Analysis

November 21, 2022

Multifamily Construction Ends Q3 on a Low

Written by David Schollaert

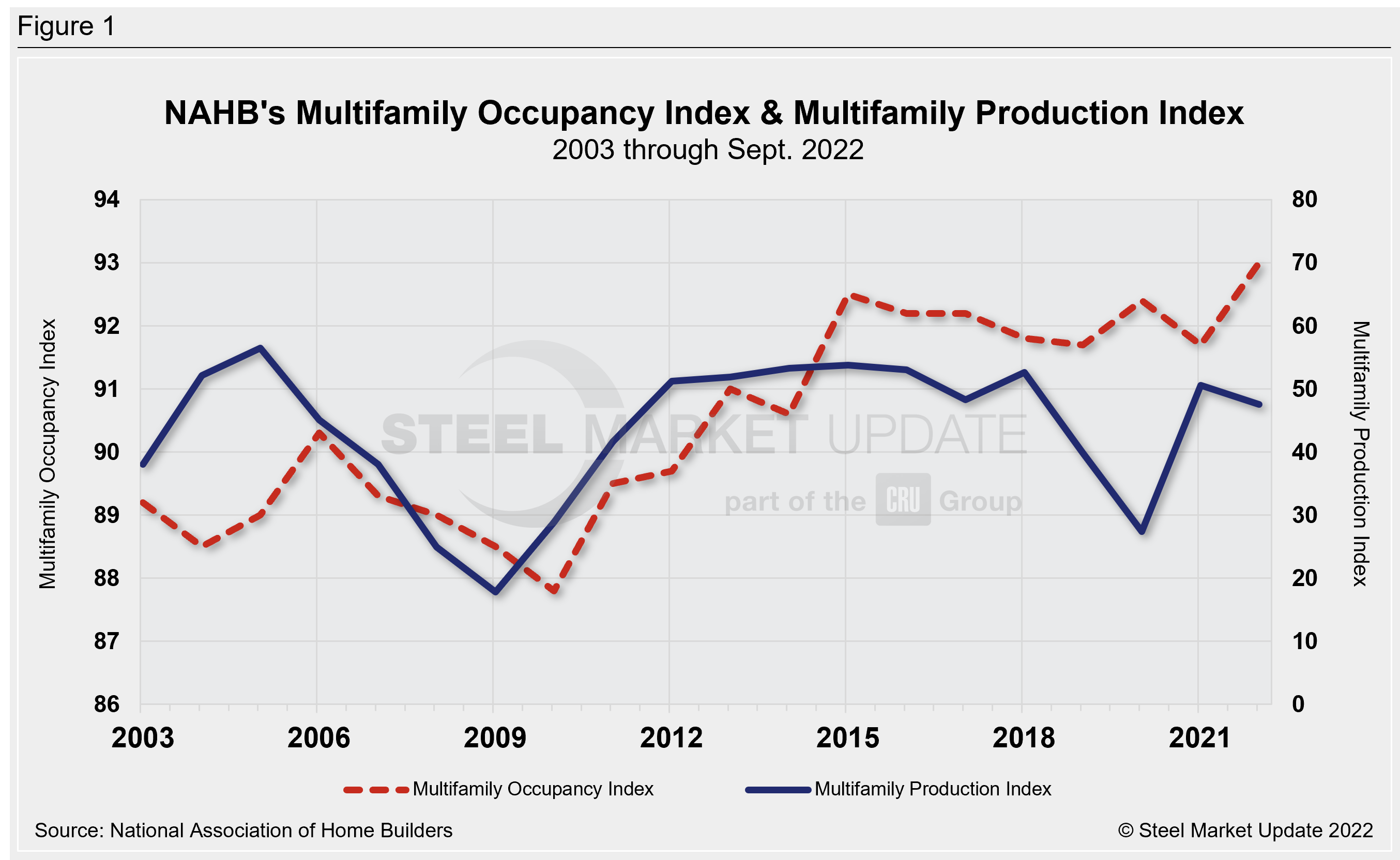

The outlook for multifamily construction closed the third quarter on a low note, as confidence in the market for new multifamily housing declined significantly during the period, according to the National Association of Home Builders’ (NAHB) Multifamily Market Survey (MMS).

The MMS’s two separate indices saw mixed results. The Multifamily Production Index (MPI) fell 10 points from the previous quarter to 32, while the Multifamily Occupancy Index (MOI) dropped 15 points to a reading of 45.

The MPI measures builder and developer sentiment about current conditions in the apartment and condo market, while the MOI measures the multifamily housing industry’s perception of occupancies in existing apartments. Both are measured on a scale of 0 to 100 with a result above 50 indicating growth.

The MPI is a weighted average of three key elements of the multifamily housing market: low-rent units/apartments, market-rate rental units/apartments, and condominiums. All three components decreased from Q2 to Q3 2022. The component measuring market-rate rental units dropped 13 points to 39, while the component measuring for-sale units posted a 10-point decline to 23. The component measuring low-rent fell nine points to 36 during the same period.

“Although demand for multifamily housing remains strong in many parts of the country, some multifamily developers are starting to see signs of a slowdown,” said Sean Kelly, NAHB’s Multifamily Council chairman. “The ongoing problems of scarcity and high cost of land and materials are making it difficult to go forward with certain projects, particularly affordable housing projects.”

The MOI measures current occupancy indexes for class A, B and C multifamily units. The index fell 15 points to 45, the lowest level since Q1 2010, aside from the onset of the pandemic in the spring of 2020.

“Multifamily developers are becoming cautious, as supply constraints have caused a large backlog of projects started but not yet completed to accumulate in the pipeline,” said Robert Diez, NAHB’s chief economist. “An emerging additional constraint is financing for new multifamily development, which 79% of developers say is somewhat or significantly less available than it was a year ago. NAHB is now projecting a significant decline in multifamily starts in 2023.”

About the report: The Multifamily Market Survey (MMS) is based on a quarterly survey of NAHB multifamily builders and property managers. The survey is designed to monitor conditions for multifamily production starts and multifamily rental occupancy in the current versus preceding quarter as well as in the next six months.

By David Schollaert, David@SteelMarketUpdate.com