Prices

January 5, 2023

Steel Mills Continue to Balk at Negotiating Lower Tags

Steel mills are less willing to negotiate prices as we enter into the new year. With the exception of Galvalume, all of the products SMU surveyed remained more fixed in price compared with the last market check two weeks ago, and a far cry from early November of last year.

In fact, the plate market showed the largest decline, where 50% of buyers said mills were willing to negotiate price in our survey this week ended Jan. 5, down from 75% two weeks earlier.

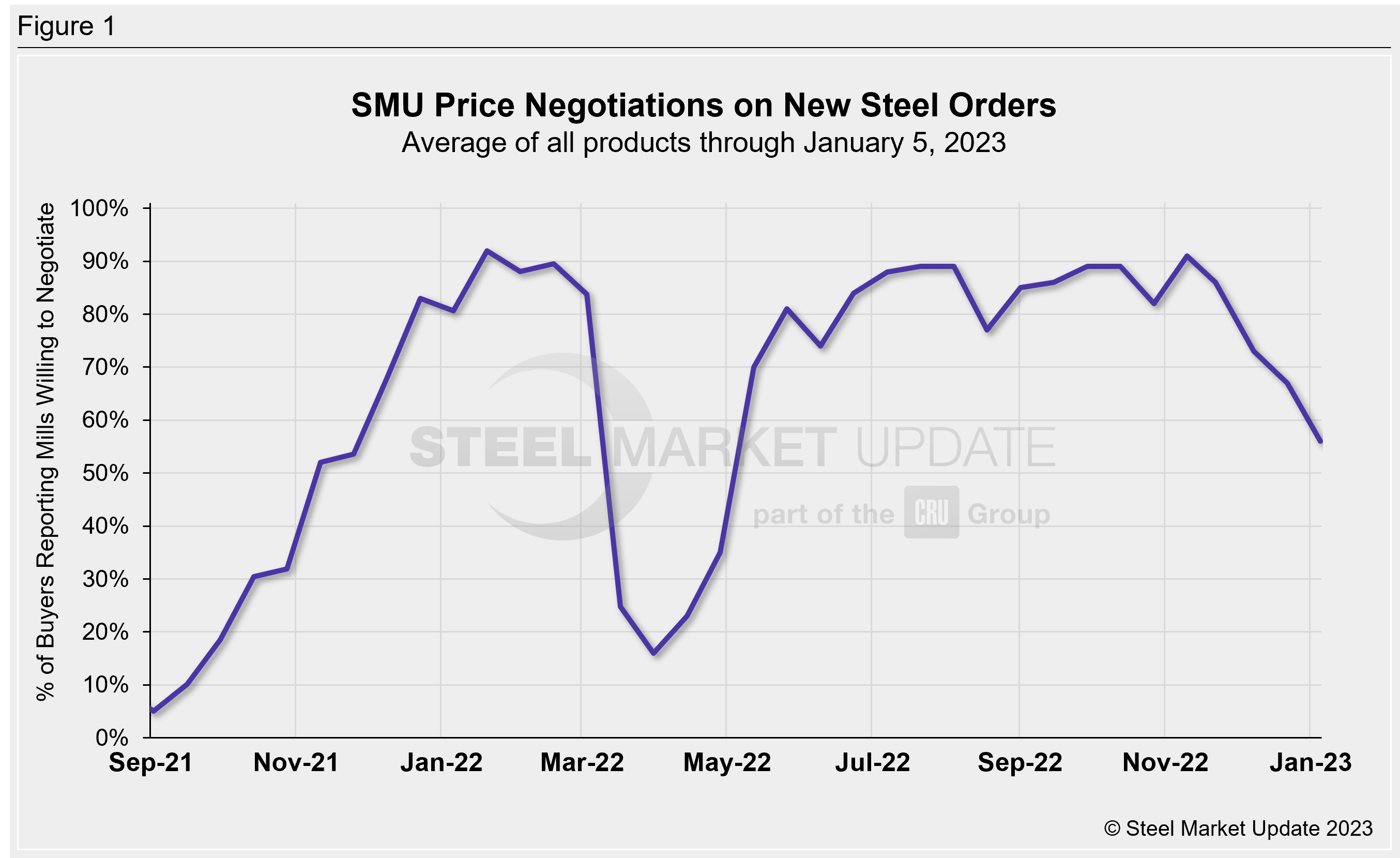

Every two weeks, SMU asks hundreds of steel buyers: Are you finding domestic mills willing to negotiate spot pricing on new orders? On average, 56% of steel buyers polled this week reported mills were willing to talk price on new orders, down from an average rate of 67% two weeks ago, and a fall from 73% one month ago. As shown in Figure 1, negotiation rates continue their downward trend from the beginning of November.

