Market Segment

January 3, 2023

SMU Sentiment Index Rises Six Points

Written by Ethan Bernard

Steel Market Update’s (SMU) Current Steel Buyers Sentiment Index rose six points through Dec. 22 compared with two weeks earlier. Our Future Buyers Sentiment Index also jumped, edging up four points from the previous market check. Current Sentiment remains slightly above a month ago.

SMU’s Buyers Sentiment Index measures how steel buyers feel about their company’s ability to be successful in the current market, as well as three to six months down the road. Every other week we poll steel buyers about sentiment, with historical data going back to 2008.

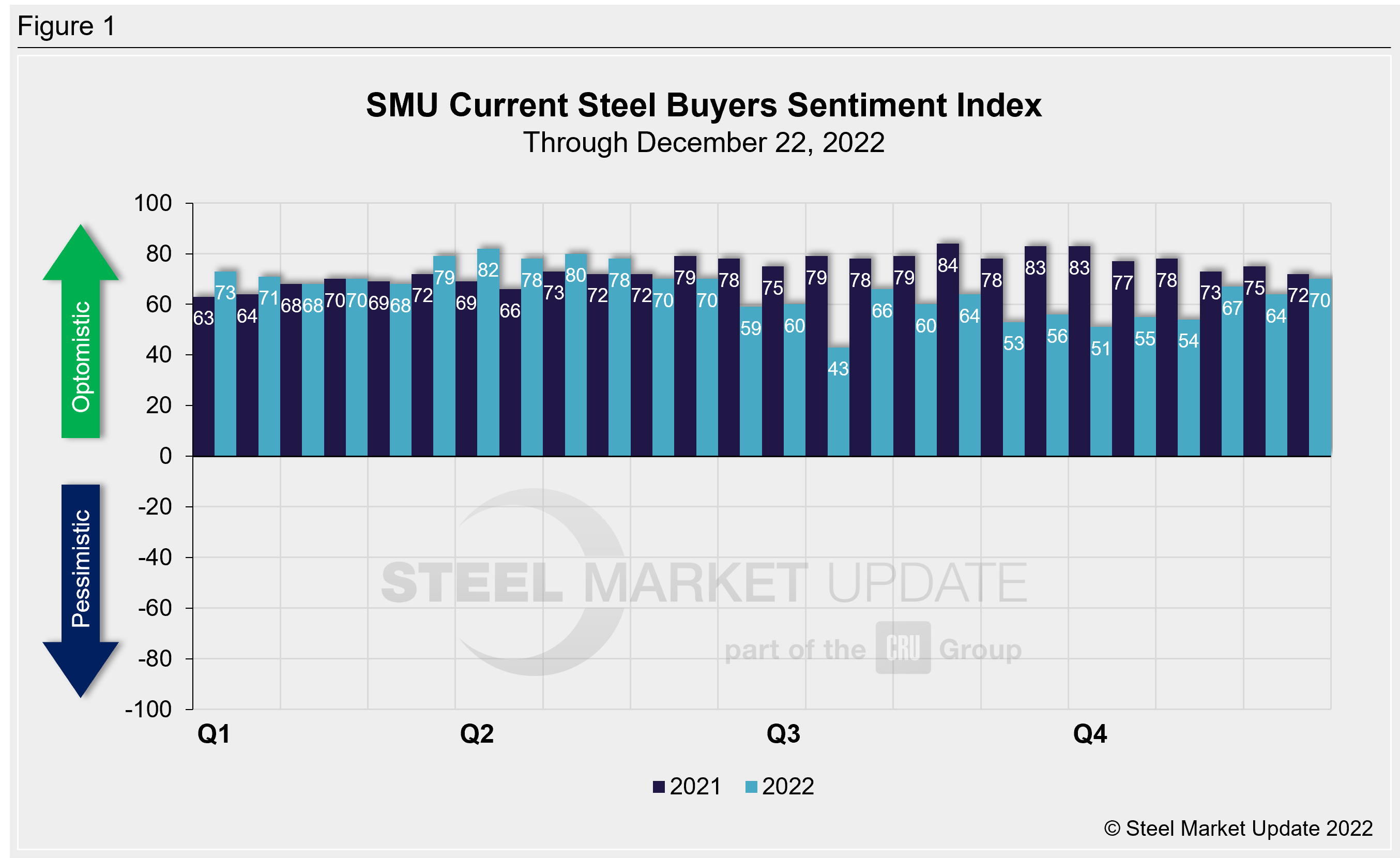

SMU’s Current Buyers Sentiment Index was recorded at +70, up from +64 at our previous market check, and three points higher than compared to one month ago (Figure 1).

