Prices

January 17, 2023

AHRI Shipments Fall in November

Written by Becca Moczygemba

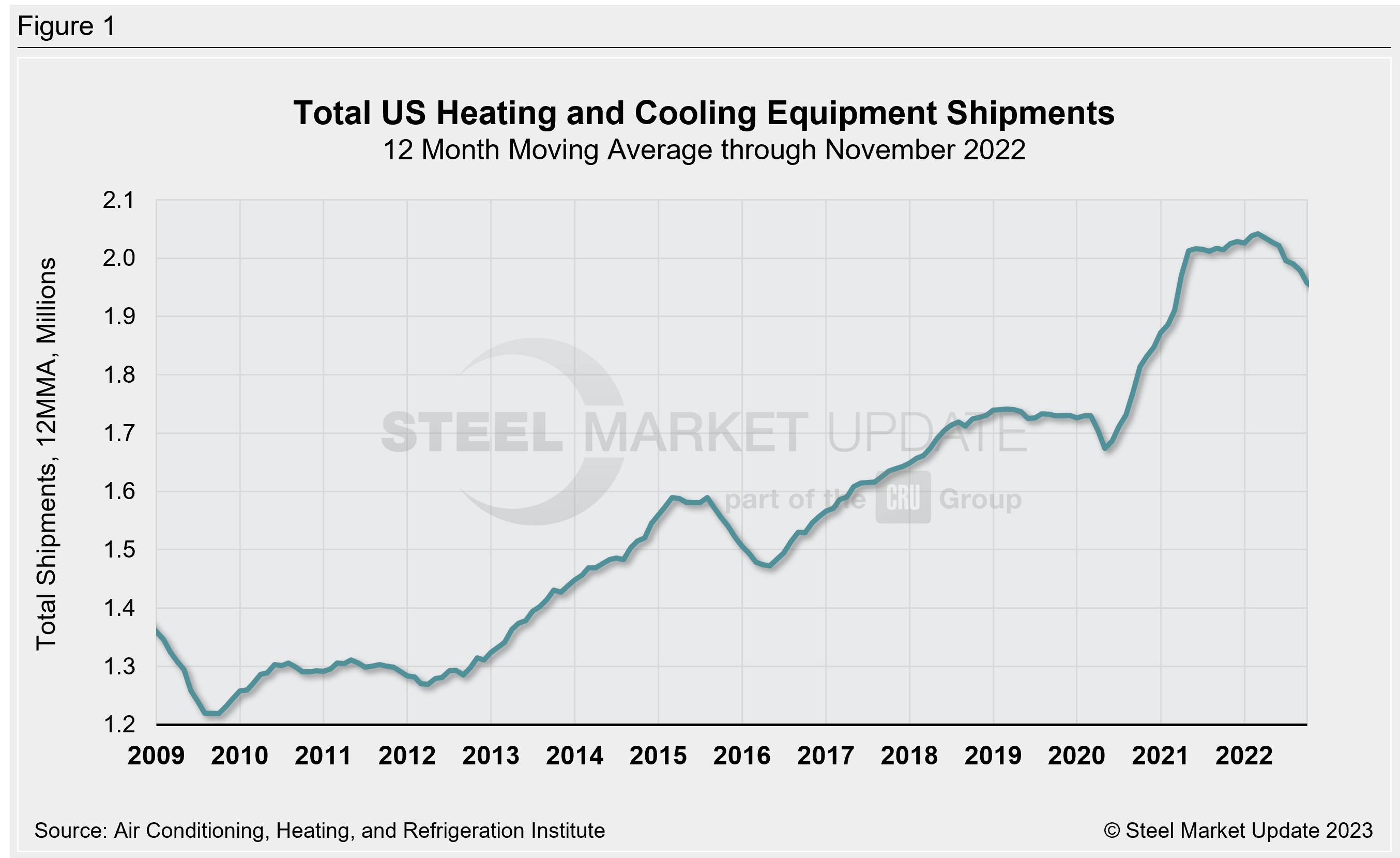

US heating and cooling equipment shipments declined further in November, according to recently released data from the Air Conditioning, Heating, and Refrigeration Institute (AHRI). Total shipments in November were 1.768 million units, 6% less than October levels and down 6% compared with the same month last year. November represents the lowest shipment rate recorded in the last 24 months, Previously, the lowest recorded level was 1.66 million units in November 2020.

