Market Data

November 6, 2022

CRU: Midterm Elections to Determine Fate of Biden’s Climate Agenda

Written by Zsombor Garzo

By CRU Sustainability Analyst Zsombor Garzo, from CRU’s Sustainability Services

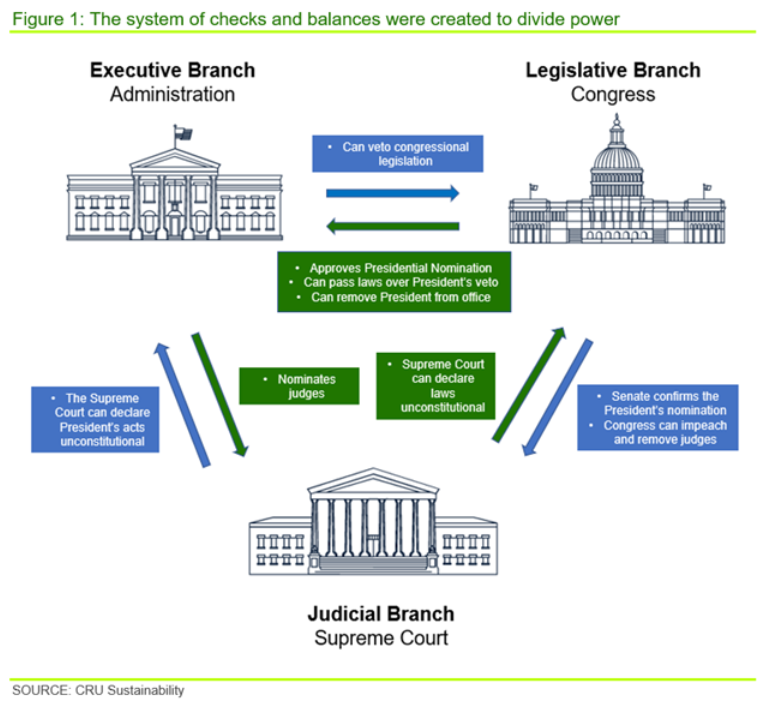

– The US political system was designed to balance power – with the President, the Congress, and the Supreme Court all being able to challenge each other.

– Democrats losing control of Congress would considerably limit the Biden administration’s ability to pursue its climate change ambitions.

– Elections to determine state governors can have large impacts on state-level climate policy, impacting the mining sector and the future of the coal industry.

– The US economy will continue to decarbonize due to technological progress, but the pace of the transition could slow if there is limited policy support.

Three Pillars to Balance Power

The US political system was designed to balance power with the three pillars – the President, the Congress, and the Supreme Court, each being able to challenge or obstruct the motions put forward by the others. The President is elected every four years and there is a two-term cap per person. The President can pass executive orders and has the right to send back bills to Congress for reconsideration.

The President also has the power to nominate Supreme Court judges and to appoint government agency leaders and members of the Executive Branch. For the metals and mining industry, the most important agencies and branches are the Department of the Interior, the Department of Energy, and the Environmental Protection Agency. These are set for each presidential term.

Congress has two chambers. The upper chamber is called the Senate, and its members are elected for six years in three cycles, meaning that approximately a third of the Senate seats are up for election every two years. The Senate gives all US states equal representation, with two senators representing each, regardless of their population, with 100 seats total. To give the population equal representation, the House of Representatives – the lower chamber – provides states with seats roughly proportional to their relative population, with 435 seats total. The representatives are elected every two years. Both chambers have the power to create and pass bills but must agree on a version before it is sent to the President. Finally, the Supreme Court justices are sworn in for life. They cannot create legislation but can allow or block laws at the federal level based on their interpretation of constitutional rights or by passing down the decision to individual states.

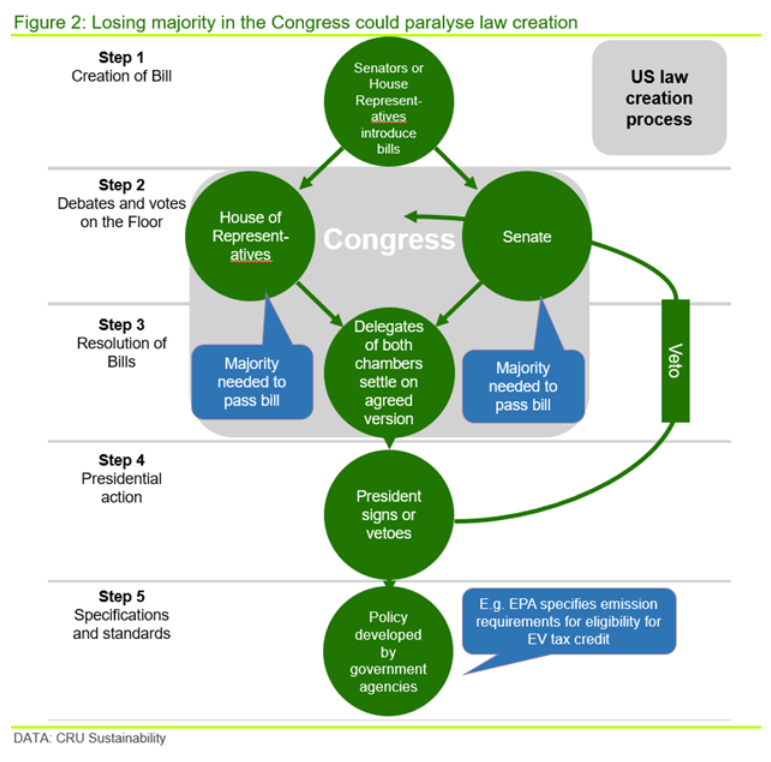

Midterm Results Can Obstruct Federal Policy Development

The midterm elections are quickly approaching, and November 2022 could be a turning point in US politics. Should Republicans gain control of either chamber of Congress, it would limit the Biden administration’s ability to pursue its climate change ambitions.

