Government/Policy

January 18, 2023

US Light Vehicle Sales Ease Again in December

Written by David Schollaert

US light-vehicle (LV) sales slowed further in December, with an unadjusted figure of 1.26 million units, the US Bureau of Economic Analysis (BEA) reported. Despite the month-on-month (MoM) decline, last month’s total was still 4.9% higher year on year (YoY), and the fifth consecutive month to see YoY increases in sales. Prior to August 2022, YoY sales gains had not been seen since July 2021.

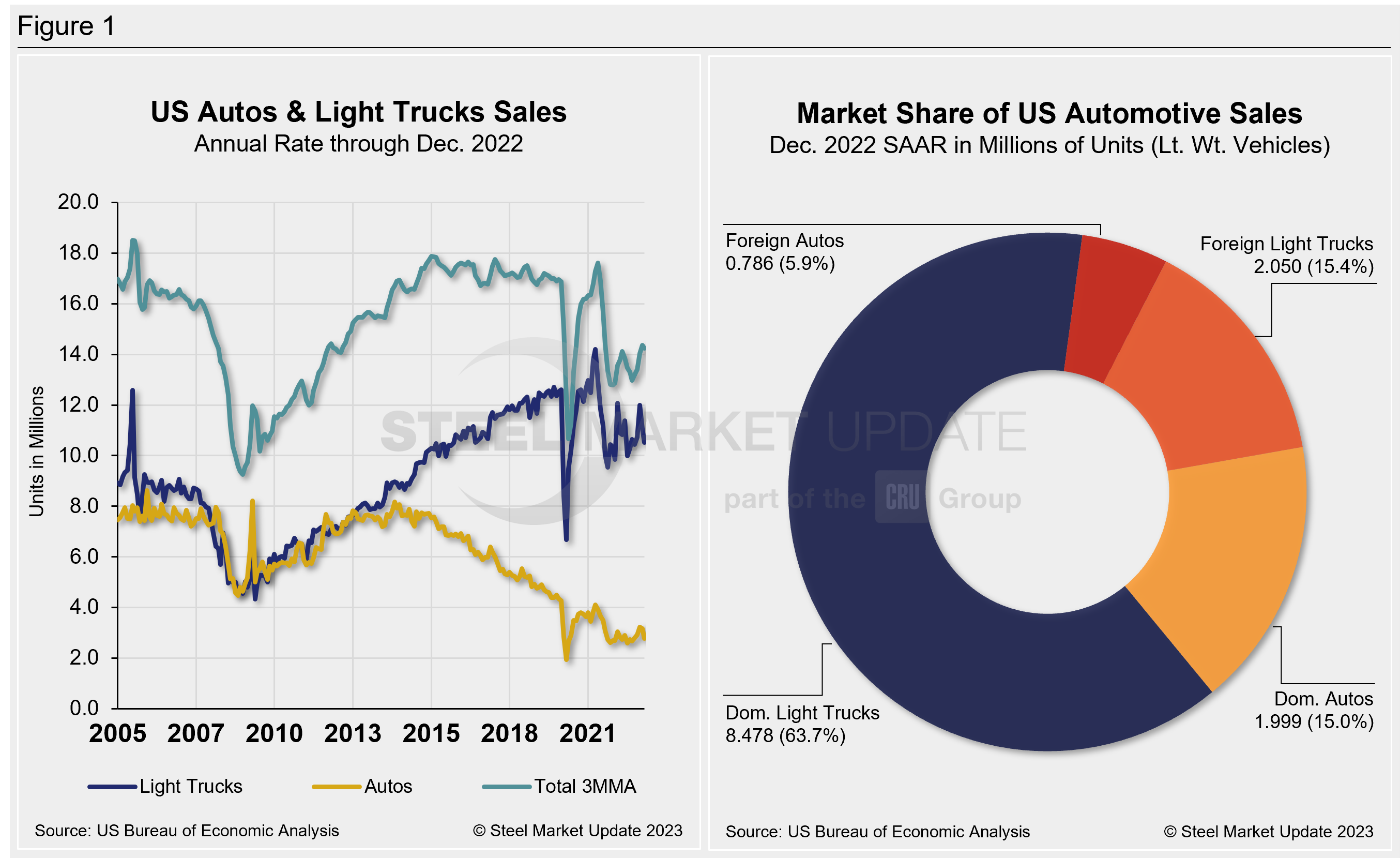

LV sales were down 6.3% MoM in December, slipping to an annualized 13.3 million units. This was slightly above the consensus forecast that expected a larger decline to 13.0 million.

After rising to a nine-month high in October, vehicle sales have now declined repeatedly through December. Last month’s sales ended the year with some deterioration, falling back to an annualized level not seen since last summer. Data suggests the late December winter storm had some impact on last month’s soft reading. The harsh winter weather across much of the US kept buyers away over the holiday shopping season.

All told, sales averaged just 13.7 million units for the year – the lowest annual tally since 2011.

Both passenger vehicles (-12.0% MoM) and light-trucks (-4.8% MoM) registered declines. Light-trucks accounted for 81% of last month’s sales, down roughly a percentage point from December 2021.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2005 through December 2022. Additionally, it includes the market share sales breakdown of December’s 13.3 million vehicles at a seasonally adjusted annual rate.

