Market Data

January 31, 2023

CRU: Turkish Scrap Prices Remain Rangebound

Written by Yusu Mao

By CRU Research Analyst Yusu Mao, from CRU’s Steelmaking Raw Materials Monitor

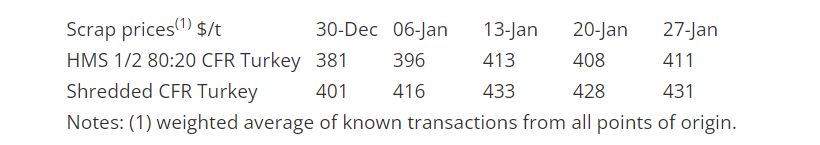

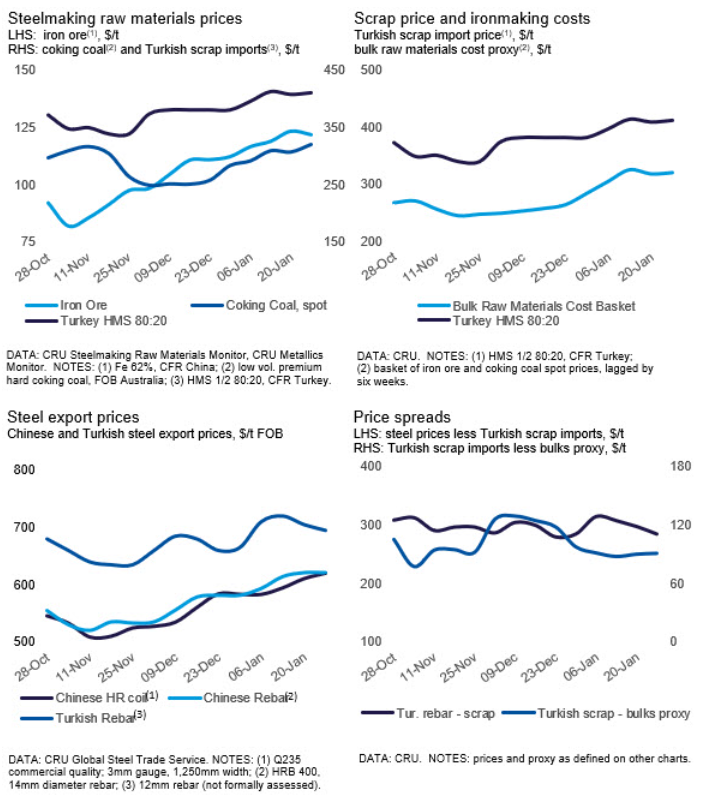

Last week, buying activity continued in the Turkish scrap market, and our assessment for HMS 80:20 rose slightly to $411 per ton CFR Turkey, that’s a $3-per-ton increase week on week and a boost of more than $30 per ton vs. the prior month on confirmed deals.

Mills are struggling with current scrap prices and falling export offer prices for rebar due to persistent demand weakness. So far, an active domestic market for finished steel has helped sustain scrap prices at ~$410 per ton CFR level, while steelmaking margins are squeezed on higher input costs and limited overall demand.

Energy rates are still much higher than the previous year, while additional costs including a rise in minimum wages have affected profitability. With scrap import prices at ~$410 per ton CFR and a tradable rebar offer levels at ~$680 per ton FOB, there is very little to no profit, causing industry-wide crude steel capacity utilization rates to drop sharply, just 51% in November. Nevertheless, steelmakers are keeping their finishing mills running by effectively using cheaper imported semi-finished steel.

The Asian scrap market was off last week due to holidays, and the latest offer we heard is at $450 per ton CFR for bulk HMS 80:20, up by $20 per ton compared to early January levels.

Outlook: Turkish Scrap Prices to Face Downward Pressure

Turkish steelmakers will not be able to pay a higher price for scrap while offering rebar at current levels. Therefore, they are currently pressing for lower scrap prices. Meanwhile, given that demand for Turkish finished steel exports may remain limited in the near term, steelmakers will likely continue to operate at reduced utilization rates and look to import cheaper billet to feed their finishing mills. As a result, we expect there will be downward pressure on scrap demand and prices in the near term.

This article was originally published on Jan. 30 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com