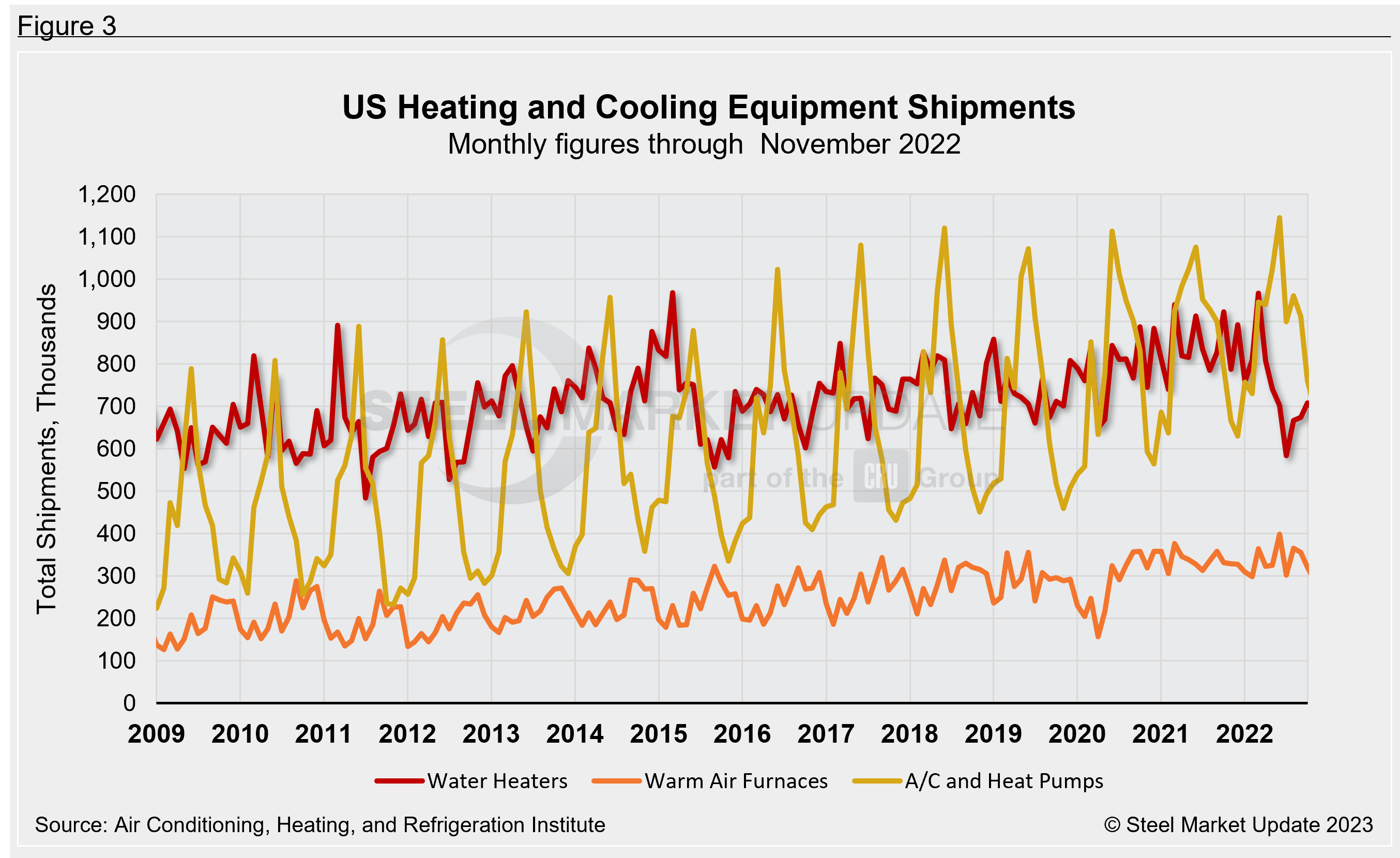

Recall that shipment levels bounced around over the summer months. June saw the fifth-highest monthly shipment rate in SMU’s 14-year history. July shipments fell 20% month over month (MoM) to a then eight-month low, the largest monthly decline seen since late 2020. August saw a MoM increase of 12%.

The average monthly shipments level for the first 11 months of 2022 was 1.96 million units, down from an average of 2.04 million units in the same period of 2021. Shipments averaged 2.03 million units per month throughout 2021, up 10% vs. the 2020 average of 1.85 million units per month.

Shipments have been slowing on a 12-month moving average (12MMA) basis, averaging 1.94 million units per month between November 2021 and November 2022.

