Market Segment

December 14, 2022

North American Auto Assemblies Slip in November

Written by David Schollaert

North American auto assemblies declined by 6.2% in November, reversing the nearly 3% increase in October. Last month’s assembly output was among the lowest totals year-to-date (YTD) and just 3.7% higher year-on-year (YoY), according to LMC Automotive data.

Though the market remains supply-constrained due to ongoing parts and supply shortages, November’s downgraded production continued to highlight the ongoing ebb and flow auto assemblies have seen for most of 2022.

Supply-chain constraints have continued to improve, aiding production, and boosting dealership inventory, but increased deliveries in October were likely a contributing factor to last month’s decline. Despite recent improvements, ongoing parts and chip shortages are expected to remain a factor in the near to medium term.

The impact of the global semiconductor crisis on the North American automotive market was extensive, at times nearly crippling. The early onset of the pandemic certainly slowed auto assemblies. However, the chip scarcity led to extensive production halts, delays, and inventory shortages.

Though at times slow, the recovery has been notable, especially over the past few months. But November’s production decline underscores that there is still ground to be made up. When compared to the last “normal” year in 2019, production is down 12.4%, a notable shift from a month prior when assembly totals were just 2.7% behind.

New-vehicle inventory stocks, though well above last summer’s lows, are heavily skewed towards base models and higher-priced vehicles. And while November’s available retail inventory exceeded one million units for a second consecutive month, it was yet another month where supply constraints kept vehicle sales artificially low but delivered record transaction prices and dealer profitability.

North American vehicle production, including personal and commercial vehicles, totaled 1.191 million units in November, down from 1.271 million units in October, but better than the 1.149 million units produced one year ago.

