Market Data

January 17, 2023

Service Center Shipments and Inventories Report for December

Written by Estelle Tran

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, email Info@SteelMarketUpdate.com.

Flat Rolled = 61.2 Shipping Days of Supply

Plate = 57.3 Shipping Days of Supply

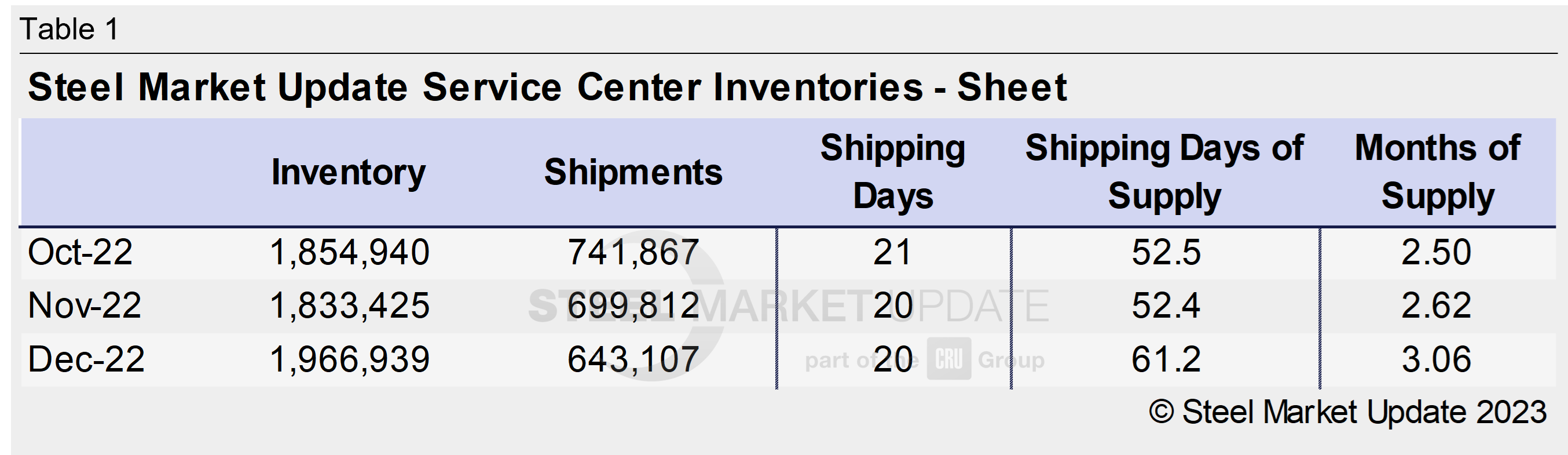

Flat Rolled

US service center flat-rolled steel supply spiked in December, in line with seasonal trends. At the end of December, Steel Market Update data showed service centers carried 61.2 shipping days of supply on an adjusted basis, up from 52.4 days in November. In terms of months on hand, service centers had 3.06 months of supply at the end of December, up from 2.62 in November.

We calculated 20 shipping days in December, the same as November. The number of shipping days in December typically varies significantly by company, though. December inventories were comparable to December 2021, when flat-rolled steel inventories represented 63.9 shipping days of supply, or 3.19 months of supply. In December 2019, service centers carried 62.9 shipping days of flat-rolled steel supply, representing 3.15 months of supply.

Service center contacts reported higher-than-usual levels of material on order at the end of December, as service centers and their customers sought to beat price increases. This pulled orders forward into December, and most contacts are expecting solid shipments for January.

In December, the amount of inventory on order rose from in December. This is also distorted by the lower daily shipping rate in December. Lead times were still short at the end of the year, so much of the material on order placed at lower levels, ahead of prices increases, likely shipped by the end of the month.

The restocking pattern has pushed out lead times slightly, though. In SMU’s latest survey published Jan. 5, mill lead times for HRC reached 4.95 weeks, up from 4.35 weeks the month before.

Market contacts have reported more inquiries to start the year but remain concerned about overstocking, as it is unclear how many of these inquiries represent real demand vs. demand that is being pulled forward.

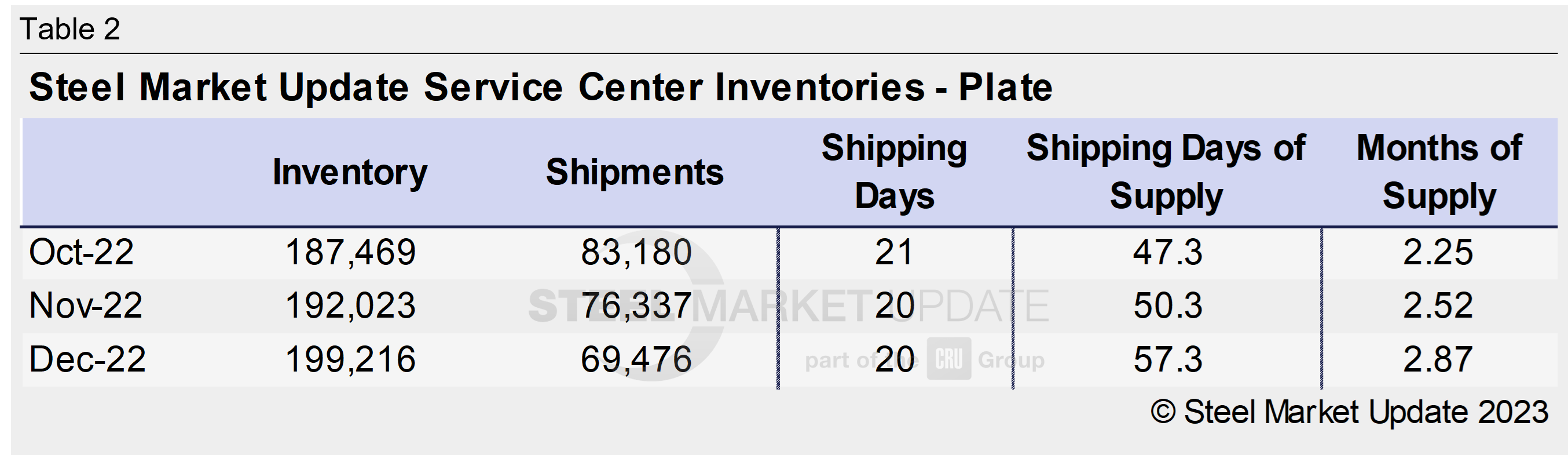

Plate

US service center plate inventories also swelled in December, following seasonal trends. At the end of December, service centers carried 57.3 shipping days of plate supply, according to SMU data. This is up from 50.3 shipping days in November. Plate inventories in December represented 2.87 months of supply, up from 2.52 in November.

In December 2021, service centers carried 67.1 shipping days of supply, or 3.35 months of supply. In a more typical year, 2019, service centers stocked 60.4 shipping days of plate supply, or 3.02 months of supply. Because of this, we view plate inventories to be balanced.

There is no pricing-related catalyst to pull plate orders forward, as there is in sheet. We have heard of some news about project-related purchases and strong energy-related demand supporting orders, though.

At the end of December, service centers carried more supply than November.

Plate lead times are reflecting the typical restocking pattern. The latest SMU survey pegged mill lead times at 5.7 weeks, up from 4.8 weeks a month ago.

By Estelle Tran, Estelle.Tran@CRUGroup.com