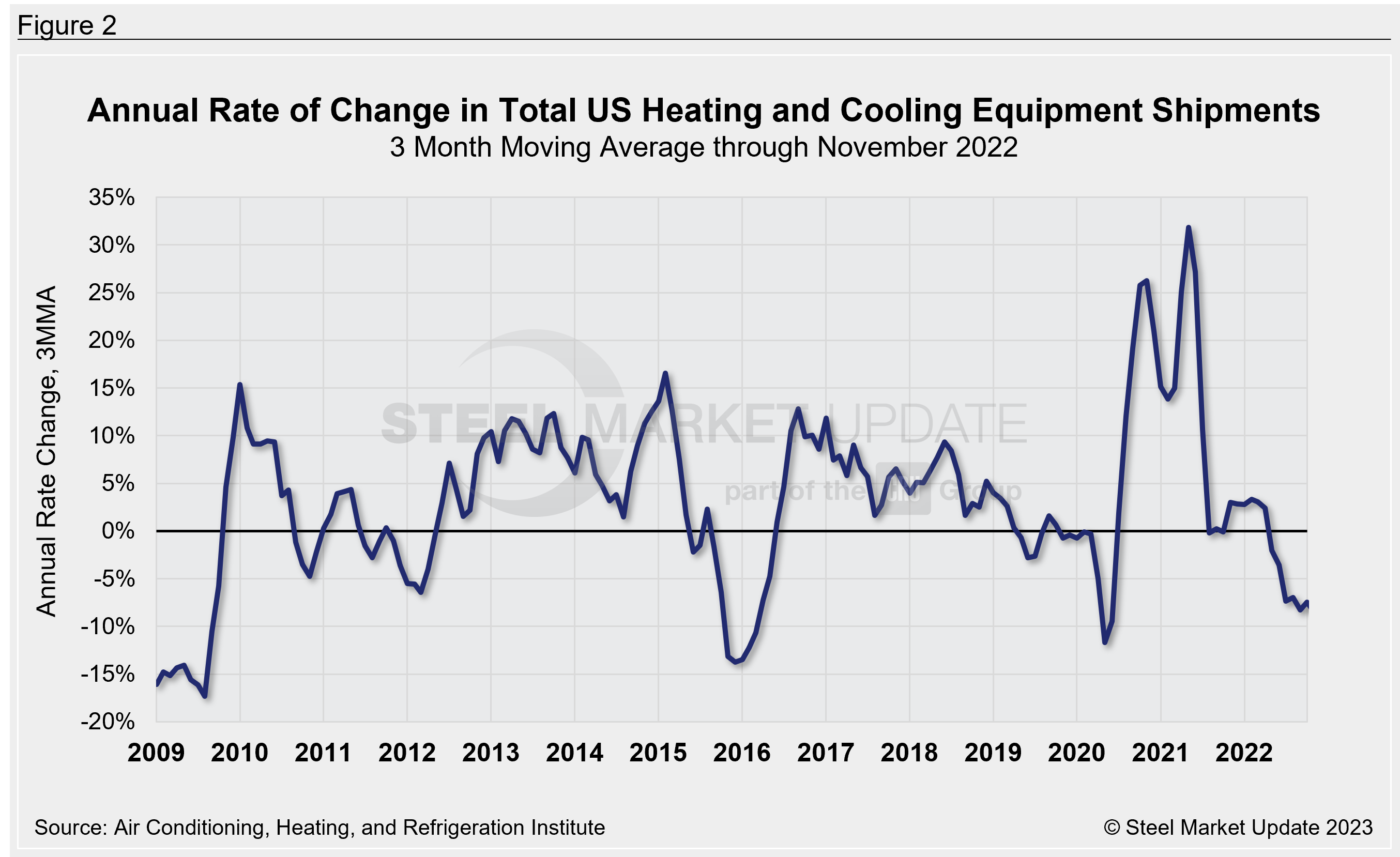

As shown in the chart below, total heating and cooling shipments on a three-month moving average (3MMA) basis through October are down 8% compared with the same period one year prior. This also brings us back to the year-over-year (YoY) growth rate we saw back in September. May and June 2021 hold the record-high 3MMA annual growth rates at 32% and 27%, respectively. Between November 2021 and April 2022, we saw a steady annual growth rate of 2–3% each month. Prior to 2020, the highest rate in our history was in February 2015 at 17%.

Residential and commercial storage water heater shipments decreased 12% YoY to a combined 690,870 units in Novemberr, when 675,600 units were shipped for residential use and 15,000 units for commercial use. Water heater shipments were down 2% MoM.

October shipments of warm air furnaces totaled 288,560 units, a decrease of 12% compared with the same month last year. Shipments for warm air furnaces declined 10% from September.

Central air conditioners and air-source heat pump shipments were up 5% vs. one year ago, totaling 697,000 total units in November. 398,500 air conditioners and 298,600 heat pumps were shipped. AC and heat pump shipments were down 8% compared with levels one month prior.

