Market Segment

January 8, 2023

SMU Buyers Sentiment Indices Slip

Written by Ethan Bernard

Steel Market Update’s (SMU) Current Steel Buyers Sentiment Index and Future Steel Buyers Sentiment Index both edged down this week.

SMU’s Steel Buyers Sentiment Indices measure how steel buyers feel about their company’s ability to be successful in the current market, as well as three to six months down the road. Every other week we poll steel buyers about sentiment. We have historical data going back to 2008.

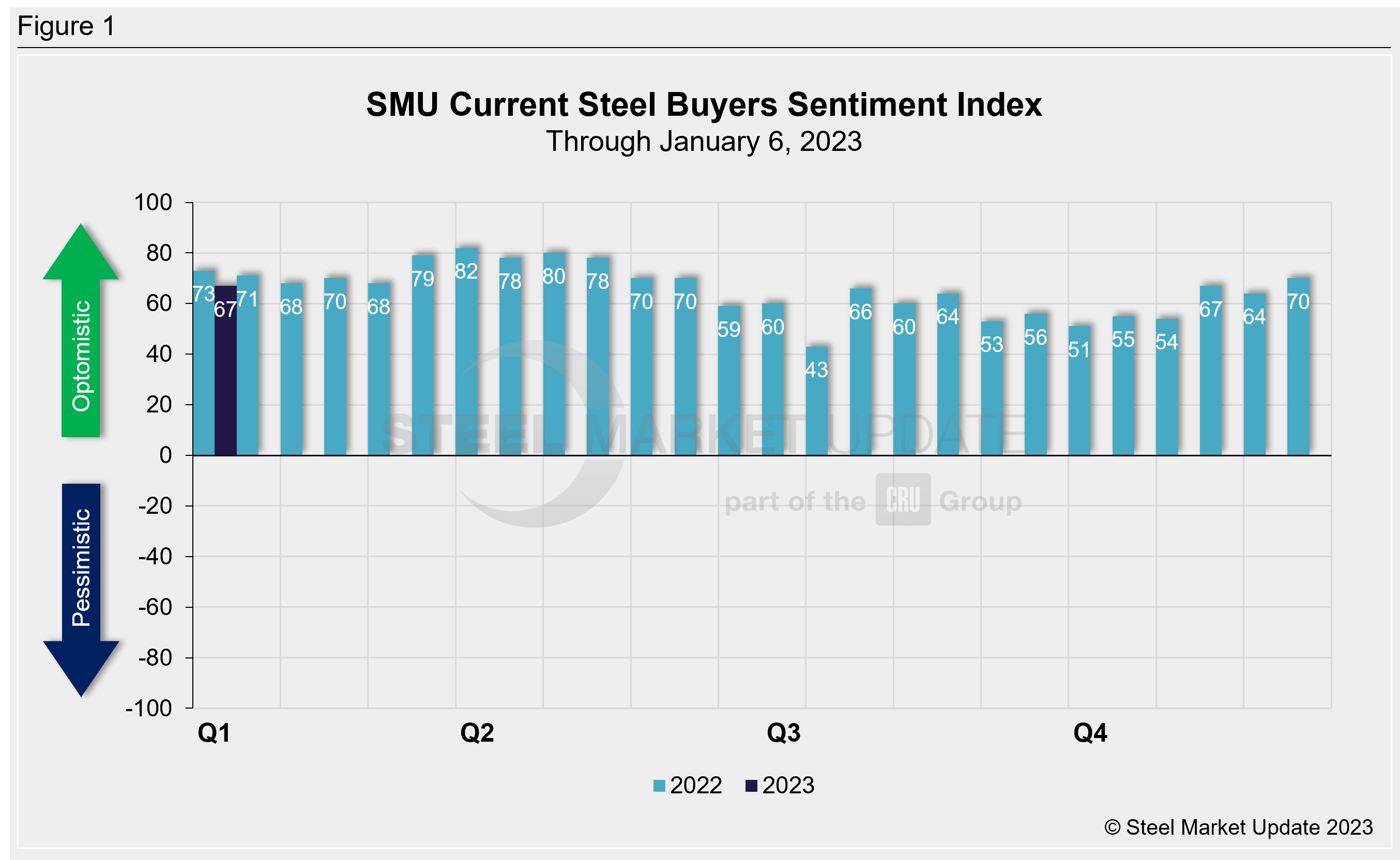

SMU’s Current Buyers Sentiment Index was recorded at +67, down 3 points from the +70 recorded two weeks ago (Figure 1).

