Mexico

November 4, 2022

GrafTech’s Results Down on Softening Demand, Monterrey Outage

Written by Laura Miller

GrafTech International Ltd. posted sharply lower earnings results for the third quarter as steel demand, and thus demand for graphite electrodes waned, while production at its Monterrey, Mexico facility remains suspended.

“Ongoing geopolitical tensions and global economic uncertainty have softened near-term demand for steel and, therefore, graphite electrodes. This, combined with the current inflationary environment and the impact of the suspension of our operations in Mexico, led to declines in our key operating and financial metrics for the quarter,” explained president and CEO Marcel Kessler.

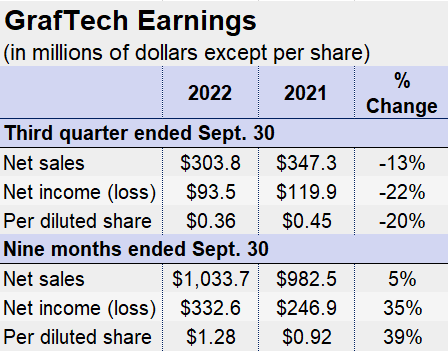

The Brooklyn Heights, Ohio-based graphite electrode producer’s Q3 net income declined 22% year-on-year (YoY) to $93.5 million as sales fell 13% to $303.8 million. Sales volumes of graphite electrodes of 35,700 metric tons were 16% lower sequentially and 18% lower YoY.

Production at the company’s Monterrey manufacturing facility remains down due to a temporary suspension of operations that began in September after an environmental inspection. While movement of existing inventory is permitted, there is no clarity on how long production will remain suspended. The facility has an annual production capacity of 60,000 metric tons of electrodes, or 30% of its total annual production excluding its St. Mary’s operations.

Due to the ongoing shutdown, GrafTech is considering a restart of its St. Marys, Pa., facility, where production is currently limited to graphitizing and machining of electrodes and pins.

“Until operations in Monterrey are resumed or mitigation activities are successfully implemented, our ability to fulfill customer orders will be significantly impacted,” the company stated. “Specific to the fourth quarter of 2022 … we estimate the suspension will impact approximately 10,000 to 12,000 metric tons of such customer orders.”

GrafTech expects demand for graphite electrodes to remain soft in Q4 and into 2023 due to softening steel industry trends in the US “although the market remains comparatively healthy and more stable” than those in other markets such as Europe. Q4 costs are expected to rise sequentially due to inflation and elevated prices for raw materials, energy, and logistics.

“Longer term, we remain confident that the steel industry’s accelerating efforts to decarbonize will lead to increased adoption of the electric arc furnace method of steelmaking, driving long-term demand for graphite electrodes,” GrafTech’s earnings report stated.

By Laura Miller, Laura@SteelMarketUpdate.com