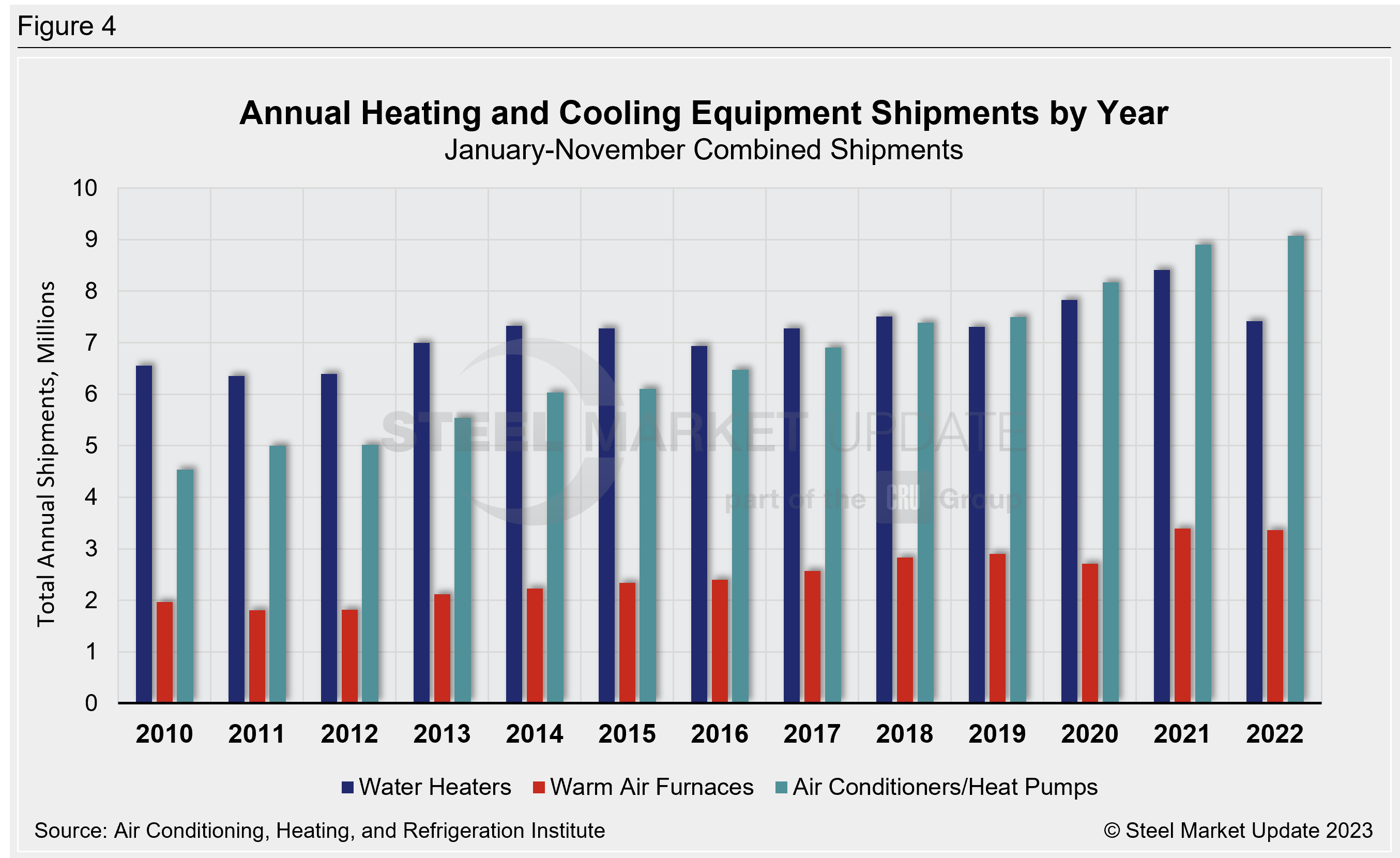

Year-to-date (YTD) shipments through November 2022 totaled 21.5 million units. This is down 4% in comparison to the first 11 months of 2021 when shipments totaled 22.49 million units.

As seen in the chart below, 2022 YTD shipments for water heaters totaled 8.1 million units, 12% below the same period of 2021. Warm air furnace shipments totaled 3.65 million units YTD, down 2% YoY. Air conditioner shipments totaled 9.77 million units in the first 11 months of this year, up 2% from the same period last year, and now the highest November YTD figure seen in our data history.

The full press release from which this data comes from is available on the AHRI website.

An interactive history of heating and cooling equipment shipment data is available on our website. If you need assistance logging in to or navigating the website, please contact us at Info@SteelMarketUpdate.com.

By Becca Moczygemba, Becca@SteelMarketUpdate.com