Dodge is the leading index for commercial real estate, using the data of planned nonresidential building projects to track spending in the sector for the next 12 months.

By Ethan Bernard, ethan@steelmarketupdate.com