Market Data

October 28, 2022

Global Steel Production Increased in September

Written by David Schollaert

World crude steel production edged up slightly month-on-moth (MoM) in September, though driven almost singlehandedly by Chinese output. Global production was also up 5.1% versus the same period last year, according to World Steel Association (worldsteel) data.

September’s output gained marginal ground when compared to August, up just 0.7%, but expanding for the second consecutive month. World crude steel production was estimated at 151.7 million metric tons last month.

September’s marginal increase in crude steel production was driven by a 3.7% increase in Chinese output, while the rest of the world saw production decline by 3% MoM. The rest of the world produced a total of 64.7 million metric tons, down from 66.7 million metric tons the month prior.

Last month’s global total was down 13%, or 22.7 million metric tons less than May 2021’s all-time high of 174.4 million metric tons. September’s marginal MoM gain put output up just 0.3%, or 427,618 metric tons more than the pre-pandemic period of September 2019.

The US remained the fourth-largest crude steel producer in the world in September, accounting for 6.6 million metric tons, or 6.4%, of the global total. US production last month was down 5.7%, or 400,000 metric tons less than August’s total.

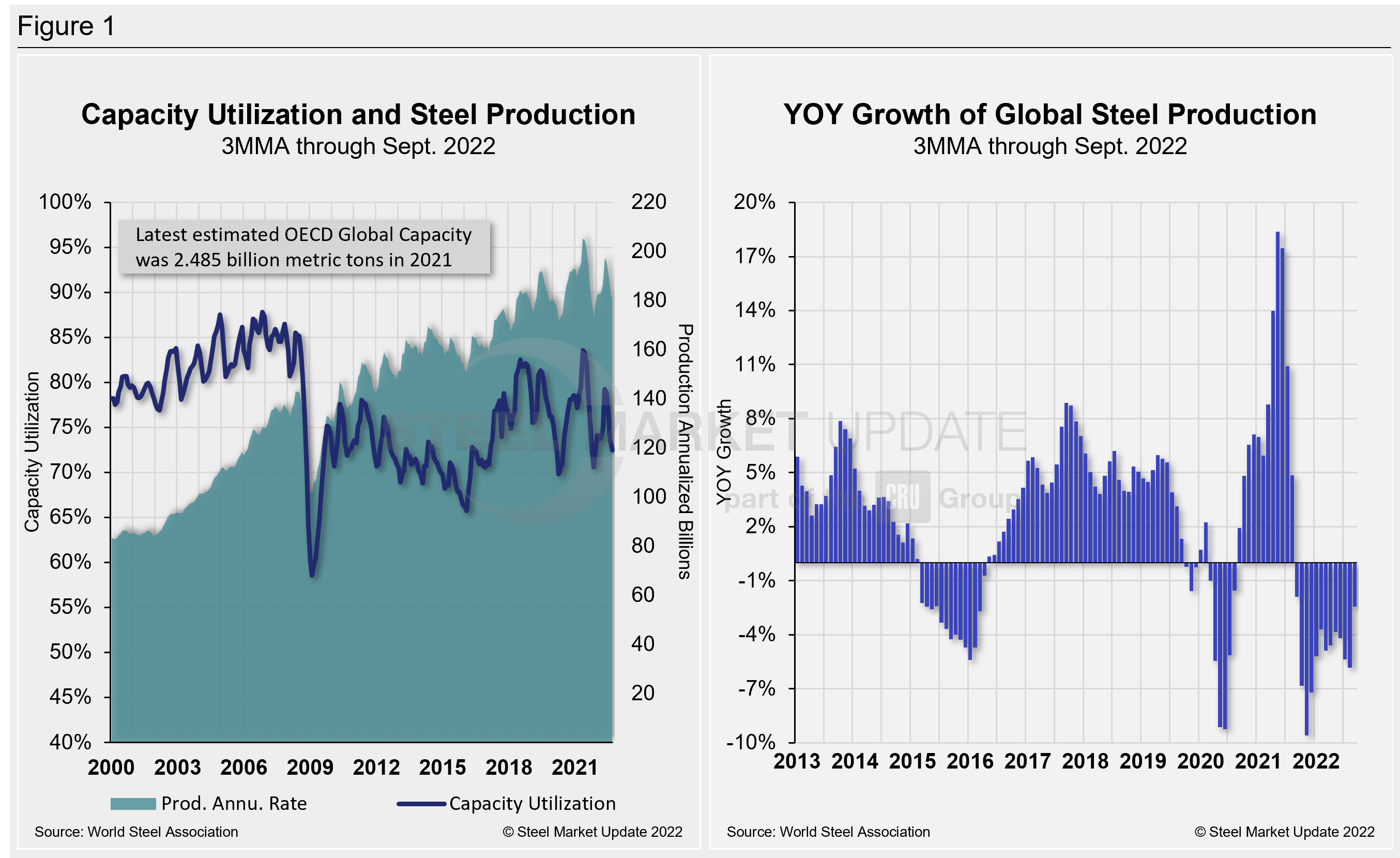

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis as well as capacity utilization since January 2000. Also shown is the year-on-year (YoY) growth rate of global production on the same 3MMA basis since January 2013. Both are based on worldsteel data.

Mill capacity utilization in September on a 3MMA basis was 72.5%, down one percentage point from the month prior. On a tons-per-day basis, production last month was 5.057 million metric tons, up 4.1% MoM. That figure is nearly 800,000 tons off May 2021’s record rate of 5.813 million metric tons. Growth on a 3MMA basis through September YoY was -2.4%, a 3.4 percentage point improvement from the month prior. Despite the progress, it’s a far cry from the 18.4% expansion seen in May of last year.

