Logistics

November 15, 2022

River Water Levels Impacting Steel Industry

Written by Becca Moczygemba

Drought-stricken rivers have affected areas across the United States, leaving some concerned about the impact that persistent dry skies might have.

![]() The steel industry relies heavily upon the ability to ship material up and down the Mississippi River, as shipping high volumes of goods via barge is substantially cheaper than truck or rail. However, if the water level drops too low, there’s a question of how it will affect the steel supply chain.

The steel industry relies heavily upon the ability to ship material up and down the Mississippi River, as shipping high volumes of goods via barge is substantially cheaper than truck or rail. However, if the water level drops too low, there’s a question of how it will affect the steel supply chain.

The US Army Corps of Engineers for the Mississippi Valley Division is working to ensure the river stays open. “There are eight dredges working throughout the area and as of now traffic is open with no issues,” stated Lisa Parker, director of public affairs for the Mississippi Valley Division. “We’ve experienced droughts like this in the past, it’s cyclical. We saw similar situations in 1988, and more recently in 2012.”

The Mississippi River gets 60% of its water from the Ohio River and 30% of its water from the Missouri River, and droughts on those rivers are directly affecting its water levels. While there has been rain and snowfall, it has not been enough to ease concerns. “These rain events are happening, we just need to see more of it. November and December are the rainiest months for us in this area, so we should see some relief soon,” noted Parker.

Most of the riverbed of the Mississippi is silt and sand, but a portion located near St. Louis is rock. If the situation becomes too difficult to pass through, the US Army Corps of Engineers would have to blast a portion of the basin to ensure a clear path for the barges. In a worst-case scenario, the US Coast Guard will restrict traffic flow down to one way, alternating between north and south-bound traffic throughout the day. For now, the Corps is still able to maintain a nine-foot depth and 300-foot width.

Steel Industry Concerns

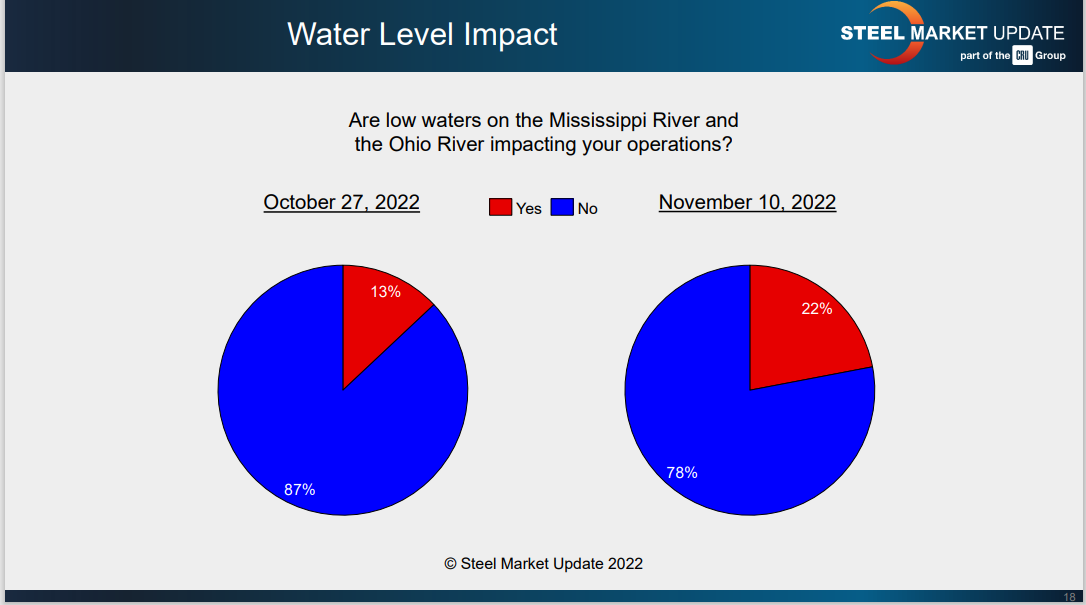

Steel Market Update’s most recent survey results show over 75% of participants are not concerned about water levels on the Mississippi River, but the number reporting being concerned is on the rise:

Here’s what some industry professionals had to say:

“Warehouse space at NOLA is filling up quickly and greater demand is being placed on rail and trucks.”

“Limiting the amount of material we bring in via barge.”

“Barge times and prices are going up.”

“We are still using the river but less cargo per load is raising costs.”

“Limited barge shipments. Rail alternative is expensive during grain season.”

“Requires higher cost transport for steel deliveries.”

“Not directly but yes, indirectly.”

“Just had to move some barge shipments to rail.”

By Becca Moczygemba, Becca@SteelMarketUpdate.com