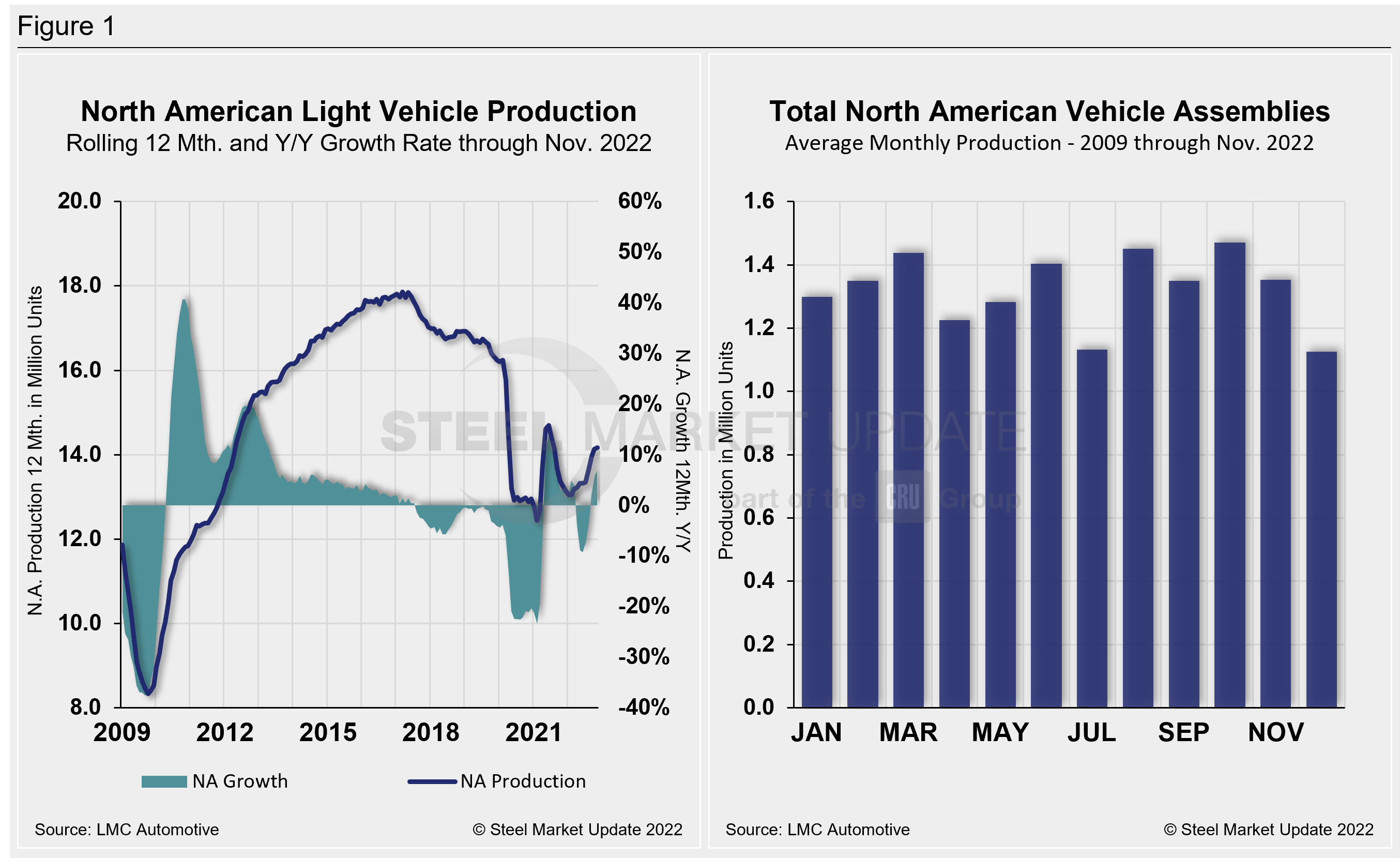

Below in Figure 1 is North American light-vehicle production since 2009 on a rolling 12-month basis with the year-over-year (YoY) growth rate. Also included is the average monthly production, which includes seasonality, over the same period.

