Market Segment

October 27, 2022

USS Posts Sharply Lower Q3 Results on ‘Higher Than Normal’ Costs

Written by David Schollaert

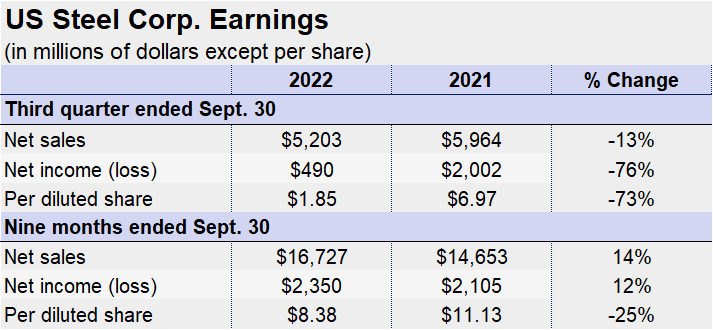

US Steel Corp. recorded sharply lower profits in the third quarter of 2022 both sequentially and versus the same quarter last year, driven by lower steel prices and higher input costs.

Despite the lower earnings, the Pittsburgh-based steelmaker remains on pace for its second-best financial year in the company’s history thanks to stronger margins in the first half of the year.

![]()

“We delivered another solid quarter and are on pace for our second-best financial year ever and a third consecutive year of record safety performance,” said company president and CEO David Burritt. “Our assets are running well to deliver high-quality steel, safely and reliably to our customers.”

Burritt made the comments in a press release announcing the company’s Q3 earnings results on Thursday, Oct. 27.

All told, US Steel recorded net earnings of $490 million in Q3, down nearly 50% sequentially and down 76% from $2 billion in the same quarter last year. The dip in profits came as sales were $5.2 billion during the quarter, down by nearly18% and 13%, respectively in the same comparison.

Total steel shipments also slipped. They were 3.7 million tons for Q3 of this year, down 11.5% from 4.21 million tons in Q2, and down 10.2% from 4.12 million in the year-ago quarter.

The sharp declines were driven by demand headwinds but exacerbated by “higher than normal” raw material costs. The steelmaker is still working through inventory it built up in response to the war in Ukraine, particularly at its mini mill in Osceola, Ark., and its rolling mill in Košice-Šaca, Slovakia.

The decline in Q3 shipments was largely the result of its flat-rolled operations in the US and abroad, as Burritt acknowledged that European markets were further impacted by “escalating energy costs,” which he said are expected to remain high.

Tubular operations came to the rescue and posted marginally higher shipments. The segment, he said, “continued to deliver sequential improvements, reliably serving strong demand in domestic energy end markets.”

By David Schollaert, David@SteelMarketUpdate.com