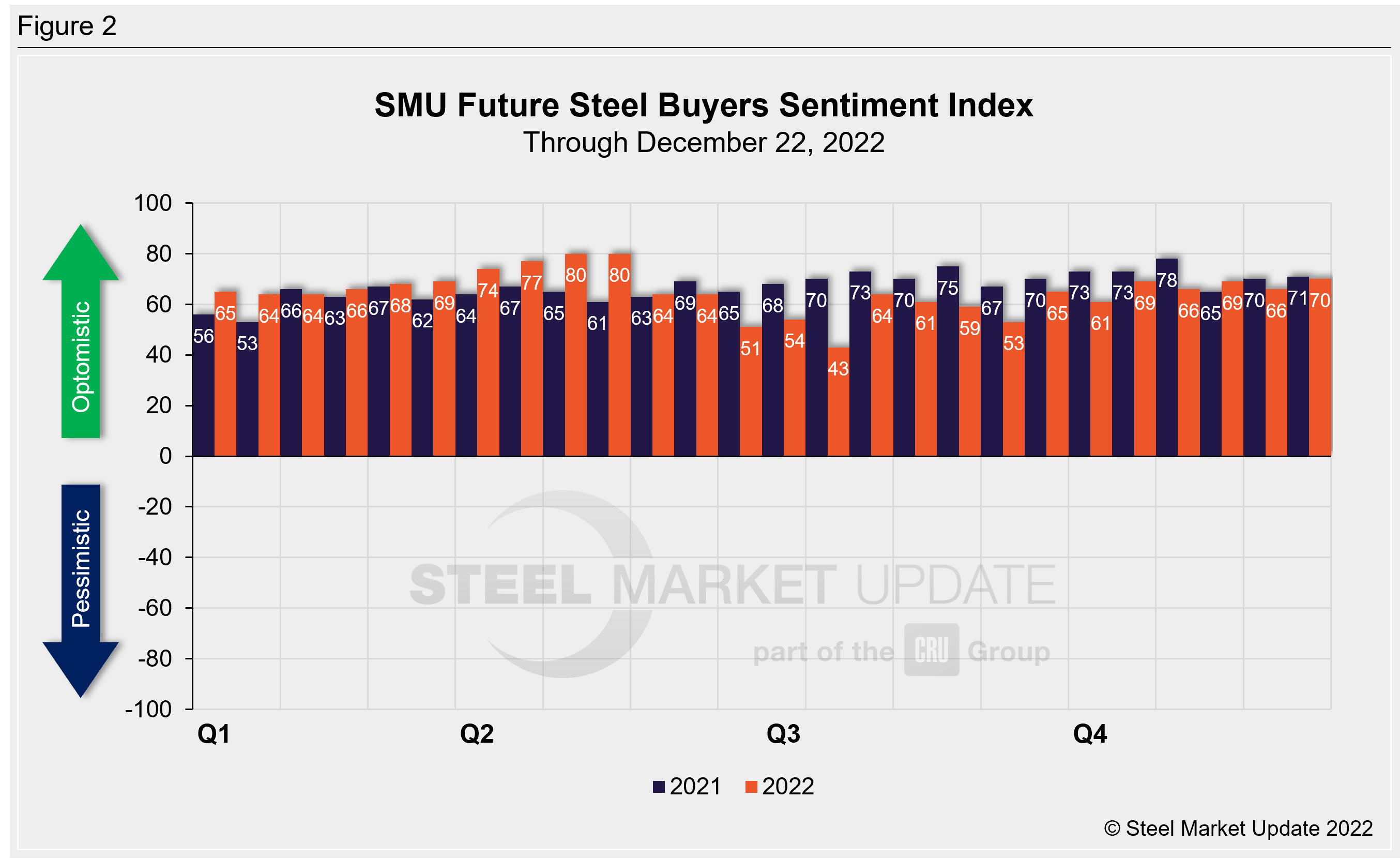

SMU’s Future Buyers Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. Future Sentiment jumped four points from our previous survey to +70, and up one point from +69 a month ago. (Figure 2). At the beginning of last year, Future Sentiment was at +65.