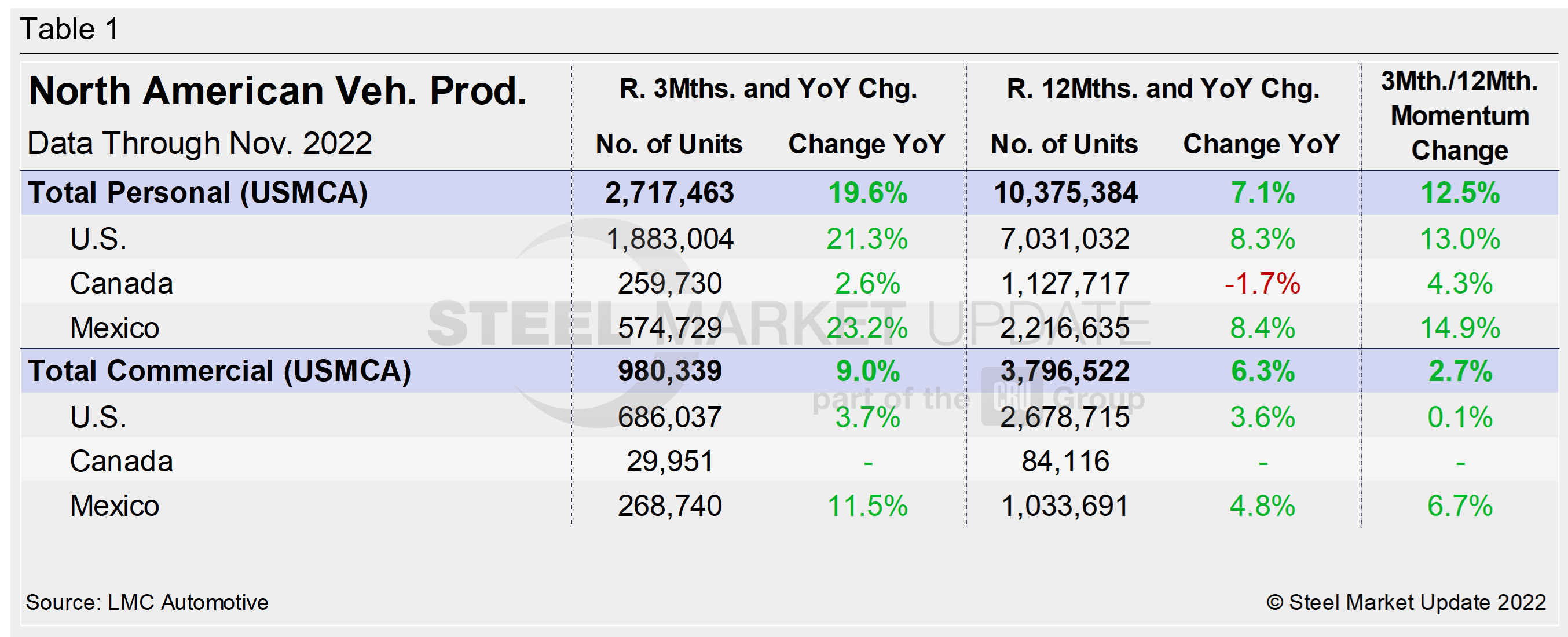

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into US, Canadian and Mexican components, along with the three- and 12-month growth rates for each and their momentum change.

The initial recovery from Covid’s early spread was significant, but the effect of the chip and parts shortage has been more extensive and prolonged. Through last September, growth rates for personal and commercial light vehicles were -25.8% and -8.4%, respectively, owing to the ongoing chip shortage and supply-chain disruptions. They have since recovered nicely, now both posting steady gains.

For the three months through November, the growth rate for total personal and commercial vehicle assemblies in the USMCA region is up noticeably. On a 12-month basis, the story is a bit different, but still improving.

