Distributors/Service Centers

October 13, 2022

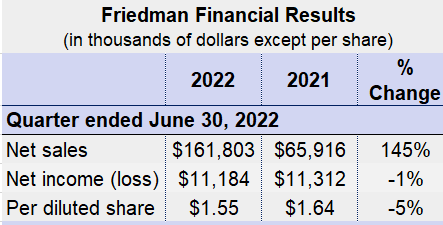

Friedman Benefits from Plateplus Buy, Posts Solid Q1 Profit

Written by Laura Miller

Friedman Industries is already seeing the benefits of its April acquisition of Plateplus Inc., but hedging losses continue to impact the company.

The Longview, Texas-based steel processor and manufacturer said the fiscal 2023 first quarter ended June 30, 2022, was positively impacted by the acquisition, resulting in the second most profitable quarter in the company’s history.

Above-average margins due to sharply increasing steel prices also benefited the company during the quarter, Friedman noted in its latest earning report.

Tons sold in the company’s coil segment were up 141% in the quarter to 94,000 tons, with Plateplus shipments accounting for 54,000 of those tons. Hedging losses of $626,180 were down from $3.1 million in the year-ago quarter.

Higher selling prices in the tubular segment were offset by a 27.6% year-on-year decline in tons sold to 10,500 tons during the quarter. The segment saw a loss of $412,340 on hedging activities.

The Plateplus acquisition completed in April consisted of facilities in East Chicago, Ind., and Granite City, Ill., as well as steel inventory and customer and supplier networks from Plateplus locations in Loudon, Tenn., and Houston. The purchase price was $63.8 million in cash and 516,041 shares of Friedman’s common stock.

The acquisition has allowed Friedman to expand its reach to the heavy concentration of steel consumers in the Midwest, said president and CEO Michael J. Taylor.

Installation of steel processing equipment at Friedman’s new facility in Sinton, Texas, was completed in September and equipment commissioning began this month. It expects to begin shipping material to customers later this month. In fiscal 2024, it anticipates shipments from the facility to reach 110,000 tons to 140,000 tons.

For the fiscal second quarter, Friedman anticipates reporting sales of $150 million on shipments of 115,000 tons.

For the third and current quarter, market conditions are already more stable, but sales volumes are expected to be down slightly to 105,000 tons due to the slowdown of the upcoming holiday season, the company said.

By Laura Miller, Laura@SteelMarketUpdate.com