Analysis

November 15, 2022

US Light Vehicle Sales Gain More Momentum in October

Written by David Schollaert

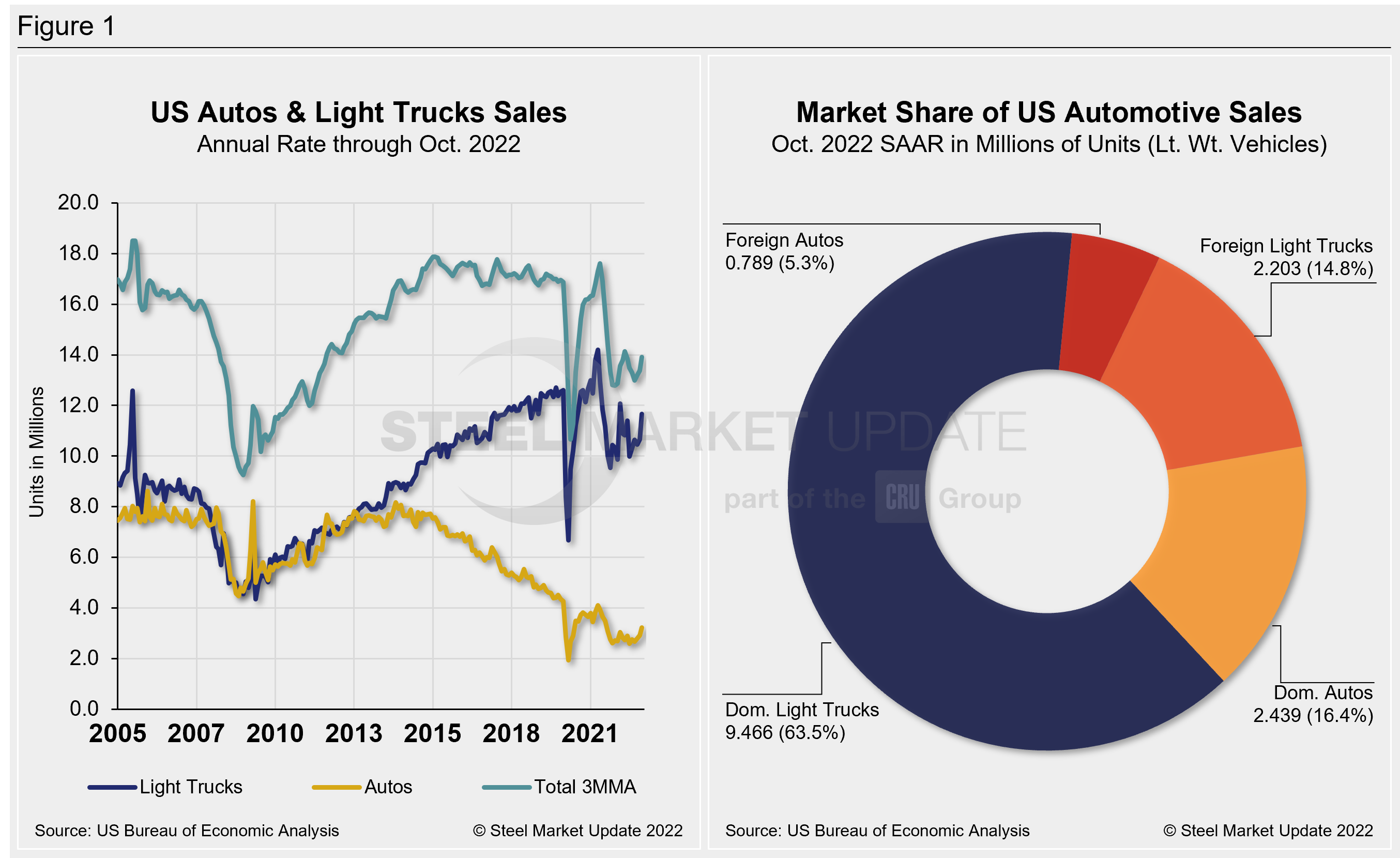

US light vehicle (LV) sales grew in October, coming in at an unadjusted figure of 1.15 million units. Last month’s total was a 9.5% increase year-on-year (YoY), the US Bureau of Economic Analysis (BEA) reported. October was the third consecutive month to see YoY increases in sales. Prior to August, YoY sales gains had not been seen since July 2021.

LV sales were also up 9.8% month-on-month (MoM) in October, rising to an anualized 14.9 million units. This was the second-best result all year, beating the consensus forecast of 14.5 million units.

US vehicle sales accelerated to a nine-month high in October, just slightly below the 15.1 million anualized units in January. Continued growth should be tempered somewhat in the coming months as last month’s gain was likely boosted by replacement buying in the wake of Hurricane Ian.

Property damage across the state of Florida was extensive in late September, to the tune of more than 50,000 vehicles, according to national estimates. Current analysis suggests a sizeable share of damaged inventories may have been replaced in October. Some giveback in sales should be expected in the months ahead, said LMC Automotive.

Other factors that are likely to weigh on sales are elevated prices and higher financing costs that will price out potential buyers.

Sales of both light trucks (+9.5% MoM) and passenger vehicles (+11% MoM) were higher in October, while light truck sales accounted for 79% of last month’s total sales.