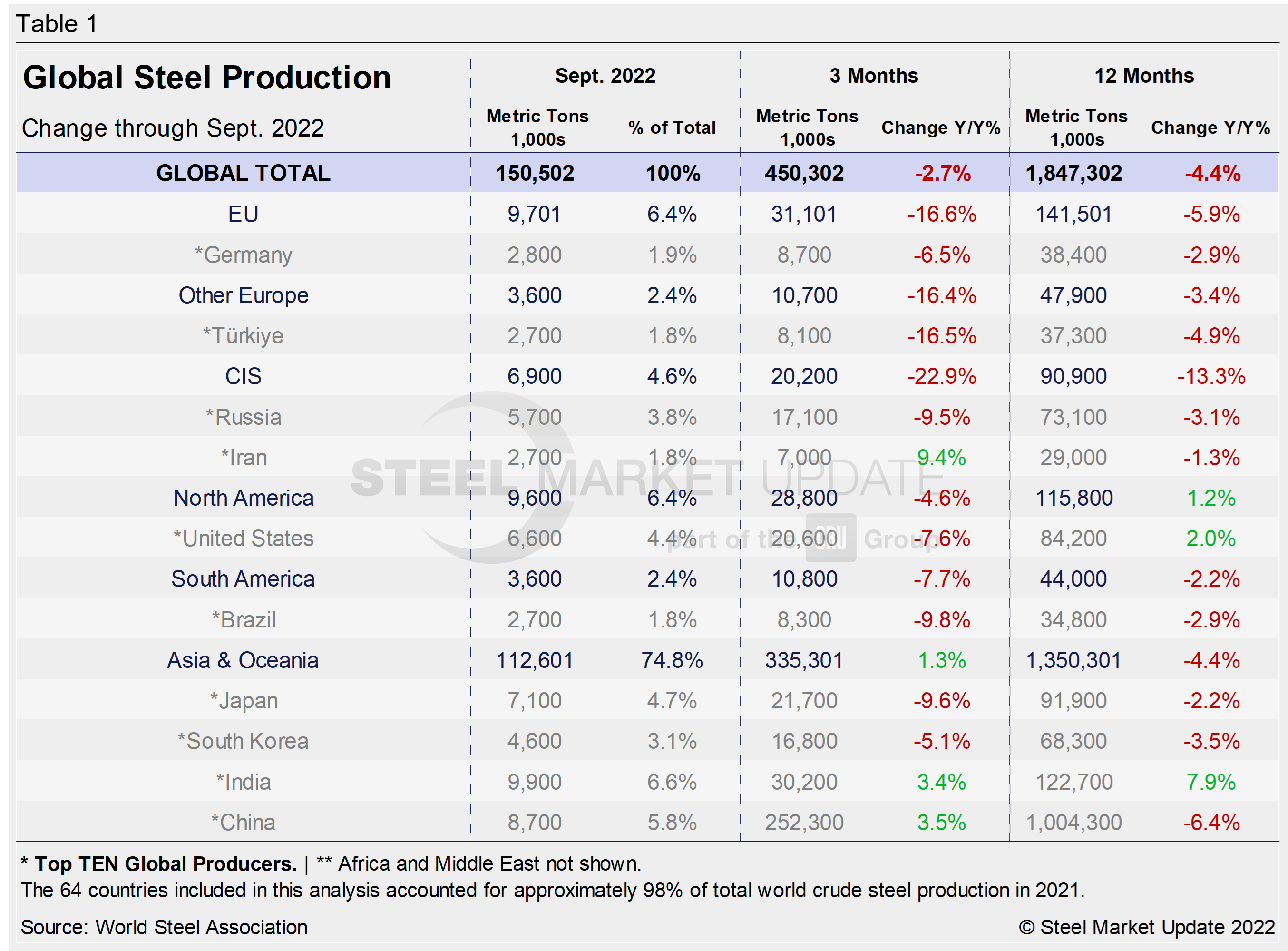

Displayed in the table below is global production broken down into regions. It shows the production of the top 10 nations in September and their share of the global total. It also shows the latest three months and 12 months of production through September with YoY growth rates for each period. Regions are shown in black font and individual nations in gray.

World steel production overall is down in both the three- and 12-month comparisons, and down nearly universally over the same periods regionally and across the globe’s top-producing nations. The results show a significant deceleration from the 10.9% growth just about one year ago. The recent gains over the past two months, albeit small, show the market has maintained some positive momentum: the three-month growth rate is better than the 12-month growth rate. It’s the first growth shift following 11 consecutive months of decline.

The table shows that North American production declined in the three months through September but is up on a YoY basis. The positive momentum in the North American market over the past 12 months indicates that the economy has been steady despite the pandemic and recent inflation. Yet, when compared to the same pre-pandemic period in 2019, present output is down 3.1%.