Personal Vehicle Production

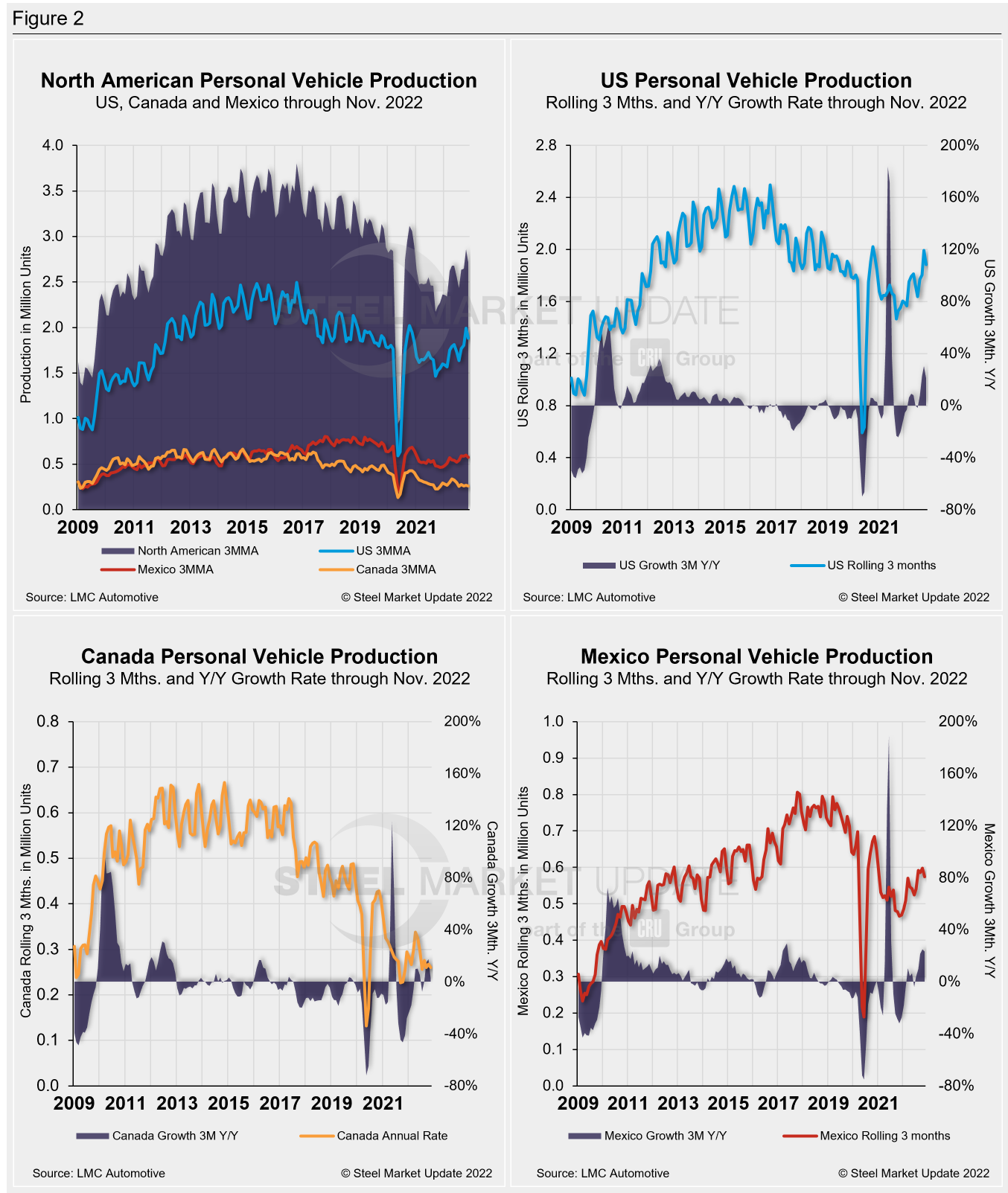

The longer-term picture of personal vehicle production across North America is shown below. The charts in Figure 2 show the total personal vehicle production for North America and the total for the US, Canada, and Mexico. Personal vehicle production in the US, Canada, and Mexico and their YoY growth rate are also displayed.

In terms of personal vehicle production, only the US saw a month-over-month (MoM) decrease in November.

Canada saw the largest increase in units produced and percentage growth in November versus October, up 18,586 units (+24%). It was followed by Mexico, up 11,249 units (+5.9%). The US saw a 78,496-unit loss (-11.9%) MoM.

Despite mixed results last month for the region, the annual growth rate in November was up. Mexico was ahead last month, showing a 23.3% growth rate, followed by the US, still expanding at 21.3% despite the MoM decline, and Canada, up 2.6%.

Production share across the region was largely unchanged. The US saw its personal vehicle production share of the North American market edge down by 0.4 percentage points to 69.3%. Mexico and Canada were both up just 0.2 percentage points to 21.1% and 9.6%, respectively.