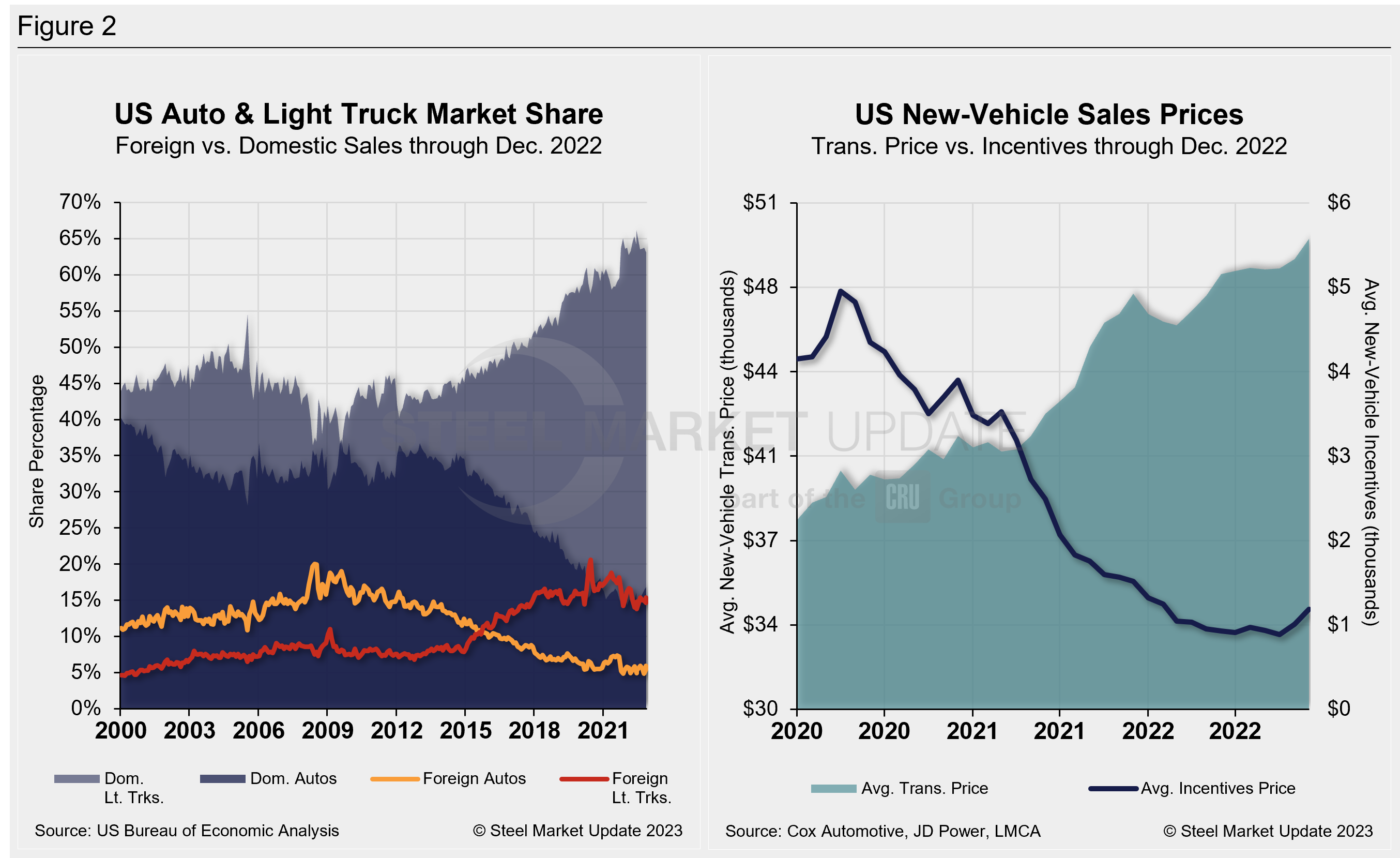

The new-vehicle average transaction price (ATP) was $49,507 in December, up from $48,681 in November, and setting a new all-time high. ATPs were 1.7% higher (+$826) in December vs. the prior month and 4.8% (+$2,264) above the year-ago period, according to Cox Automotive data.

Incentives increased again for the second straight month. Last month’s incentives were $1,187 in December, up from $1,009 in November. With the MoM recovery, incentives were back above the $1,000 mark for the second time in eight months and roughly 2.4% of the average transaction price. Incentives are down 21.7%, or $329 YoY.

In December, the annualized selling rate of light trucks was 10.529 million units, down 4.8% vs. the prior month but still 6.8% better YoY. Auto annualized selling rates saw similar dynamics over the same periods: down 11.8% but up 3.7%, respectively.

Figure 2 details the US auto and light-truck market share since 2010 and the divergence between average transaction prices and incentives in the US market since 2020.

Canadian light vehicle sales were estimated to have increased by 7% YoY, to 107.000 units in December, according to LMC Automotive data. The selling rate is thought to have slowed to 1.5 million units annually, from a downwardly revised 1.6 million units annually in November. Total annual sales were just 1.5 million units, down by 8% YoY, and the lowest since 2009.

Mexican light vehicle sales were up by 20% YoY in December to 120,000 units. For the calendar year, sales grew by a healthy 8% YoY, to 1.1 million units.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. Specifically, the report describes light vehicle sales in the US.

By David Schollaert, David@SteelMarketUpdate.com