Market Segment

January 12, 2023

CRU: Metallics Market Heads Into 2023 With Cautious Optimism

Written by Puneet Paliwal

By CRU Senior Analyst, Puneet Paliwal, from CRU’s Scrap, DRI/HBI & Pig Iron Monitor

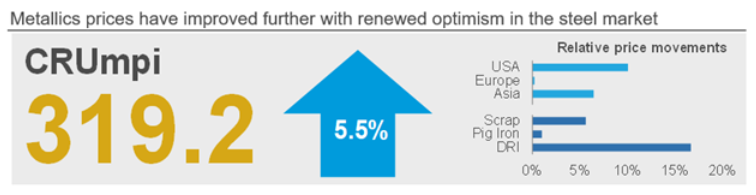

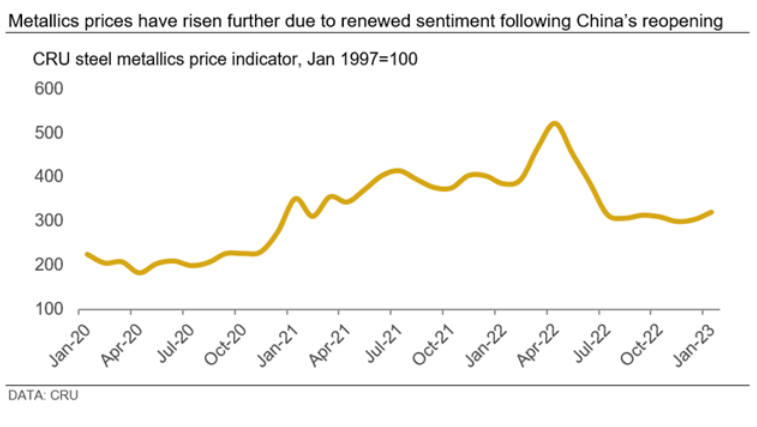

The CRU metallics price indicator (CRUmpi) for January rose by 5.5% month-on-month (MoM), to 319.2, registering the fastest MoM growth since last April. The optimism brought in by China’s unexpected reopening has reverberated across major economies and was further boosted by the continued easing of inflationary pressures.

While improved market sentiment resulted in some restocking demand, the availability of metallics, particularly scrap, has dwindled due to seasonal factors, thereby aiding prices.

Metallics prices across major geographies have either increased or stayed stable at the start of 2023. Scrap prices in Asia and North America increased substantially, while those in the EU had a relatively quiet start to the year.

EU-based scrap buyers have just returned from the winter holidays and were greeted by sellers attempting to raise prices. Suppliers have been citing the limited availability of obsolete and prime grades due to low collection at the end of 2022, alongside rising freight rates and the resurgence of Turkish buying appetite, as the reasons for raising their bids. At the time of writing, negotiations were still underway as buyers are still not convinced market fundamentals had improved enough to support higher input costs.

In the US, on the other hand, 2023 started off with initial bids of scrap rising by $60 per long ton for primary grades and $30 per long ton for secondary grades. Mills have cited larger buy programs for the month, so rising demand on the back of seasonally lower availability is mounting upward pressure on scrap prices.

An increase in export offer prices to Turkey and Asia has also pulled domestic prices higher. Nevertheless, it is important to note that while mills are actively buying scrap, its steel production remains quite subdued, with crude steel capacity utilization down 8% year-on-year (YoY) during the first week of January.

While the recent rise in domestic steel prices (i.e. US Midwest HR coil price is up by over $80 per short ton MoM) has brought in some optimism, concerns remain over the sustenance of steel demand in the near term as recessionary threats continue to loom.

Within Asia, scrap prices have moved up by $25–35 per metric ton MoM aided by optimism brought on by the easing of Covid-19 restrictions in China and the resultant sharp uptrend in regional steel prices. The results of CRU’s latest Asian Sentiment Survey indicate that market participants are now maintaining an optimistic view towards market activity (against an overall bearish view in November), so much so that idled steelmaking assets are being gradually restarted in the region.

Some of the mills in the region are actively buying scrap much ahead of their normal restocking period, fearing prices will jump even higher in the coming weeks. Nevertheless, as is with other regions, actual steel demand is yet to recover, which puts into question the maintenance of recent price rises.

While scrap price movements were mixed, the prices of ore-based metallics have moved up evenly across key regions. FOB Black Sea pig iron price is up $10 per metric ton MoM to $ 378 per metric ton, while Brazilian origin pig iron price is up $20 per metric ton MoM.

Italian HBI price also increased $50 per metric ton MoM to $350 per metric ton CFR. Pig iron buyers are anticipating Indian suppliers to offer more volumes in the coming months, now that the export tax was lifted, which may put some supply-side pressure on seaborne prices. Nonetheless, rising scrap prices support pig iron prices and this may continue in the near term.

As is with scrap, the primary concern in the ore-based metallics market is the underlying steel demand conditions, which remain quite modest. While increasing activity and prices do indicate confidence building amongst steelmakers towards raising output levels, macroeconomic risks to steel demand are still aplenty.

Outlook: Further Upside to Scrap Prices to be Capped

Given the weakness of steel market fundamentals and emerging macroeconomic risks, we remain skeptical of a sustained short-term improvement in demand for metallics in major global markets. Additionally, easing winter conditions in the US will raise scrap collection as well as the recent upswing in recycling margins amidst higher prices, which will ease supply tightness.

In Asian markets, we expect the current sentiment-driven price increase to be short-lived. As the Chinese New Year (CNY) holiday period is in late January, one week earlier than in previous years, workers will enter holiday mode earlier. This means that underlying steel demand in China will weaken in the coming weeks, despite improving sentiment related to the reopening and possible economic stimulus.

Mill production will also fall during the CNY period affecting scrap demand not only in China but also in other parts of Asia where demand sentiment resonates that in China.

For pig iron prices, the recent increase in scrap prices across major demand centers should prevent declines, though offers from non-traditional suppliers such as India may put some supply-side pressure. Nevertheless, there is an upside risk to prices if demand improves more than expected as Brazil is currently the sole large source of pig iron, particularly in the US and Europe.

This article was originally published on Jan. 12 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com