Prices

February 5, 2023

Final Thoughts

Written by David Schollaert

US plate prices have been largely stable since the beginning of December after tags fell by $140 per ton following Nucor’s price cut notice at the end of November with the opening of it January order book. A move that caught many by surprise at the time. But since then, plate prices have varied by just $10 per ton on average from week to week.

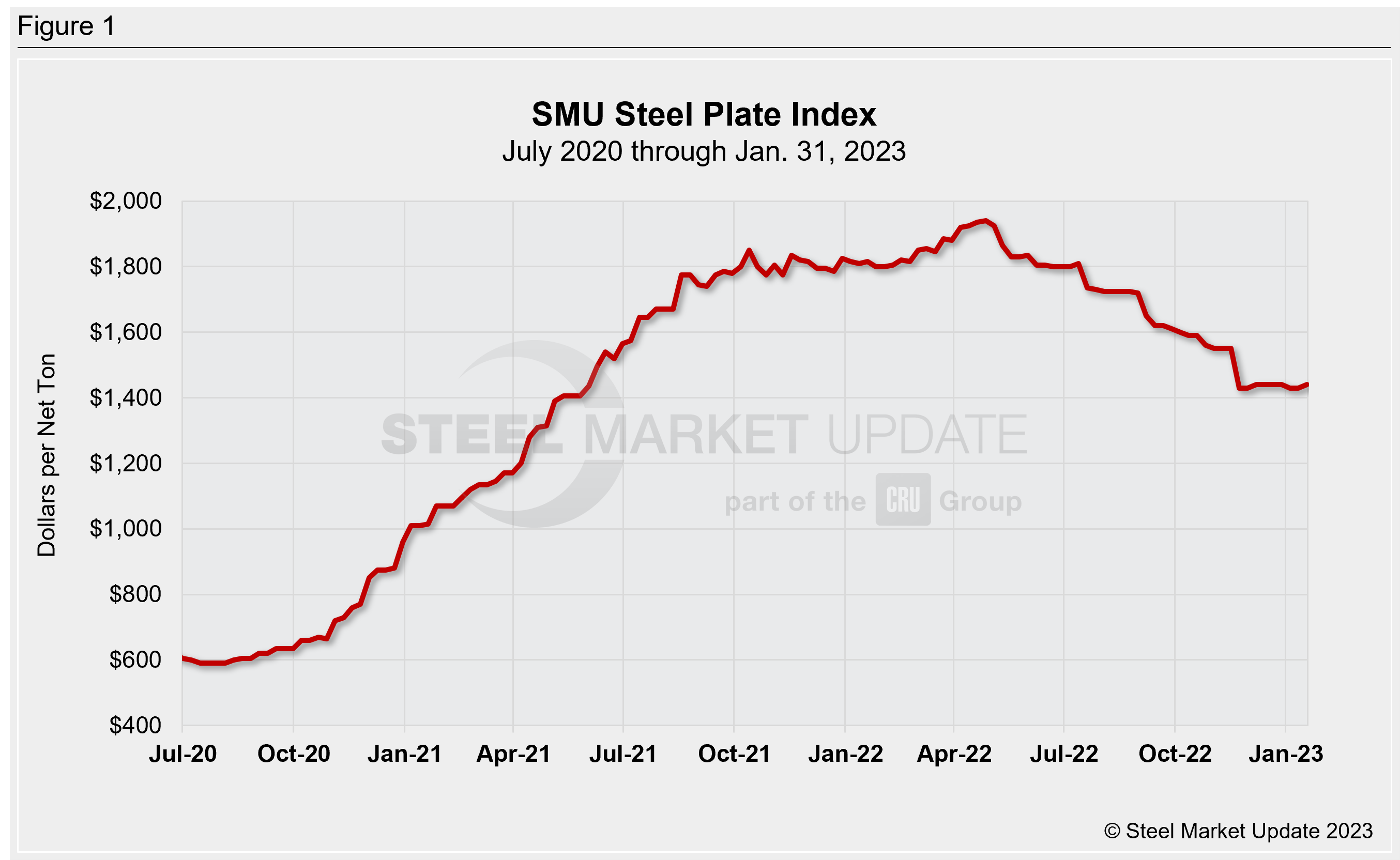

SMU’s most recent check of the market on Tuesday, Jan. 31, placed plate prices between $1,400-1,480 per ton with an average of $1,440 per ton FOB mill east of the Rockies – down $10 per ton week-on-week (WoW), according to our interactive pricing tool. (See also Figure 1.)

