Market Segment

October 20, 2022

Nucor Posts Lower Q3 Earnings on Reduced Margins, Shipments

Written by David Schollaert

Nucor Corp. experienced another quarter of strong earnings despite sequential declines in average sales price per ton and total tons shipped in the third quarter ended Sept. 30, the company said in its latest earnings report on Thursday, Oct. 20.

![]()

Decreased steel mills segment earnings drove the sequential decline in quarterly earnings, the company said. The result was due primarily to metal margin contraction and reduced shipping volumes, particularly at its sheet and plate mills.

Nucor’s steel products segment and raw materials segment both accelerated in Q3 versus the prior quarter. The latter’s gain was a result of decreased profitability in scrap brokerage and processing operations that were offset by the increased profitability of its DRI facilities.

Despite the lower sequential results, the Charlotte, N.C.-based steel company expects 2022 will be its most profitable year to date.

“Nucor has already achieved a record-breaking year for earnings per share through the first nine months of 2022 and we continue to believe that we will set a new record for full-year earnings in 2022,” said Leon Topalian, Nucor’s chair, president, and CEO.

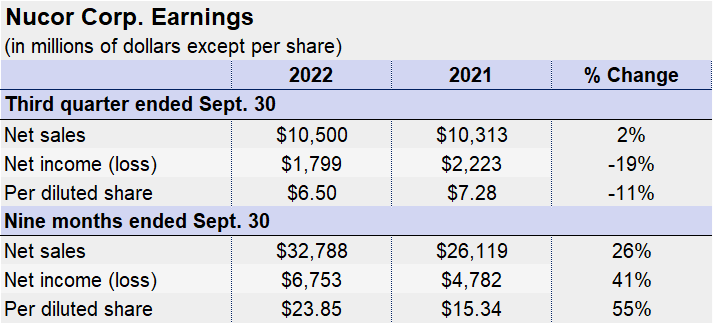

Nucor reported net income of $1.79 billion on sales of $10.5 billion in the third quarter, a decline from net income of $2.22 billion in Q3 2021, though sales were up 2% year-on-year (YoY).

Total steel mill shipments of 6.4 million tons in Q3 were down 8% sequentially and down 11%YoY.

Sheet mill shipments were down 4% YoY to 2.68 million tons, bar shipments were down 8% to 2.17 million tons, structural shipments were down 21% to 583,000 tons, and plate product shipments fell 37% to 379,000 tons. Shipments of other steel products, meanwhile, were even at 61,000 tons.

Q3 operating rates at the company’s steel mills were 77%, down from 85% in Q2 and down from 97% in the year-ago quarter. Operating rates in the first nine months of 2022 decreased to 80% versus 96% in the first nine months of 2021.

The outlook points to “increasingly challenging market conditions amid economic uncertainty”, Nucor said in the earnings report.

The company expects Q4 earnings to be lower compared to Q3, driven by “considerably lower” earnings in its steel mills segment due to lower average selling prices and lower volumes. It anticipates sheet mills to see the sharpest decrease in profitability, followed by its steel products and raw materials segments. The sequential decreases will be driven by lower selling prices, the company said.

“While economic uncertainty and inflation continue to put pressure across a myriad of sectors in the US, we believe the medium- and long-term outlook and fundamentals in our industry remain positive,” said Topalian. “We believe our growth investments and acquisitions continue to position Nucor to meet and exceed our customers’ and shareholders’ expectations today and well into the future.”

By David Schollaert, David@SteelMarketUpdate.com