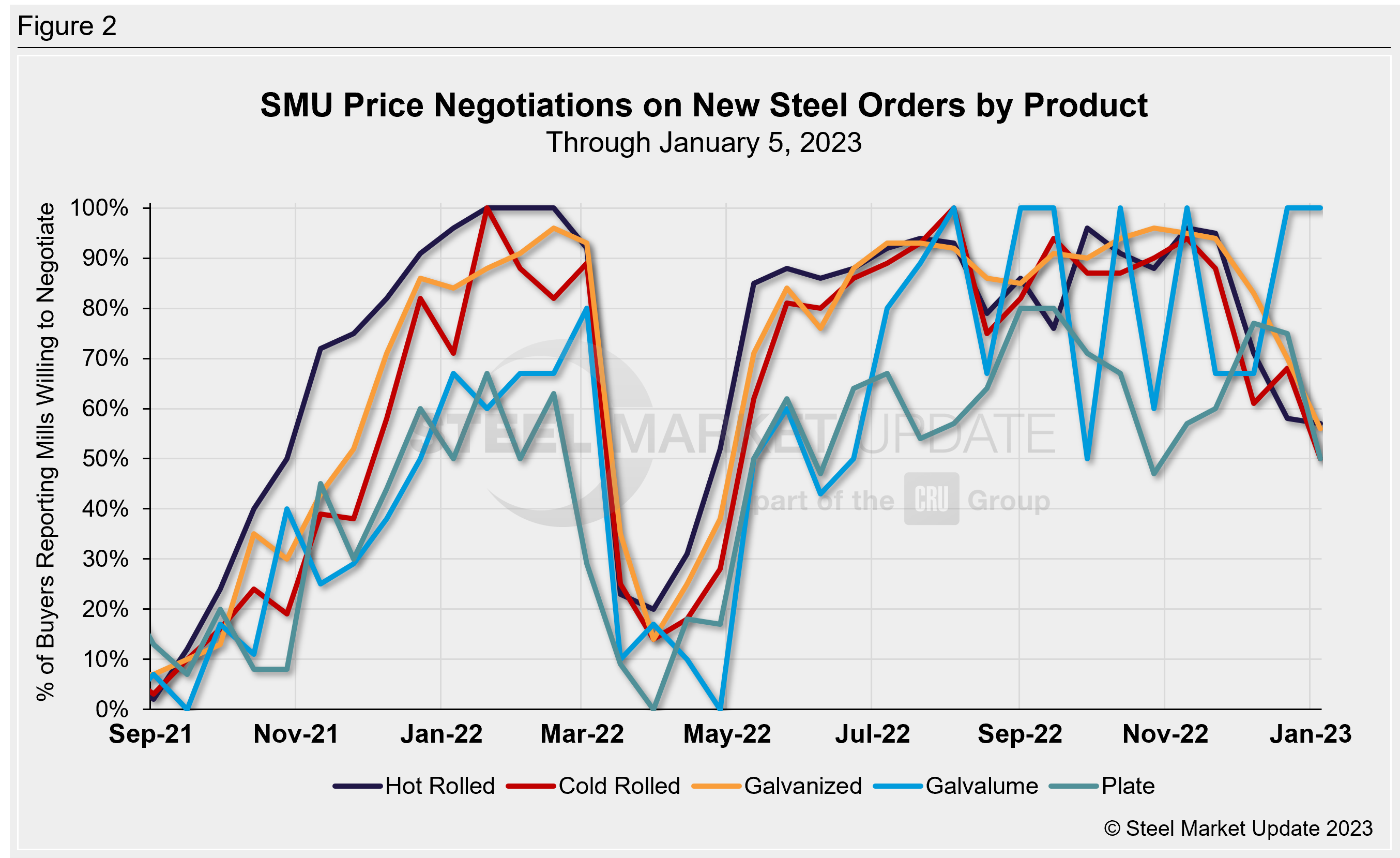

Figure 2 below shows negotiation rates by various products. This week, hot-rolled remained relatively flat, with 57% of hot-rolled buyers reporting mills are willing to negotiate lower prices on new orders vs. 58% two weeks ago.

Buyers in the cold-rolled market reported 50% of mills willing to negotiate prices this week, a drop of 18% vs. Dec. 2, and a steep fall from the 94% willing to negotiate recorded for the week of Nov. 10.

In galvanized steel, 56% of buyers said mill prices were negotiable this week, compared to 70% two weeks ago, off highs above the 90th percentile through late November.

Galvalume negotiation rates were the outlier, staying completely flat over the two-week period, with all respondents saying prices were negotiable. Only a month ago that rate stood at 67%.

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Ethan Bernard, Ethan@SteelMarketUpdate.com