SMU’s Future Buyers Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. Future Sentiment dropped two points to +68 vs. two weeks earlier (Figure 2).

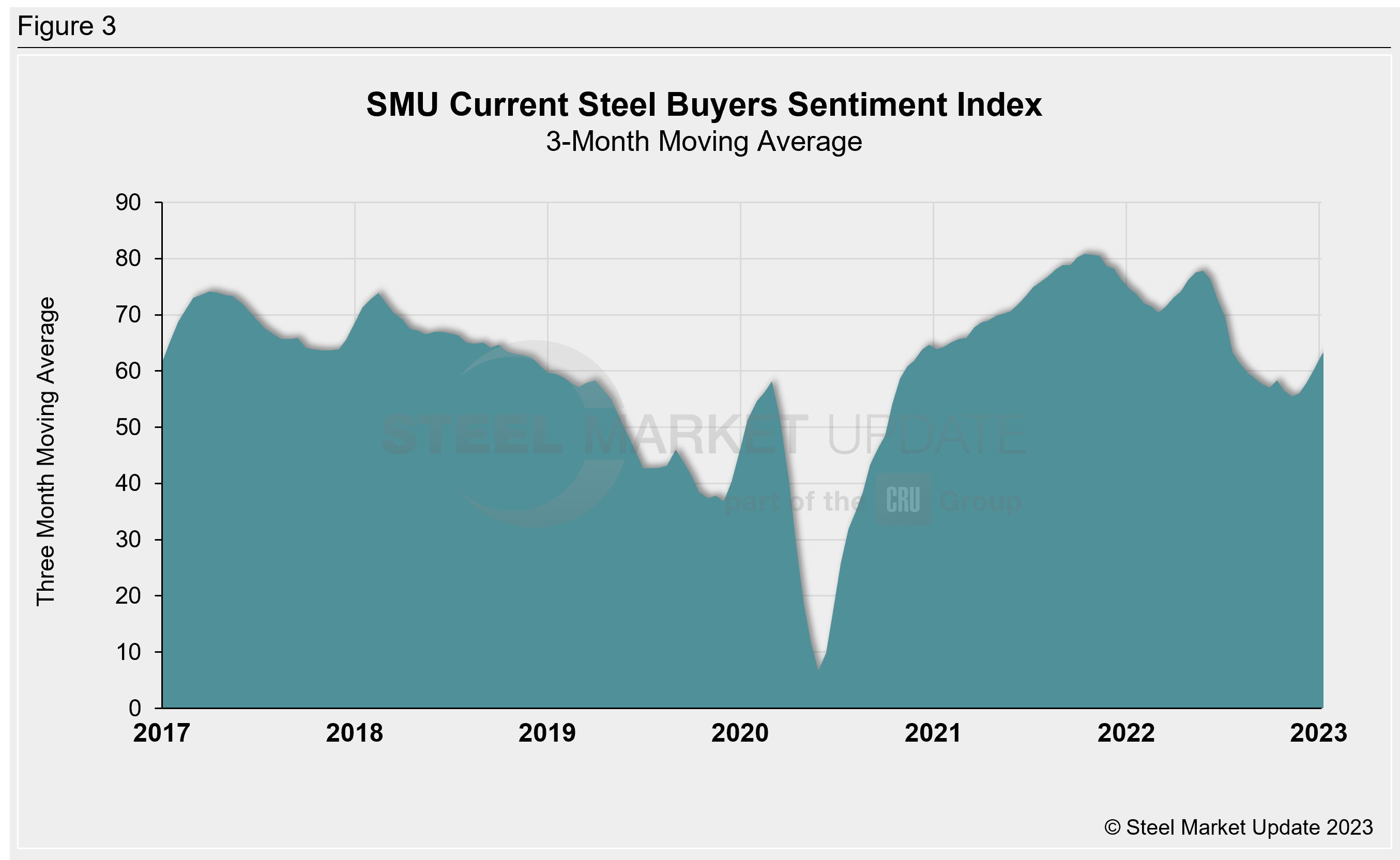

Measured as a three-month moving average, the Current Sentiment 3MMA rose over two points to +62.83 compared to two weeks earlier. (Figure 3).