Currently, Democrats hold the presidential seat and both chambers of Congress. But Republicans nominated six out of the nine US Supreme Court judges, thereby establishing a conservative majority. Following the Nov. 8 elections, both chambers of Congress could switch hands, as all House and 35 Senate seats are being contested.

By gaining a majority in the House or a single additional seat in the Senate, Republicans can challenge and block any bill the Democrats put forward, which would significantly slow Biden’s agenda.

Voter turnout and swing voters tend to decide the outcome of the midterm elections. Since the mid-1800s, midterm election voter turnout has fallen behind presidential election turnout by 10–20%. Historically, American swing voters often vote against the president’s candidates in the midterms. In the past 75 years, only two presidents have been able to at least maintain the seats won in their respective presidential campaigns.

A Roadblock to the Climate Agenda

In August, Congress passed the Inflation Reduction Act – a landmark climate law that will see $374 billion spent on decarbonization and climate resilience, including tax credits and grants to low-carbon technologies. Indicating the difficulty of passing future climate bills, the Inflation Reduction Act passed without the support of a single Republican member of Congress. Should Republicans take control of either the House or the Senate, the split of power between Republicans and Democrats would mean difficulty in moving forward with the President’s agenda regarding climate policy.

Gubernatorial Elections with Much at Stake

Gubernatorial elections (i.e., state governor elections) will also take place in 36 of the 50 states and this will have an instant and direct impact on state-level politics. A new governor will be elected in several of the largest states, including California, Texas, New York, Pennsylvania, Ohio, Florida, and Illinois. For the most part, states operate as sovereign entities. Therefore, governors can have a sizeable impact on state laws and regulations regardless of the federal backdrop.

A good case study in the power of governors is Pennsylvania – the fourth largest CO2 emitter among US states. In 2020, its energy production alone was responsible for ~1.5% of all US emissions and ~5% of emissions from domestic electricity production, amassing a total of 70 MtCO2, according to data from the US Energy Information Administration (EIA).

Historically boasting a prosperous industrial sector, Pennsylvania has reduced its emissions through technological advancements, switching from coal to gas and renewable energy deployment, driven by private sector innovation and bipartisan support. The deregulated construct of America’s infrastructure allows for competition and innovation, which is partially influenced by government policy. Both national and state-level political goals are critical to gain and to maintain support across industries and society at large.

Climate plays a central part in political campaigning as the state re-entered the Regional Greenhouse Gas Initiative (RGGI), a regional carbon pricing scheme, in July 2022. RGGI is the Northeast’s cap-and-invest system that regulates the power generation sector. Republican governor nominee, Doug Mastriano, has announced he will withdraw the state from the initiative. The state’s participation is currently suspended as the Supreme Court of Pennsylvania is hearing two lawsuits filed by Republican lawmakers and the local coal industry. The injunction pauses the implementation of the program until the court’s decision, which is not expected before year-end.

If the state’s participation stays in effect, Pennsylvania will account for ~40% of emissions capped by the RGGI currently. With its involvement in the cap-and-invest system, it is considered Pennsylvania could cumulatively reduce its emissions by up to 225 MtCO2 through to 2030. This cumulative reduction is roughly equal to the entire annual emissions of the whole state.

The gubernatorial race in Pennsylvania will impact the coal industry and fracking in the state. Should Mastriano win in November, he would likely deregulate fracking, exclude the state’s coal industry from federal regulation and lift Governor Wolf’s ban on mining leases in state parks and forests. As Pennsylvania is responsible for 7% of US coal production and has 5% of the demonstrated reserve base of the US, deregulating the industry within the state would have a sizeable impact on the domestic coal sector. Shapiro, the Democrat’s nominee, proposes to establish framework for “responsible fracking” and minimal environmental harm in energy production, arguing that combatting climate change can create jobs for Pennsylvanians.

Current polls put Shapiro ahead of Mastriano in the Pennsylvania gubernatorial race.

Global Trends Keep Driving US Decarbonization

The US economy will continue to decarbonize due to technological progress, but the pace of the transition could slow if there is limited policy support. There are growing pressures at the corporate level. For example, the EU is pushing for more corporate climate disclosures, and the US Securities and Exchange Commission (SEC) is also working on disclosure standards. Another example is the auto industry, where electric vehicles are exhibiting increasing penetration rates. International companies, including large US-based automakers, are also having to meet increasingly stringent international standards on many products. There is also more pressure from investors and shareholders as the risks from climate change to assets and communities grow.

These various pressures continue to drive the decarbonization of the US economy. But the outcome of the elections will likely alter the pace and trajectory.

This article was originally published on Nov. 3 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com