The apparent stability doesn’t mean the plate market has been boring over the past couple months. We’ve seen SSAB Americas notify customers of a $60-per-ton ($3 per cwt) price hike on all new, non-contract orders confirmed to ship in late Q1, followed by Nucor’s pricing notice of stable plate tags with the opening of its March order book.

Both pricing notices were unexpected and indicate that the direction of plate prices is still a bit of an unknown.

SSAB’s push brought their price point up, more in line with Nucor’s current level. That led some to wonder if Nucor would use SSAB’s move as an opportunity to drive prices up. Nucor’s choice to maintain tags was potentially a broader indication of supply-demand dynamics.

Some suggested that SSAB’s decision to increase prices was intended to spur orders by motivating buyers to get ahead of the next increase. But that doesn’t seem to have worked.

“I don’t think there is anyone buying ahead because they are concerned about pricing moving up,” said a source. “I think the expectation is still that price will be relatively flat over the next 30-60 days and could have some downward pressure when Nucor Brandenburg ramps up.”

“I think it’s all a lot of noise,” said a second source. “Whether it leads to anything, not sure.”

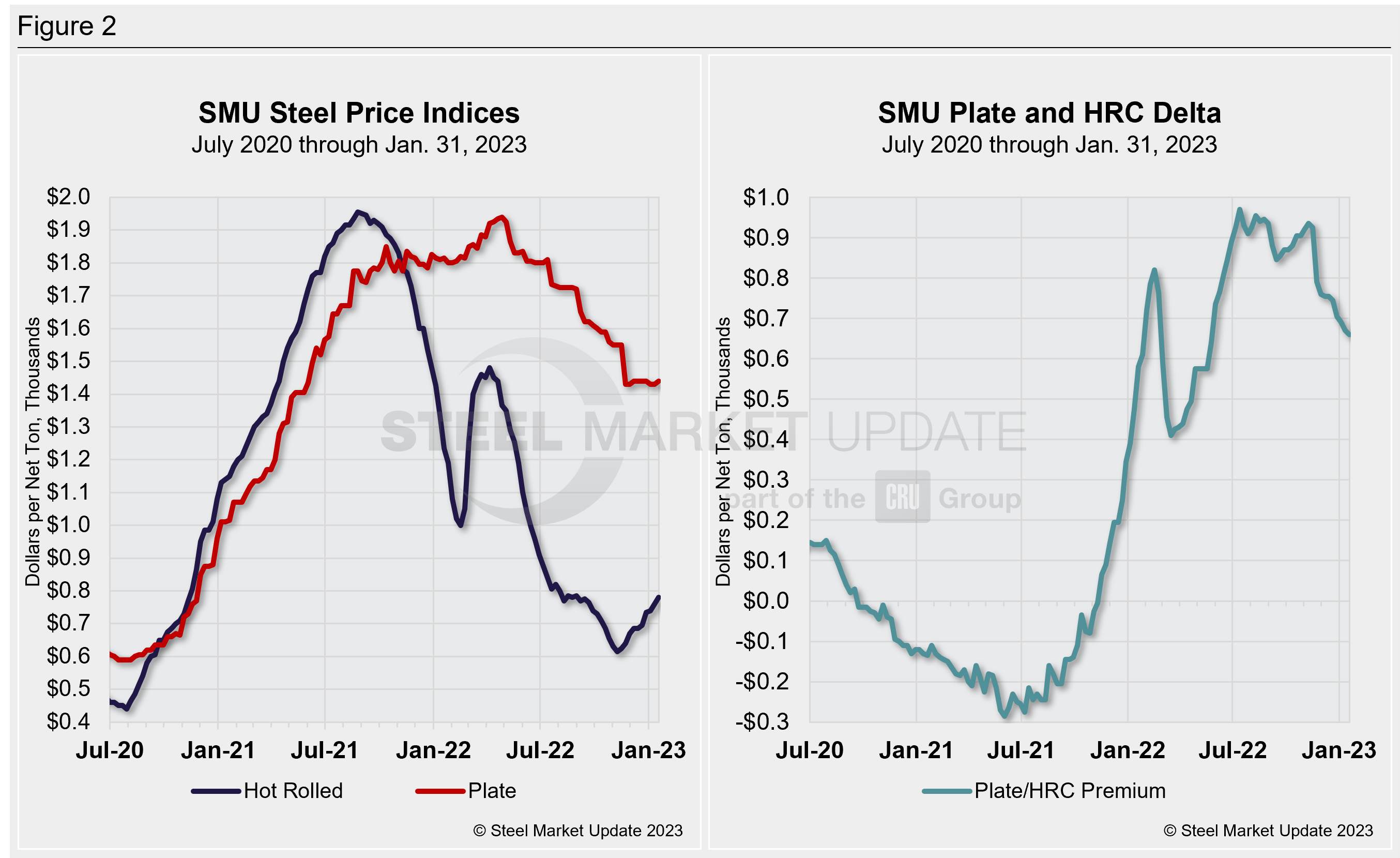

In the meantime, Nucor continues to try to decouple discrete plate from hot-rolled coil (Figure 2), executives said during its Q4 earnings conference call in late January. Allen Behr, Nucor’s executive VP of plate and structural products, said that steelmaker had bifurcated its order book to clearly segregate coil and cut-to-length plate from discrete plate to ensure it collects a premium Nucor sees as warranted.

That move has produced a historically wide premium over hot band pricing, but it’s not a move all in the market agree with.

“I think the mills are lost in their own heads these days with the crazy decoupled nature of steel markets and the uncertainty of our times,” said a third source. “But there will be a correction in this thinking. Just can’t say when, and I guess no one really can right now.”

