Market Segment

November 4, 2022

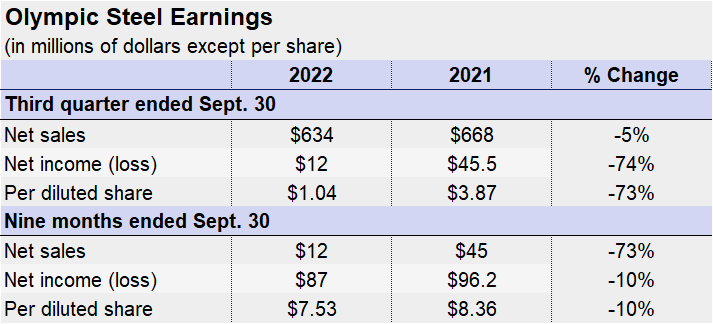

Olympic Posts Sharply Lower Results in Q3

Written by David Schollaert

Service center chain Olympic Steel posted sharply lower earnings in the third quarter ended Sept. 30 driven by a significant decline in metals prices, according to the company’s Nov. 3 earnings report.

The Cleveland, Ohio-based metals service center and processor reported net earnings of $12 million in Q3, down 68% sequentially and 74% year-on-year (YoY). The dip in profits came as sales were $634 million during the quarter, down by nearly 11% and 5%, respectively in the same comparison.

“As expected, metals pricing significantly declined during the quarter, and macroeconomic uncertainty caused by ongoing supply chain constraints, labor shortages, and inflation continued,” CEO Richard Marabito said. “The additional resilience built into our business, combined with our team’s hard work and sustained operating discipline, enabled Olympic Steel to withstand these challenges to deliver $25.3 million of adjusted EBITDA for the third quarter.”

Marabito added that Olympic has reduced its debt by 26%, or $84 million, this year.

Tons sold in both its carbon flats and specialty metals flats segments were lower YoY, with carbon flats down 16.9% to 203,122 tons and specialty flats down 17% to 34,189 tons. Average selling prices were diverged, however. Carbon flats were unchanged at $1,655 per ton, while specialty flats were 38% higher at $5,508 per ton.

“While we expect metals pricing to decline further and pressure profit margins in the fourth quarter, we are confident that we have reduced the impact of market cyclicality on our business,” Marabito added.

Headquartered in Cleveland, Olympic operates 42 facilities across North America.

By David Schollaert, David@SteelMarketUpdate.com