Prices

December 1, 2022

ISM: US Manufacturing Contracted in November

Written by David Schollaert

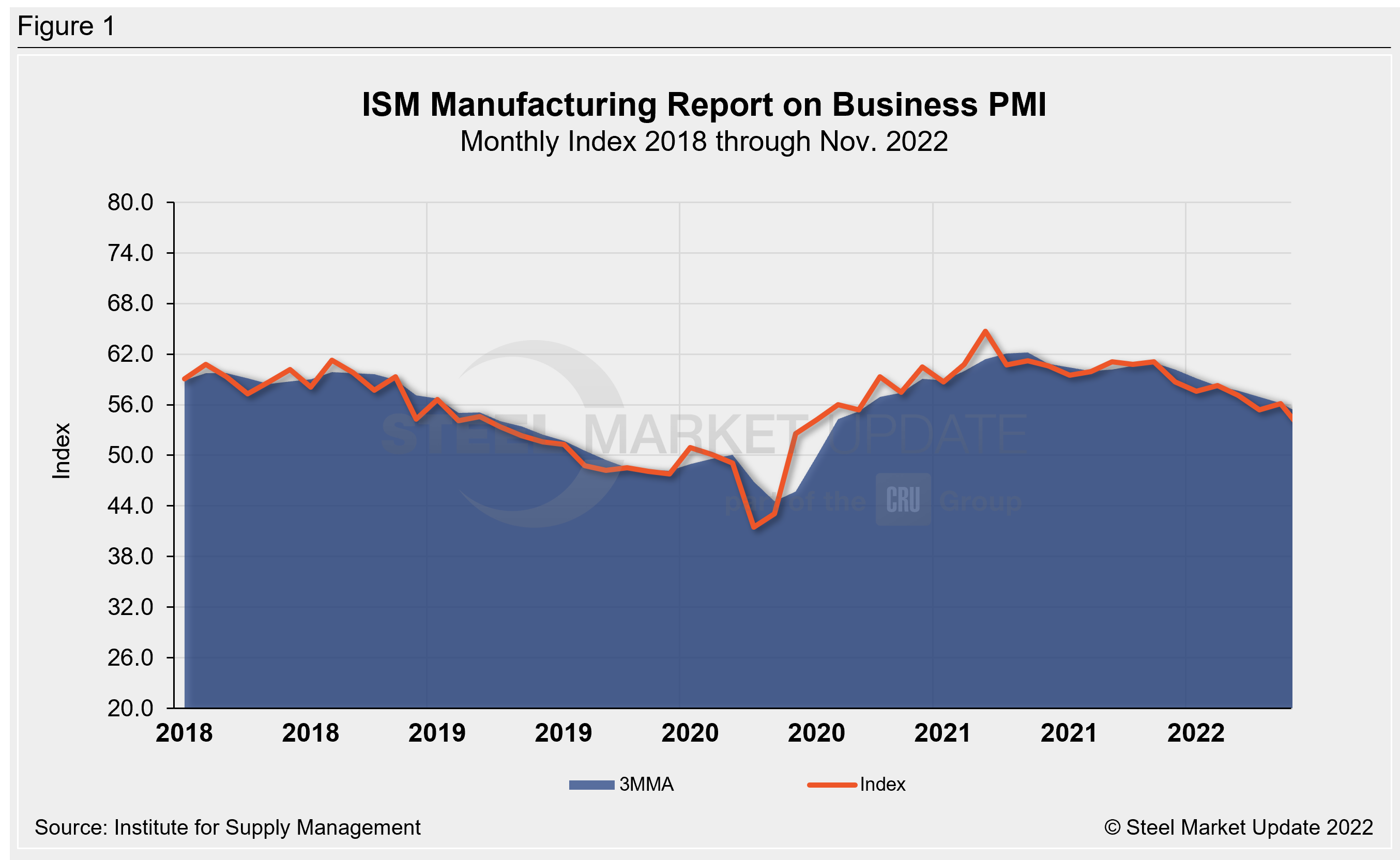

US manufacturing activity contracted in November for the first time since May 2020, according to the Institute for Supply Management (ISM).