China’s Crude Steel Production

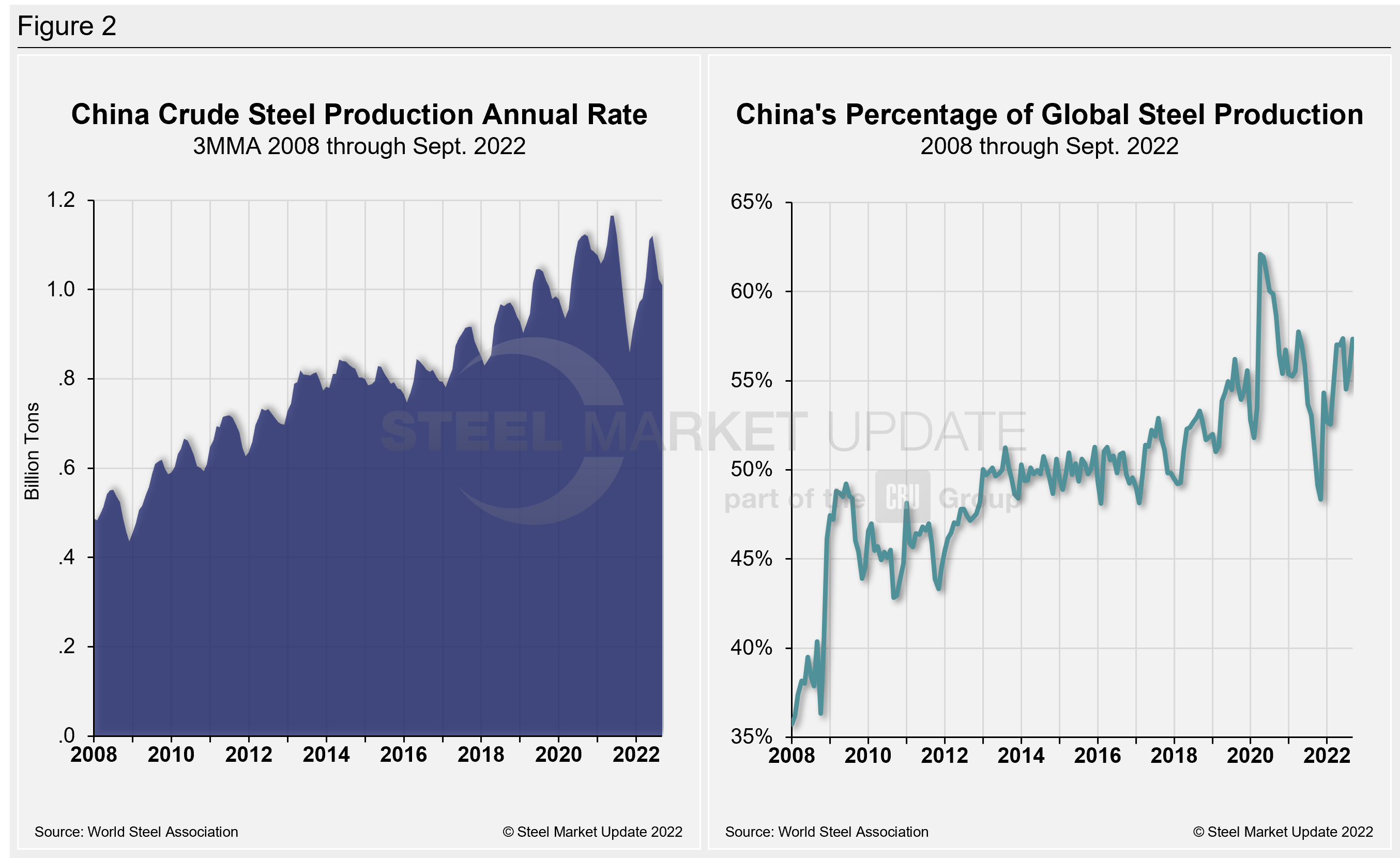

China’s monthly steel production was estimated at 87 million metric tons in September, up from 83.9 million metric tons the month prior. The 3.1-million-ton monthly gain was just the second increase in five months. September’s total is about 12.6 million metric tons below China’s all-time high crude steel output of 99.5 million metric tons in May 2021.

On a 3MMA basis, the annual rate of China’s crude steel production maxed out at 1.166 billion metric tons in May 2021. It has fallen repeatedly since February of last year, reaching its lowest total in November 2021. China’s annual capacity stands at 1.128 billion metric tons. Its annual capacity utilization was marginally higher at 89.1% last month, about 1.2 percentage points above its lowest mark in nearly two years. It’s down from an all-time high of 98.4% last June.

China still produced more than half (57.4%) of the world’s steel in September. Chinese production last month was 5.1% above its pre-pandemic levels in June 2019.

China’s crude steel production rate and its percentage of global output are displayed side-by-side in Figure 2.

The fluctuations in China’s steel production since January 2013 versus the growth of global steel excluding China, both on a 3MMA basis, are shown side-by-side in Figure 3. From October 2020 through December 2021, the rest of the world’s production rose sharply, reaching a peak of 38.0% in April. Since then, the rate for the rest of the world’s annual production has decreased sequentially to -3.2% in March. In April and May, the percentage improved slightly but shrank back to -8.4% last month. China’s annual growth rate was -3.5% in September, just 0.5 of a percentage point down MoM. Annual growth is nowhere near the +15.1% seen last April.

By David Schollaert, David@SteelMarketUpdate.com