Community Events

December 15, 2022

Service Center Shipments and Inventories Report for November

Written by Estelle Tran

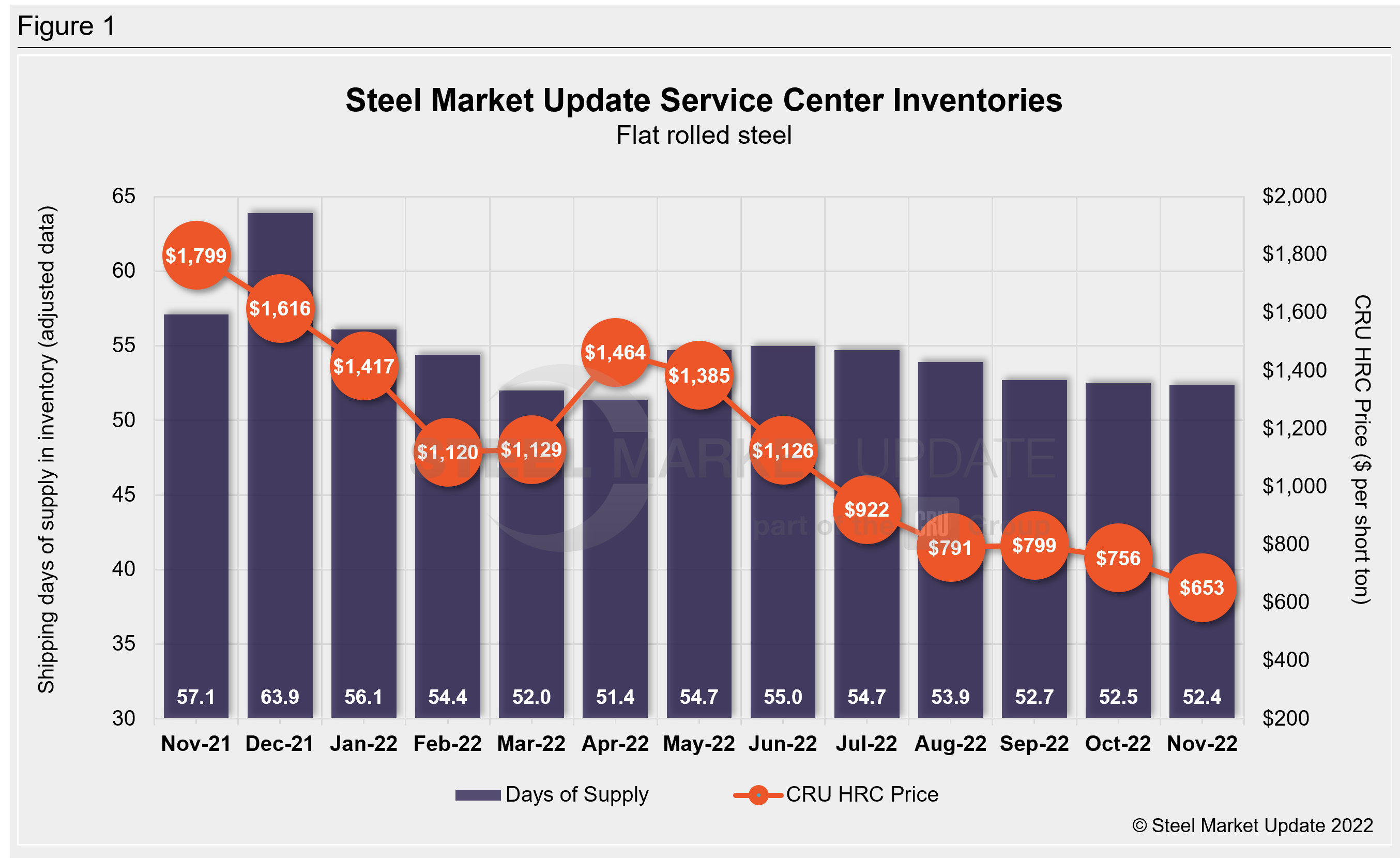

Flat Rolled = 52.4 Shipping Days of Supply

Plate = 50.3 Shipping Days of Supply

Flat Rolled

US service center flat-rolled supply in November was steady month on month (m/m), according to Steel Market Update data. At the end of November, service centers had 52.4 shipping days of flat-rolled steel supply on an adjusted basis, compared to 52.5 shipping days in October. Sheet supply represented 2.62 months of supply in November, up from 2.5 in October.

November had 20 shipping days, compared to 21 in October. With the start of the holiday season, demand, which had already been slowing, is poised to drop off. Service centers have been aggressively destocking in preparation for the seasonal slowdown. Service center contacts said that their inventories were mostly balanced with shipments, though some said their inventories were slightly on the high side. Total inventory dropped about 1%, however, while shipments fell 5.7%, with one fewer shipping day and slower seasonal demand.

At the end of November, the amount of flat-rolled steel on order eased from October. The amount of material on order is relatively high compared to November 2019.

The high level of material on order is an indication of the opportunistic blanket deals that have been done for beyond-normal lead times. Steel mills finished November by rolling out price increase announcements, and, often, mills sell large-volume orders at low prices to push out lead times and support price increases. In the latest SMU survey published Dec. 8, HRC lead times extended to 4.35 weeks from 3.9 weeks in the survey two weeks prior.

With the inventory drawdown, price increases and lead times into January, service centers have been placing more orders recently. Though market contacts are skeptical about the longevity of this potential pricing upswing because of lackluster demand, balanced inventories should support a pricing bump for the near term.

Plate

US service center plate inventories bounced up in November with lower shipments. At the end of November, service centers carried 50.3 shipping days of plate supply, up from 47.3 days in October. Inventories represented 2.52 months of supply, up from 2.25 months in October.

Plate inventories have been balanced with shipments, as service centers have been hesitant to purchase more than their immediate requirements. Market contacts have been anticipating slowing demand as well as price declines. Prices have come under pressure from dramatic declines in the sheet market, and recently, Nucor announced a $140-per-ton price decrease on plate effective Nov. 29.

The amount of plate on order remained fairly steady. Mill lead times for plate have been consistently between 4-5 weeks, and service center contacts reported no issues with getting material. With weakening demand and falling prices, service centers do not feel prompted to buy more than their immediate needs.

By Estelle Tran, Estelle.Tran@CRUGroup.com