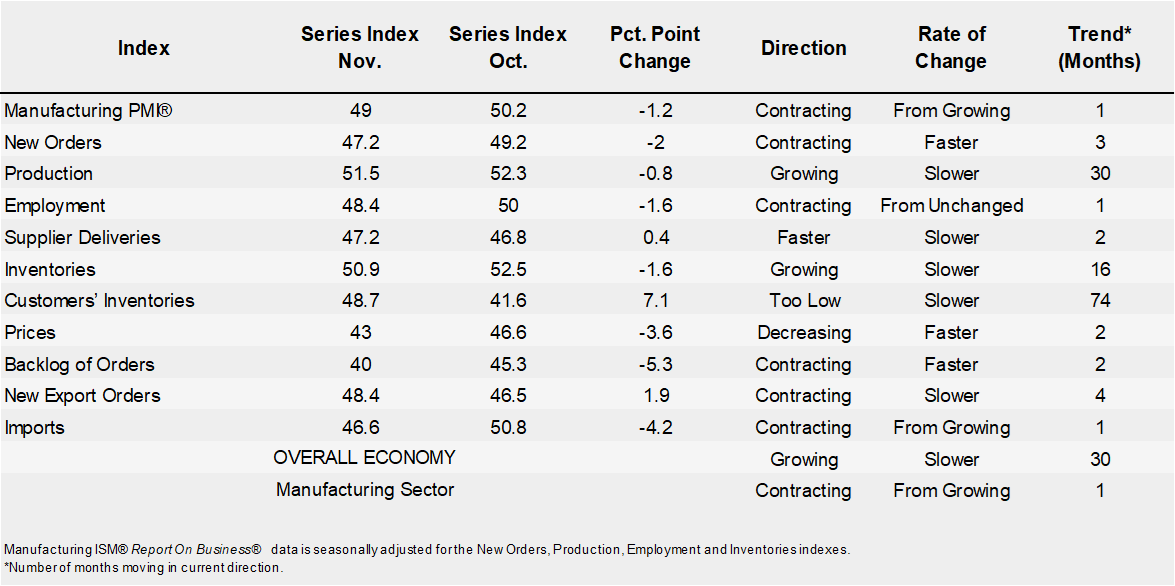

The ISM’s November manufacturing PMI dipped below the neutral 50.0 mark — the level that typically divides expansion from contraction. It was slowed as new orders remained in contraction territory, while prices fell further — declining 1.2 percentage points month-on-month (MoM) to their lowest level in two and a half years.

The ISM’s report focused on the continued softening of new order rates over the previous six months, as the November composite index reading “reflects companies’ preparing for future lower output.”

November’s manufacturing PMI fell to 49%, down from 50.2% in October, to the lowest reading since May 2020 when the pandemic recovery began. The latest reading was also down for the third straight month and below the consensus forecasts of 49.8%.

“Manufacturing contracted in November after expanding for 29 straight months,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee, adding that companies continue to judiciously manage hiring.

Fiore added that managing head counts and total supply chain inventories remain primary goals, while “order backlogs, prices and now lead times are declining rapidly, which should bring buyers and sellers back to the table to refill order books based on 2023 business plans.”

Six manufacturing industries, including primary metals, miscellaneous manufacturing, petroleum & coal products, transportation equipment, apparel, and leather and allied products reported growth. Fabricated metal products, printing, wood products, textile mills, and furniture, were among the 12 industries reporting a contraction.

The report’s forward-looking new orders sub-index remained in contraction territory in November, decreasing to a reading of 47.2, down from 49.2 the month prior. It was the fifth time this year that the index has contracted.

An interactive history of the ISM Manufacturing Report on Business PMI index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com