Commercial Vehicle Production

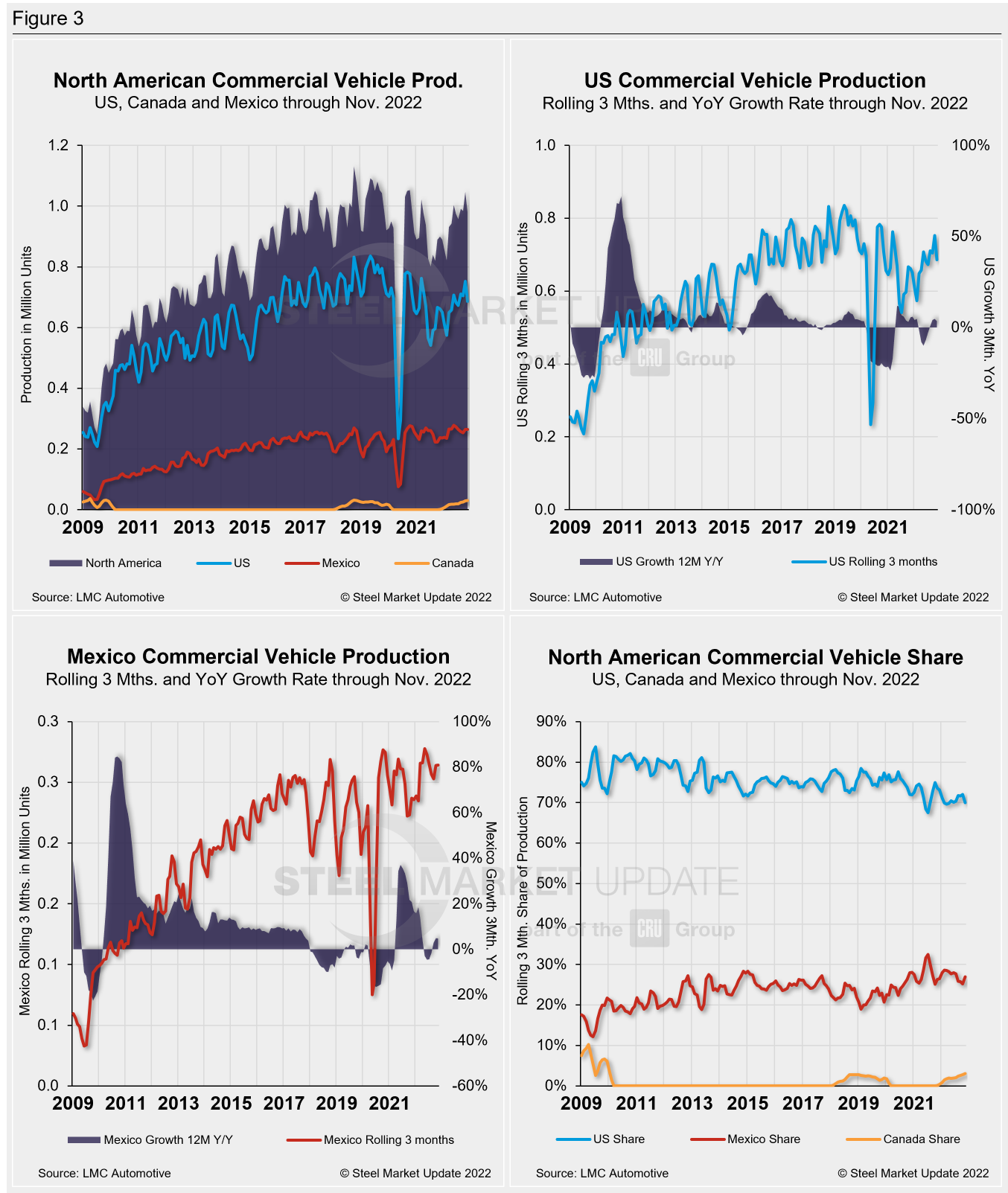

Total commercial vehicle production for North America and the total for each nation within the region are shown in the first chart in Figure 3 on a rolling three-month basis. Commercial vehicle production in the US and Mexico and their YoY growth rates, as well as the production share for each nation in North America, are also shown.

Of note for the Canadian automotive sector: November marked the 13th month since Canada resumed commercial vehicle production after a 20-month production halt. Canada produced 10,692 light commercial vehicles in November, a 15.9% increase from October, and the highest total since resuming production last November.

North American commercial vehicle production was down by 8.9% in November, though, with 312,216 units produced during the month, a decrease of 30,623 units MoM. Canada saw the largest gain, followed by Mexico, up just 104 units (+0.1%). The US posted a 13.2% decline MoM, with 32,190 fewer units MoM in November.

The overall decline put the commercial production growth rate at 9% for the region. Though down nearly 50% MoM, the result was still a vast improvement from the -8.4% growth rate seen a year ago.

The US share fell by 2 percentage points to 70% in November. Mexico saw its share increase from 25.2% to 27% last month, while Canada saw its share increase from 2.8% to 3.1% in November.

Presently, Mexico exports just under 80% of its light-vehicle production. The US and Canada are the highest-volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the US, Canada, and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included).

By David Schollaert, David@SteelMarketUpdate.com