Analysis

October 19, 2022

US Light Vehicle Sales Accelerate Again in September

Written by David Schollaert

US light vehicle (LV) sales grew in September, coming in at 1.15 million units, unadjusted. Last month’s total was a 10.8% increase year-on-year (YoY), the US Bureau of Economic Analysis (BEA) reported.

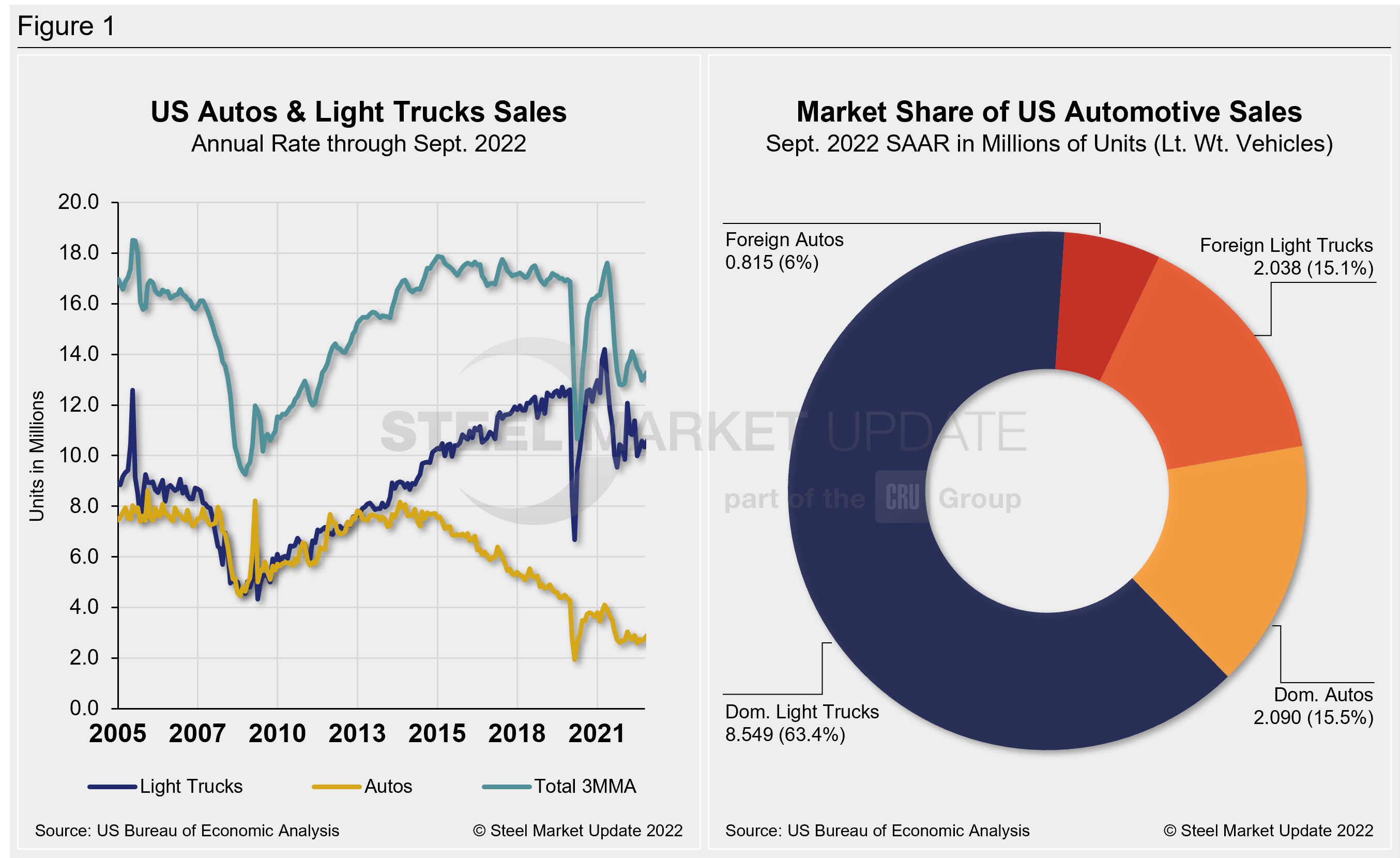

The YoY gain was just the second since July 2021. While this was the second consecutive month of YoY increases, it was helped by weak sales during 2021. US vehicle sales also rose 2.8% month-over-month (MoM) in September, rising to 13.5 million units annualized. This was the best result since April as the reading came in line with consensus estimates.

After having disappointed in August, US vehicle sales rebounded to a five-month high in September. The gain was largely the result of greater availability of new inventory, which could also become a concern and signal the market is slowing. Inventory levels increased 12.6% from last month, reaching the highest levels since May 2021.

At this point, sales remain well below the 15-16 million range they sat at when inventories were last at current levels nearly a year and a half ago. Higher interest rates and rising prices are likely to have a measurable impact on demand.

Supply chain issues are gradually improving, but production remains somewhat constrained, said LMC Automotive. This suggests model selection will also remain a challenge for some time. As a result, estimated sales are expected around the 13.7-million-unit mark this year, and are expected to move only modestly higher to 15 million units in 2023.

The daily selling rate was 44,490, up 9.5% from last September’s reading of 40,637 – both calculated over a 25-day selling period. Through the first nine months of the year, sales have totaled 10.1 million – down more than 13% from last year’s year-to-date measure.

The gain in annualized sales in September was propped up by higher sales of both passenger vehicles and light trucks, up 4.3% and 2.4%, respectively, MoM. Sales of light trucks accounted for 79.1% of last month’s sales – up 1.1 percentage points from September 2021.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2005 through August 2022, as well as the market share sales breakdown of September’s 13.5 million vehicles at a seasonally adjusted annual rate.

