Market Data

October 28, 2022

September Durable Goods Up, Momentum Slows

Written by David Schollaert

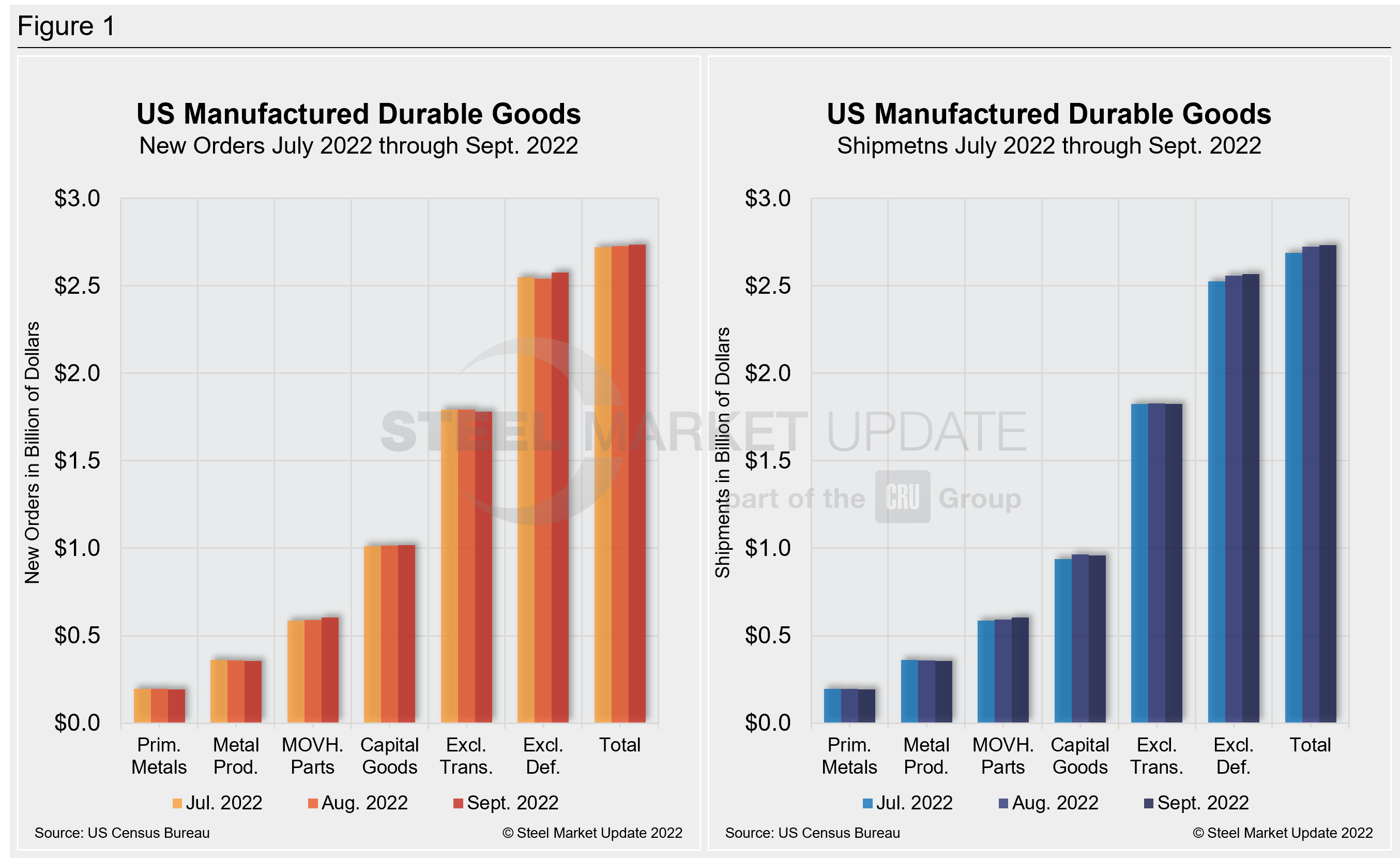

New orders for US-manufactured durable goods rose in September to a seasonally adjusted $274.7 billion — having risen now for six out of the last seven months. Orders picked up less than expected but still reversed the weaker showings of previous months.

Last month’s bookings for durable goods were up roughly 0.04% or $1 billion more month-on-month (MoM), following a 0.2% gain a month earlier, according to the US Census Bureau. Figures are not adjusted for inflation.

Orders for big-ticket, US-made goods rose last month, helped by aircraft and autos. But excluding transportation, new orders decreased by 0.5%, as companies pulled back on orders for big-ticket items in September.

Transportation equipment, up five of the last six months, drove the increase by $1.9 billion, or 2.1%, to $95.4 billion, the government data showed.

Shipments of manufactured durable goods, up 16 of the last 17 months, rose 0.3% to $274.2 billion. That’s after a 1.3% increase in August. Transportation equipment, up 11 of the last 12 months, drove the increase, rising 1.1% to $90.5 billion.

Click here for more detail on the September advance report from the US Census Bureau on durable goods manufacturers’ shipments, inventories, and orders. See also Figure 1 below.

Revised and Recently Benchmarked August Data

Revised seasonally adjusted August figures for all manufacturing industries were: New orders, $549.2 billion (revised from $548.4 billion); shipments, $549.0 billion (revised from $547.9 billion); unfilled orders, $1,131.9 billion (revised from $1,132.1 billion); and total inventories, $800.3 billion (revised from $800.2 billion).

By David Schollaert, David@SteelMarketUpdate.com