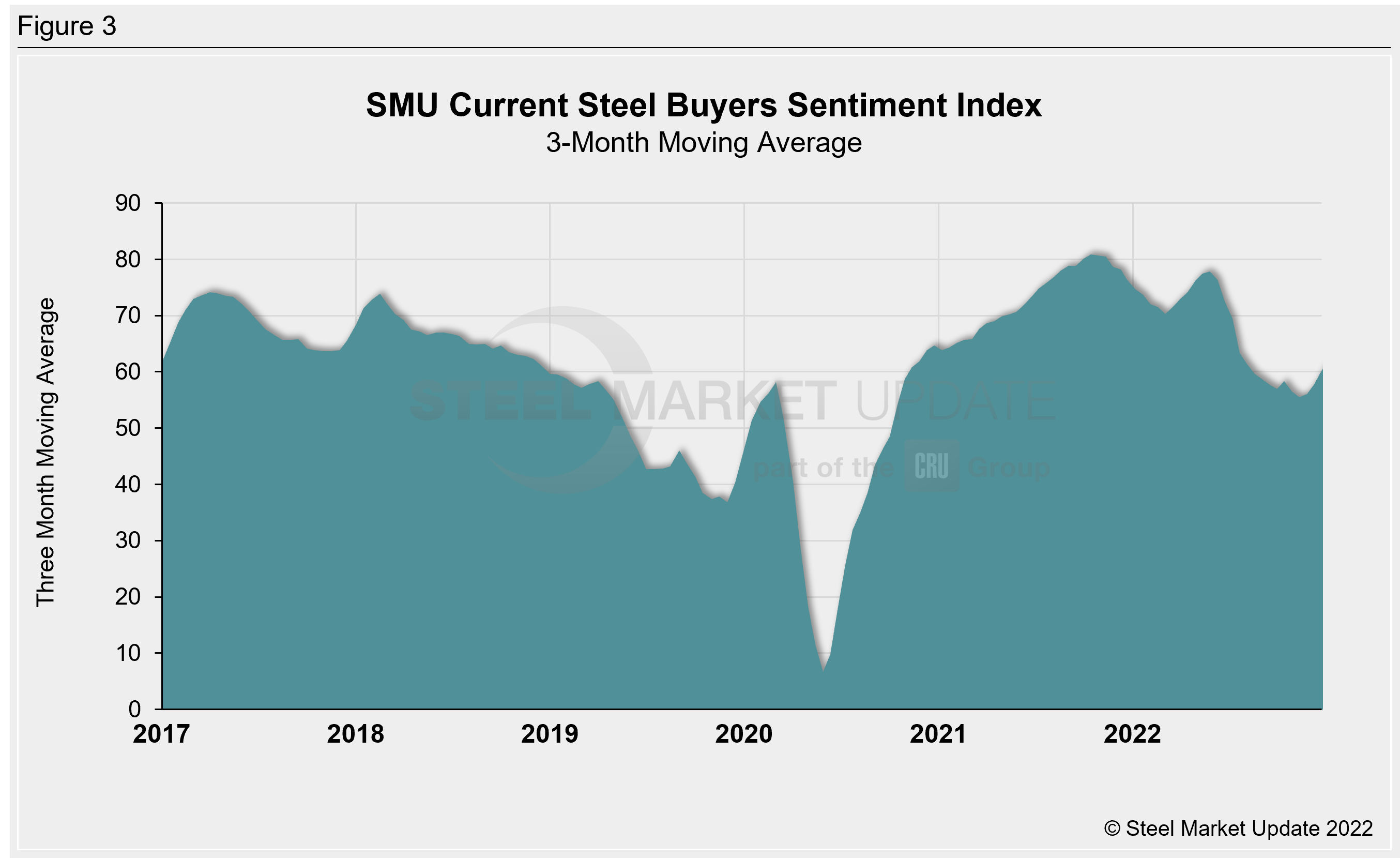

Measured as a three-month moving average, the Current Sentiment 3MMA rose over two points to +60.17 from +57.83 two weeks earlier, continuing to rebound since trending downward between May and November. (Figure 3). However, in January 2022 the Current Sentiment 3MMA stood at +74.67.

