Market Data

October 9, 2022

CRU: Turkish Scrap Import Prices See Weekly Gains

Written by Yusu Mao

By CRU Research Analyst Yusu Mao, from CRU’s Steelmaking Raw Materials Monitor

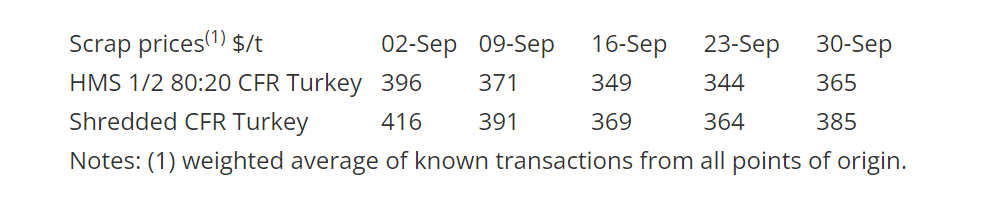

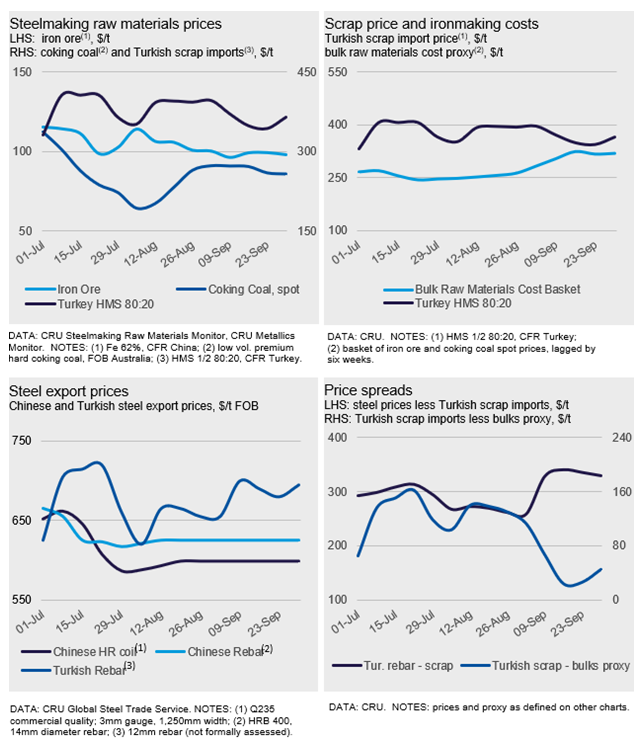

Turkish scrap prices rebounded on a fresh deal last week, for the first time since the beginning of September. Our assessment for HMS 1/2 80:20 rose to $365 per ton CFR, up by $21 per ton week-on-week (WoW) but down by $31 per ton month-on-month (MoM).

The main reason for the price increase is still unclear, as reported by market contacts. There may be two possible reasons. Firstly, some restocking demand for scrap may have come through, as stock levels gradually run low despite production cutbacks. Nevertheless, buying interest for Turkish longs products in the export market remains weak while mills’ offers are perceived to be too high. Secondly, some regional sellers may have lifted scrap offers given constrained supply.

Asian scrap markets were quiet last week, with price offers staying unchanged at $405 per ton CFR Vietnam. Finished steel demand continued to be slow in the Far East market.

Outlook: Limited Upside for Turkish Scrap Prices

Scrap prices may pick up because of restocking demand. However, the potential upside is limited, unless there is a meaningful recovery in finished steel demand. Finished steel suppliers have raised their longs prices beyond current workable price levels due to high scrap and energy costs, which may discourage buying, thereby impacting demand for both finished longs and scrap.

This article was originally published on ct. 7 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com