Market Segment

November 7, 2022

Klöckner Swings to Q3 Loss, Anticipates Weaker Q4

Written by Laura Miller

Operating in a challenging environment, Klöckner & Co. SE swung to a net loss in the third quarter of the year.

The Duisburg, Germany-based service center group, which has a large presence in the US market, foresees an even weaker fourth quarter due to seasonal factors, the continuing steel price correction, active inventory reduction, and inventory write-downs.

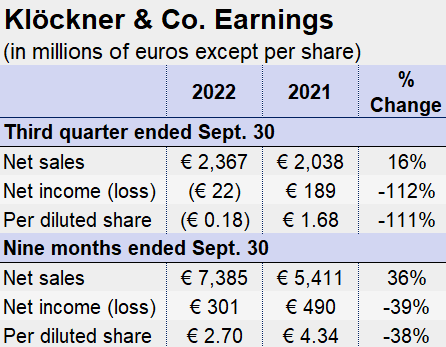

Despite a 16% year-on-year increase in sales to €2.367 billion ($2.374 billion), Klöckner posted a Q3 net loss of €22 million compared to net income of €189 million in the year-ago quarter. In Q2, the company posted net income of €151 million on sales of €2.58 billion.

Results for the first nine months of the year show a 36% increase in sales but a 39% decline in net income. The increased sales were mainly due to higher steel and metal prices, the company said in its latest earnings report.

“Despite the challenging economic environment, we have continued to systematically pursue our strategy and achieved key milestones,” including the launch of a new brand for low-carbon products and services, said CEO Guido Kerkhoff.

Conditions in the European market have been more challenging than in the US due to supply chain disruptions and related issues from the ongoing war in Ukraine, the company said.

By Laura Miller, Laura@SteelMarketUpdate.com