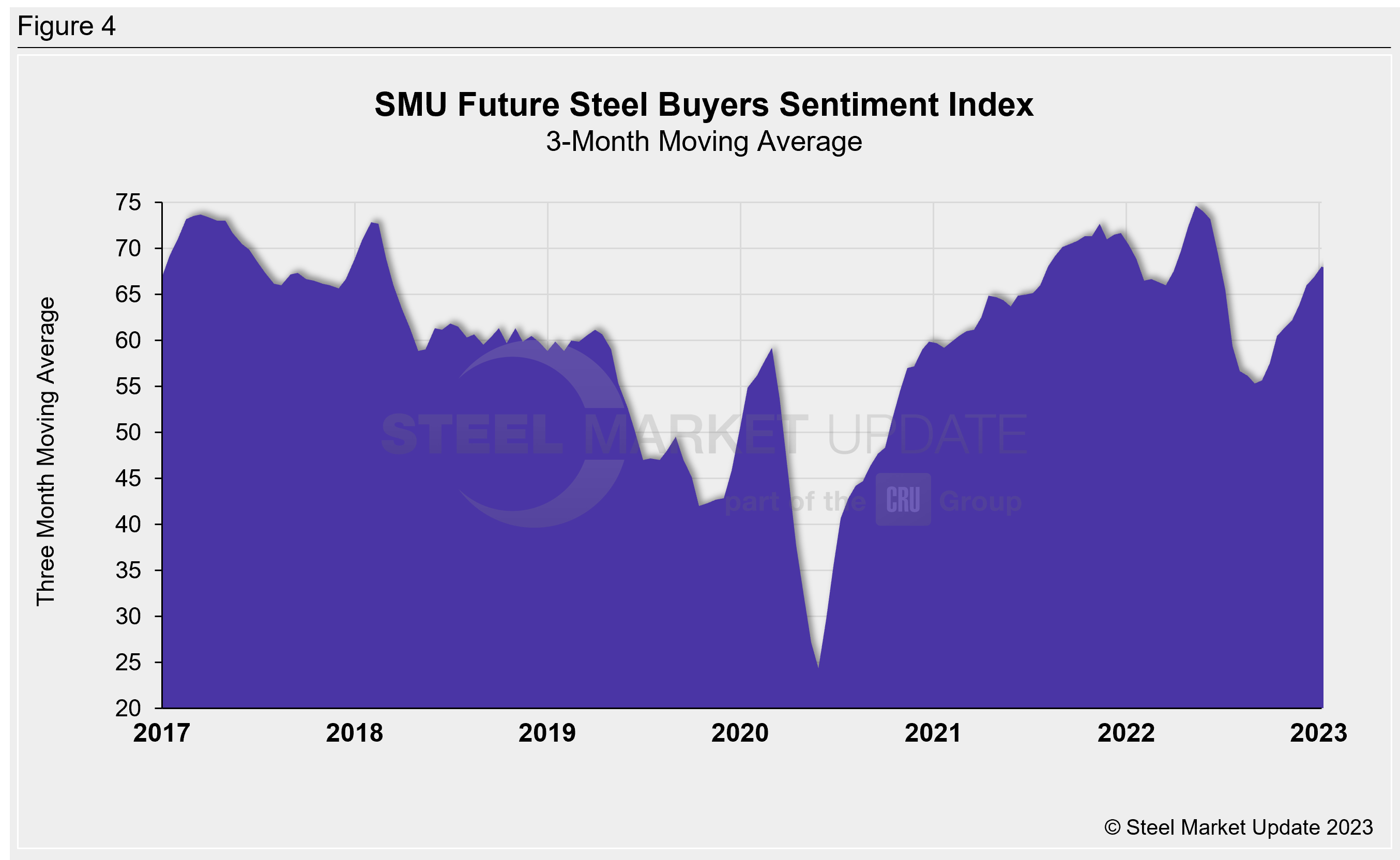

The Future Sentiment 3MMA edged up a little over a point to +68 vs. two weeks ago. (Figure 4).

What SMU Survey Respondents Had to Say:

“Hopefully, commercial construction will keep steady.”

“Good for plate products.”

“The future is unknown.”

“2023 will be a good year for plate.”

“We will scrap for what we get, but fundamentals are less than desirable.”

“The market drivers for higher pricing have mostly receded.”

About the SMU Steel Buyers Sentiment Index

The SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via SMU surveys that are conducted twice per month.

We send invitations to participate in our survey to more than 700 North American companies. Approximately 45% of respondents are service centers/distributors, 30% are manufacturers, and the remainder are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Ethan Bernard, Ethan@SteelMarketUpdate.com