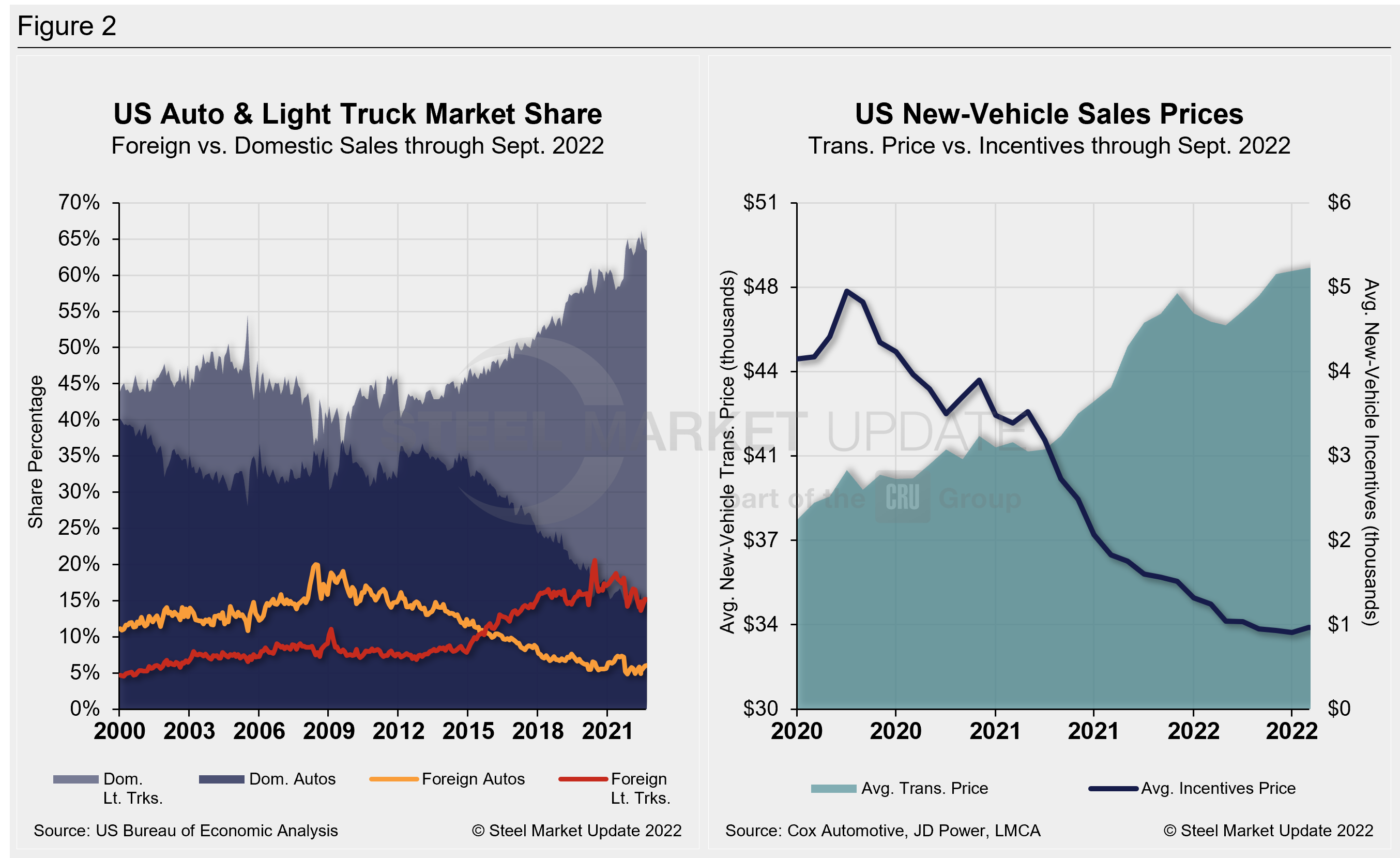

New-vehicle average transaction prices (ATP) slipped to $48,240 in September, edging down from $48,301 in August, and declining for the first time in six months. The MoM decline was just 0.1% (-$61) in September versus the prior month but was 7.1% (+$3,209) above the year-ago period, according to Cox Automotive data.

Incentives waned slightly to $936 in September, down from $969 in August. Incentives have seen a bit of ebb and flow over the past couple of months after reaching a record low of $911 in July. Yet, incentives remained below the $1,000 mark for the fifth straight month, and were just roughly 2% of the average transaction price. Incentives are down 46.7%, or $819, YoY.

In September, the annualized selling rate of light trucks was 10.59 million units, up 2.4% versus the prior month and 10.9% better YoY. Auto annualized selling rates saw similar dynamics over the same periods: up 4.6% and 5.8%, respectively.

Figure 2 details the US auto and light-truck market share since 2010 and the divergence between average transaction prices and incentives in the US market since 2020.

Canada and Mexico saw opposing dynamics again in September.

Canadian LV sales are estimated to have declined by 7.2% YoY in September to 132,000 units. While the selling rate would therefore have increased to 1.5 million units per year, the highest since March, in volume, it was the fourth lowest month of the year, an indication that increasing inflation and interest rates are likely having a cooling effect.

Mexican auto sales were up by 11.7% YoY in September to 85,000 units. In addition, the selling rate was 1.1 million units per year, only marginally down from last month. Despite the economic headwinds, the market is showing resilience.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. Specifically, the report describes light vehicle sales in the US.

By David Schollaert, David@SteelMarketUpdate.com