Market Segment

January 26, 2023

Nucor 4Q Earnings Slip as Selling Prices Drop

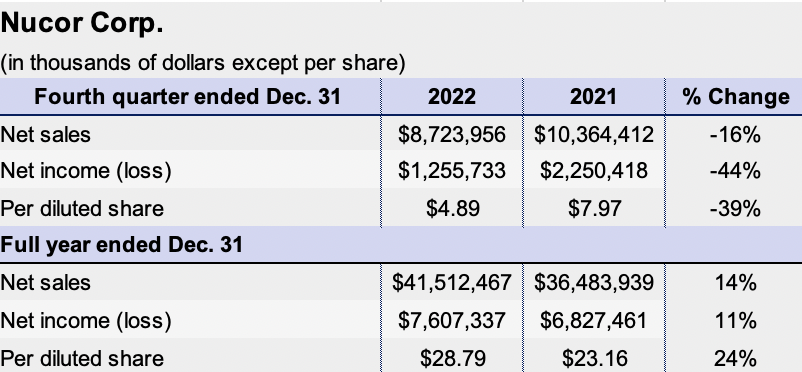

Nucor Corp.’s fourth-quarter net earnings slid 44% from a year ago, but the company still reported the most profitable year in its history.

The Charlotte, N.C.-based steelmaker posted net earnings of $1.26 billion in the quarter ended Dec. 31 vs. $2.25 billion in the same quarter of 2021 on net sales that dropped 16% to $8.72 billion.

However, for full-year 2022 Nucor posted net earnings of $7.61 billion, up 11% from $6.83 billion the previous year on net sales that rose 14% to $41.51 billion.

However, for full-year 2022 Nucor posted net earnings of $7.61 billion, up 11% from $6.83 billion the previous year on net sales that rose 14% to $41.51 billion.

“I am proud to report that 2022 was both the safest and most profitable year in Nucor history,” Leon Topalian, Nucor chair, president, and CEO said in its earnings statement.

As for steel shipments, Nucor shipped 5.1 million tons in the fourth quarter, down 13% from 5.9 million tons a year earlier, while full-year shipments dropped 10% to 25.7 million tons vs. 2021.

Average sales price per ton in 4Q 2022 fell 7% compared with the 3Q 2022 and were off 6% compared with 4Q 2021, Nucor said.

Overall operating rates at the company’s steel mills also fell in the quarter. They slipped to 70% in 4Q, compared to 77% in 3Q of 2022 and 89% in 4Q 2021.

Meanwhile, operating rates for full-year 2022 dropped to 77% vs. 94% for 2021.

Nucor said an after-tax net benefit of $60.4 million, related to state tax credits, and an after-tax net benefit of $88 million, related to a change in the valuation allowance of a state deferred tax asset, were included in 4Q results.

Also included, Nucor added, was a pre-tax $96.0 million write-off of the remaining carrying value of its leasehold interest in unproved oil and gas properties in its raw materials segment.

Regarding the drop in results in 4Q 2022 vs. the previous quarter, Nucor pointed to several factors: lower average selling prices, margin compression, and lower volumes in its steel mills segment. Also weighing on results were lower volumes and selling prices in its steel products segment; decreased profitability at its direct-reduced iron (DRI) facilities because of planned outages in 4Q, and decreased selling prices for raw materials.

For 1Q 2023, Nucor expects the profitability of the steel mills segment to increase vs. 4Q 2022 due to higher margins and volumes, with the largest boost expected at its sheet mills.

Despite some seasonally slower construction activity and some reductions in realized pricing, Nucor expects its steel products segment earnings to be higher in 1Q 2023 compared with the same quarter the previous year.

In its raw materials segment, Nucor sees increased profitability in 1Q 2023 vs. 4Q 2022, excluding the impact of the impairment charge recorded in 4Q, due to higher volumes at its DRI facilities as well as at its scrap recycling and brokerage operations.

For this year, Topalian remained optimistic. “Looking ahead to 2023, while we recognize there is uncertainty about the near-term US economic outlook, we’re starting to see a number of demand drivers gathering momentum, including the reshoring of manufacturing, large infrastructure investments, and grid modernization,” he said.

By Ethan Bernard, ethan@steelmarketupdate.com