He said it made him think of the proverb “If you find honey, eat just enough— too much of it, and you will get sick.”

The delta between hot-rolled coil and plate is more than double what it has been historically, and it remains wide even as mills push HRC tags higher.

Sources agreed, however, that demand and overall plate activity has been stronger at the start of 2023 than in prior years.

“We were up on a tons per day shipped basis in January vs. the last two January’s,” said another source.

“Steady as it goes for now,” said a fifth source. “Little to no changes in our plate world.”

SMU’s average HRC price now stands at $780 per ton, according to our latest check of the market on Jan. 31. Our overall average is up $20 per ton WoW, and up $140 per ton since December on the heels of multiple mill sheet price-hike announcements.

Another thing to keep an eye on are import prices. Recent offers from South Korean producer Hyundai Steel are $1,080 per ton ($54/cwt) DDP West Coast for mid-to-late Q1 ship dates. The rate was roughly 25% lower than some buys at the beginning of Q4 2022. The move garnered such attention from US buyers that the offer closed in a matter of hours, sources told SMU.

While those offers are unlikely to cause domestic mills to chase business, they could in theory take some share of the market, sources said.

Discrete plate lead times are still running at five weeks on average. But sources told SMU that that lead times at some plate mills are roughly four weeks for shear items and five weeks for burn items.

The Tampa Steel Conference

We’re just mere hours away from the kick-off for Tampa Steel Conference. We’ll officially get underway today, Sunday, Feb. 5, with a networking reception at the Marriot Water Street hotel at 5 pm.

The final agenda for the conference is here. Nearly 500 people have registered to date. It’s not too late to join them! More information on registration is here.

By David Schollaert, david@steelmarketupdate.com