Prices

February 3, 2023

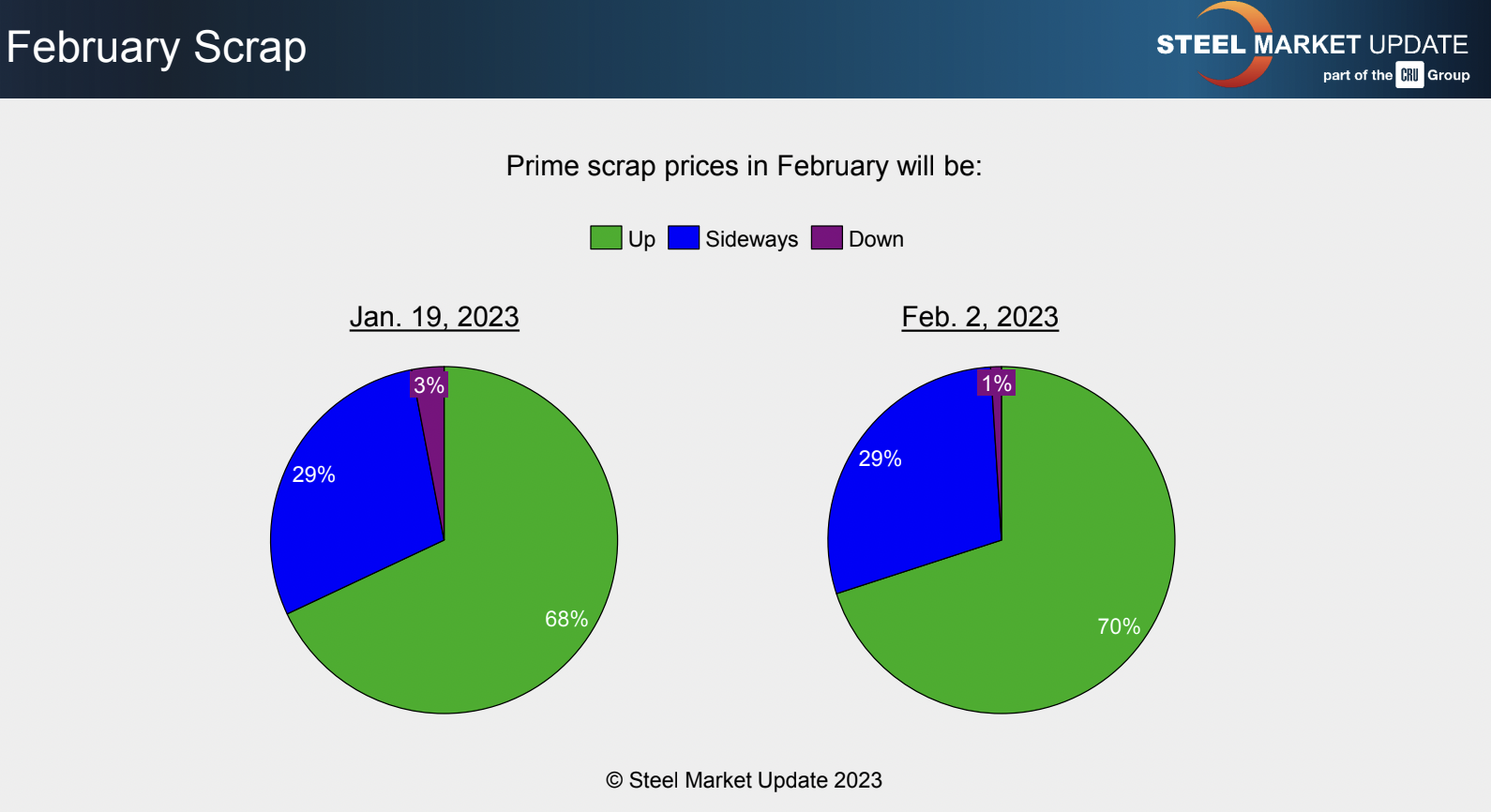

February Scrap Prices Expected to Rise

A wide majority of steel market participants expect prime scrap prices to climb in February, according to SMU’s most recent survey data.

When polled if prime scrap prices would rise this month, 70% of respondents answered “yes” for the survey ended Thursday, compared with 68% in the survey that closed Jan. 19.

Scrap market sources contacted by SMU, agreed. And they didn’t limit themselves to just prime.

“I expect we are going to get another move up by $20 in February for obsolete grades including shredded, and maybe a little more for prime,” one scrap market source said.

SMU’s scrap prices for January were busheling at $420–460 per gross ton, averaging $440, and up $60 from last December. Shredded last month was at $410–440 per gross ton, averaging $425, and up $35 from December. HMS in January was at $330–370 per gross ton, averaging $350, and up $35 from December.

The main driver for a likely rise in prices in February is that scrap is tight in the US currently, the first scrap source said. “Turkish demand has been more strong and consistent than it was in 2H 2022, and those prices are higher than they were at the beginning of January.”

He pointed out that shred to Turkey is now $442/metric ton, which he said is a premium to domestic shred for the most part, with freight rates to Turkey moving a little lower.

“From the looks of things, I think we have strength in the ferrous markets for the next 30-45 days or so, at least,” he said.

Another scrap market source agreed with the likelihood of higher tags.

“It looks like February prices will be mostly up somewhat,” the second source said, as mills are still sourcing scrap privately. “Export has maintained its firmness, and it’s still winter.”

A third source said very strong export demand, combined with the tight domestic supply, is pushing scrap prices up at least $20 per gross ton.

“Trend-setting mills have announced up $20 programs for all grades. However, this increase is being met with limited success as suppliers in some regions are pushing for up $30,” the third source said.

The second scrap source believes February prices should probably settle by Feb. 7.

By Ethan Bernard, ethan@steelmarketupdate.com