The daily selling rate was 44,299, up 13.8% from last October’s reading of 38,926, over 26 selling days, which was one less day than last October.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2005 through October 2022, as well as the market share sales breakdown of October’s 14.9 million vehicles at a seasonally adjusted annual rate.

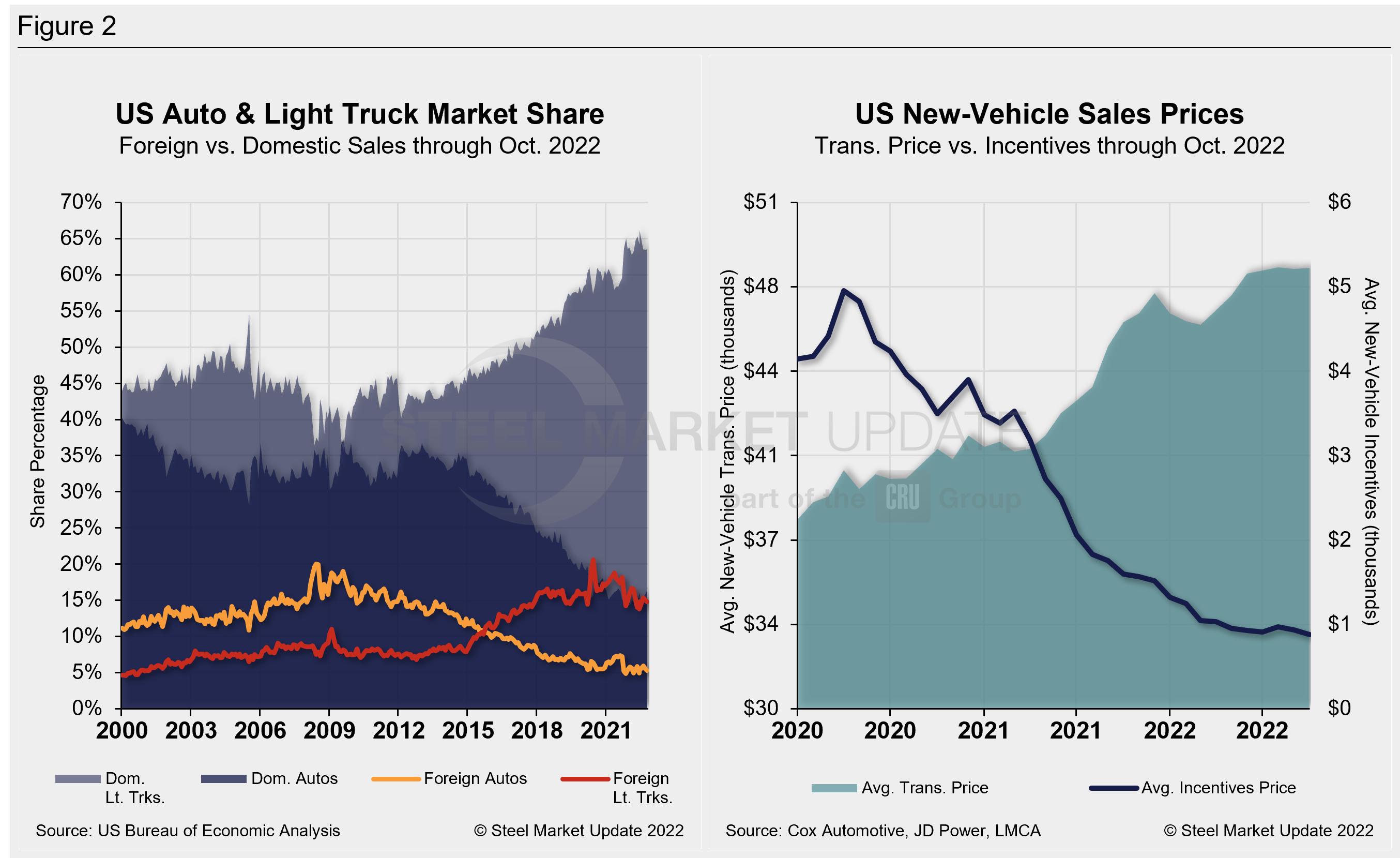

The new-vehicle average transaction price (ATP) was $48,281 in October, up slightly from $48,240 in September. ATPs were just 0.1% higher (+$41) in October versus the prior month but were 4.9% (+$2,245) above the year-ago period, according to Cox Automotive data.

Incentives waned slightly to $882 in October, down from $936 in September. Incentives are now at their lowest total on record, slipping below the recent low of $911 in July and easing for the second straight month. Incentives have now been below the $1,000 mark for a sixth straight month and were just roughly 1.8% of the average transaction price. Incentives are down 44.8%, or $718, YoY.

In October, the annualized selling rate of light trucks was 11.669 million units up 9.4% versus the prior month and 11.8% better YoY. Auto annualized selling rates saw similar dynamics over the same periods: up 11% and 23.8%, respectively.

Figure 2 details the US auto and light-truck market share since 2010 and the divergence between average transaction prices and incentives in the US market since 2020.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. Specifically, the report describes light vehicle sales in the US.

By David Schollaert, David@SteelMarketUpdate.com