Market Data

November 15, 2022

Service Center Shipments and Inventories Report for October

Written by Estelle Tran

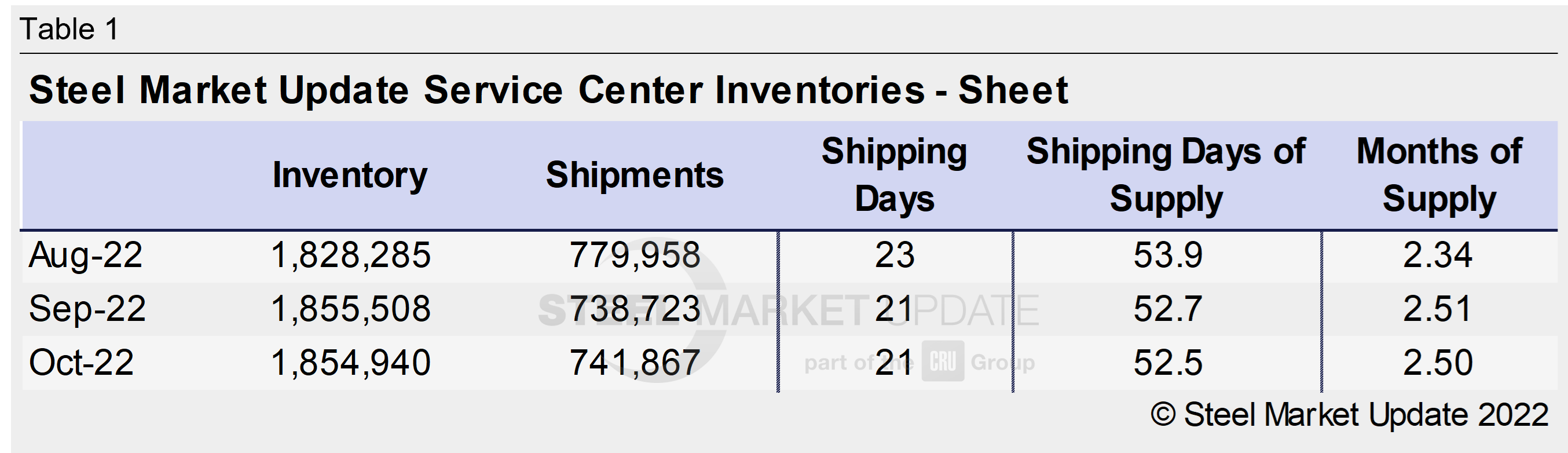

Flat Rolled = 52.5 Shipping Days of Supply

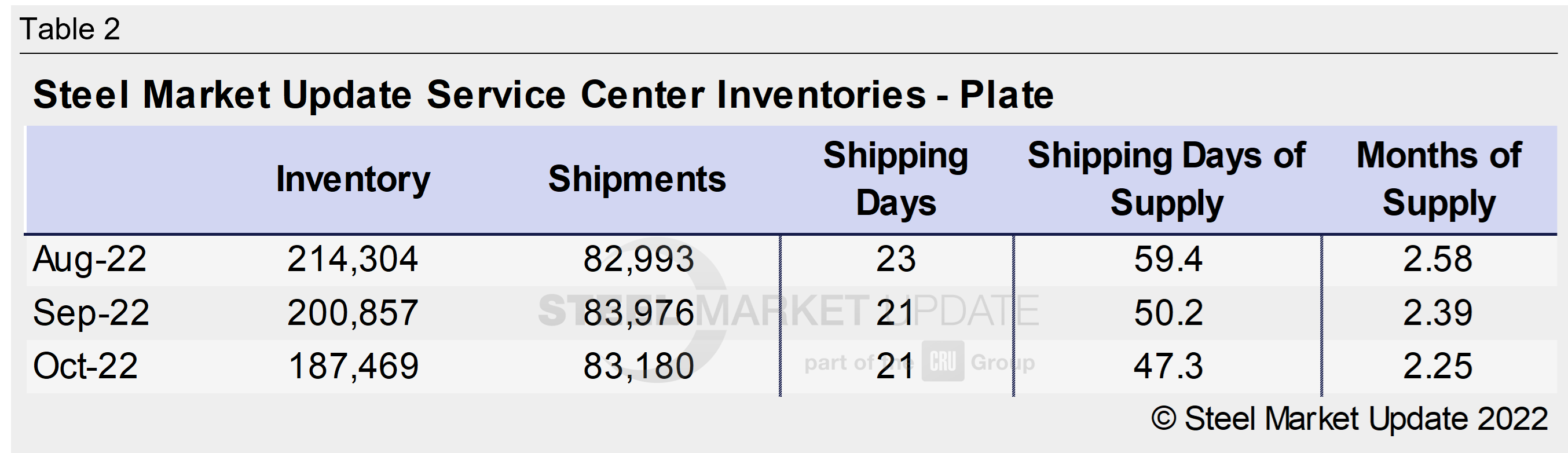

Plate = 47.3 Shipping Days of Supply

Flat Rolled

US service center flat rolled supply in October was steady month on month, according to Steel Market Update data. At the end of October, service centers had 52.5 shipping days of flat-rolled steel on hand on an adjusted basis, which was just slightly lower than September’s final level of 52.7 days. October and September both had 21 shipping days, so the supply represented as months on hand was also similar with 2.5 months of supply in October and 2.51 months of supply in September.

The inventory level was lower than anticipated, given the high level of material on order in the last two months. The flat levels of supply — rather than an inventory build — coincides with some feedback from service centers that October was better than expected, though they had to fight for orders. Other service centers have reported business levels lower than revised forecasts though. For now, inventories appear to be balanced, and we expect steel consumption to slow down as usual heading into the holiday season. The amount of inventory on order has not fallen and still remains high.

The slower-than-expected movement of material on order to inventory, despite short mill lead times, tells us that some of the flat-rolled steel has been purchased forward, perhaps as part of multi-month blanket deals. We see a significant drop-off in new orders at mills though, as most buyers are only buying what they need.

While sheet inventories appeared to be aligned with demand in October, the high level of material on order coupled with typical slower shipping rates in the last two months of the year should cause inventories to swell.

Plate

US service center plate inventories fell again in October. SMU data showed that service centers had 47.3 shipping days of plate supply at the end of October; this is down from 50.2 shipping days of plate supply in September. Service centers had 2.25 months of supply at the end of October, compared to 2.39 in September.

Shipments in October picked up a little with consistent demand from the energy and machine sectors. October’s inventory in terms of days of supply was at the lowest for plate since March.

Plate inventories are lower relative to shipments, and market participants continue to marvel at how resilient plate prices have been despite falling sheet prices. Service centers appear to be well positioned for slower seasonal demand in November and December. Plate mill lead times are at the lowest level recorded since February 2022.

The amount of plate on order is nearly flat month on month as well, with lower overall inventory levels.

The aggressive destocking in the plate market has lent some pricing support, and service centers appear to be well positioned for the end of the year. There is a risk, however, that if demand picks up suddenly, that service centers could be caught short.

By Estelle Tran, Estelle.Tran@CRUGroup.com