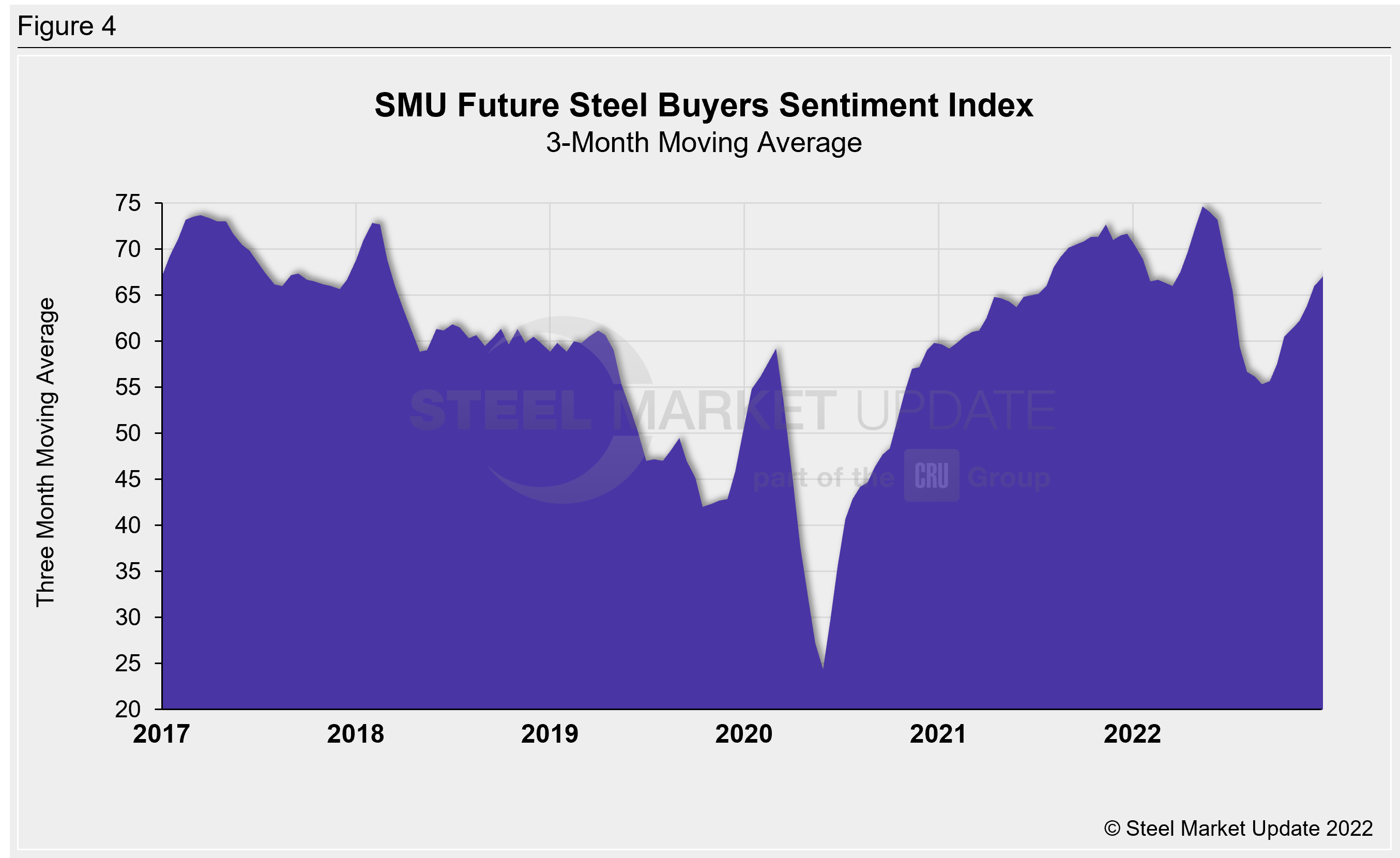

The Future Sentiment 3MMA ticked up slightly again this week to +66.83 from +66.0 two weeks ago., and up three points from a month ago. (Figure 4). At the beginning of 2022, the Future Sentiment 3MMA stood at +70.33.

What SMU Survey Respondents Had to Say:

“Steady but no or very little growth.”

“Good, dependent on making some price concessions.”

“Economic situation might deteriorate based on central banks’ aggressive rate hikes, and they will get what they are seeking – a slower economy.”

“Demand remains good. Inventory in good position to service our markets.”

“Demand is looking better and inventories do not seem bloated.”

“Order books are strong. Supply chain and labor issues are working themselves out.”

“Optimistic, but only because our business enjoys low-ish steel pricing.”

“Will be a good year, not great, because of Fed actions. Underlying demand will be ok.”

About the SMU Steel Buyers Sentiment Index

The SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via SMU surveys that are conducted twice per month.

We send invitations to participate in our survey to more than 700 North American companies. Approximately 45% of respondents are service centers/distributors, 30% are manufacturers, and the remainder are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Ethan Bernard, Ethan@SteelMarketUpdate.com