Prices

October 11, 2022

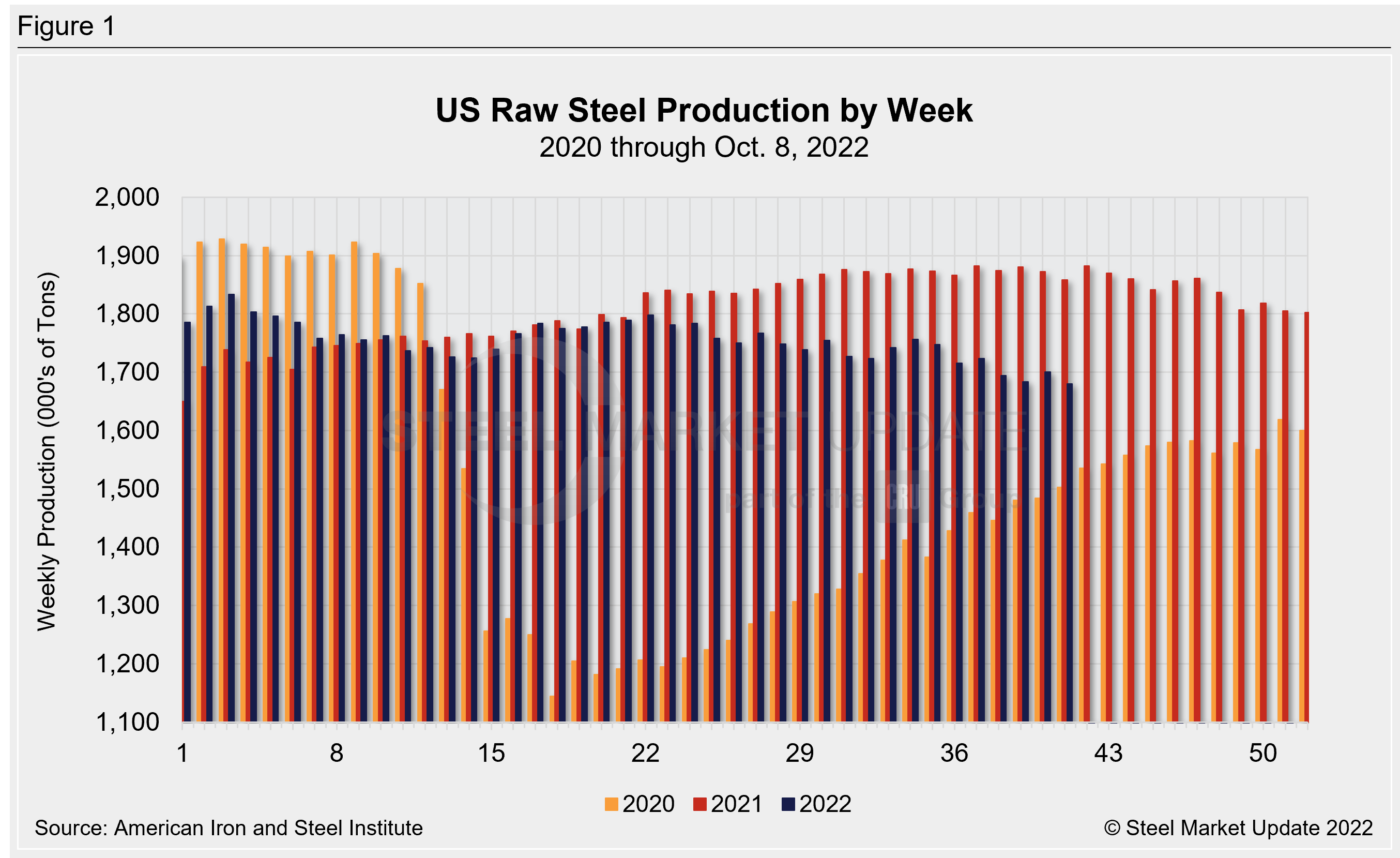

Raw Steel Production Edges Back Down: AISI

Written by David Schollaert

Raw steel production by US mills slipped back down last week, unable to maintain the slight uptick seen the week prior. Last week’s utilization also edged down compared to the previous week. Utilization rates haven’t eclipsed the 80% mark in 14 weeks, the longest run since the pandemic.

Domestic steel output was 1,680,000 net tons in the week ending Oct. 8, while capability utilization was 75.3% — its lowest rate since the week ended Feb. 6, 2021, according to the latest data from the American Iron and Steel Institute (AISI).

Output was up 1.2% from the week prior but down 8.5% from last year’s production of 1,836,000 net tons. Mill capacity utilization last week was 1.8 percentage points below the prior week and 7.9 percentage points below the same period one year ago when utilization was 83.2%.

Adjusted year-to-date production through Oct. 8 totaled 69,707,000 net tons, with an average utilization rate of 79.4%. Production is 4.4% below the same period last year when production was 72,883,000 net tons and capability utilization was at 81.2%, AISI said.

Output fell in four out of the five regions last week. The Midwest region saw the sharpest decline week-on-week, down 11,000 net tons, or -5.6%, followed by the Great Lakes (-4,000 net tons or -0.7%), South (3,000 net tons or 0.4%), and the Northeast (-2,000 net tons or -1.4%). The West district was unchanged over the same period.

Production by region for the week ending Oct. 8 was as follows: Northeast, 136,000 tons; Great Lakes, 545,000 tons; Midwest, 185,000 tons; South, 743,000 tons; and West, 71,000 tons — for a total of 1,680,000 net tons, down 20,000 net tons from the prior week.

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7,” published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of US production capacity.

By David Schollaert, David@SteelMarketUpdate.com