Market Data

September 28, 2022

Global Steel Production Up Slightly in August, Still Down YoY

Written by David Schollaert

World crude steel production recovered slightly month-on-moth (MoM) in August but remained down roughly 4% versus the same period last year. August’s output gained marginal grown when compared to July, up 0.9%, recovering for the first time in three months, according to World Steel Association (worldsteel) data.

Global output was estimated at 150.6 million metric tons in August. Steelmakers around the world increased production by an estimated 1.3 million metric tons MoM.

August’s marginal increase in crude steel production was driven by a slight increase in Chinese output, while the top 10 steel-producing nations’ output was broadly unchanged. China’s production was up 0.8% MoM, while crude steel production in the rest of the world slipped in August by 1.8% MoM. The rest of the world produced a total of 66.7 million metric tons, down from 67.9 million metric tons the month prior.

August’s global total was down 13.6%, or 23.8 million metric tons, from May 2021’s all-time high of 174.4 million metric tons. August’s marginal gain still saw output remain 3% down, or 4.6 million metric tons, versus the pre-pandemic period of June 2019.

The US remained the fourth-largest crude steel producer in the world in August, accounting for 7.0 million metric tons, or 4.7%, of the global total. US production last month was unchanged versus July’s total.

August’s US production was 500,000 metric tons below, or 6.7% less than, August 2021 output. August 2022 was also down 5.4% versus the pre-pandemic period in June 2019.

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis as well as capacity utilization since January 2000. Also shown is the YoY growth rate of global production on the same 3MMA basis since January 2013. Both are based on worldsteel data.

Mill capacity utilization in August on a 3MMA basis was 73.5%, down 3.1 percentage points from the month prior. On a tons-per-day basis, production in August was 4.858 million metric tons, up 0.9% MoM. That figure is nearly 1 million tons off May 2021’s record rate of 5.813 million metric tons. Growth on a 3MMA basis through August YoY was -5.8%, a 0.4 percentage point decline from the month prior. That’s a far cry from the 18.4% expansion seen in May of last year.

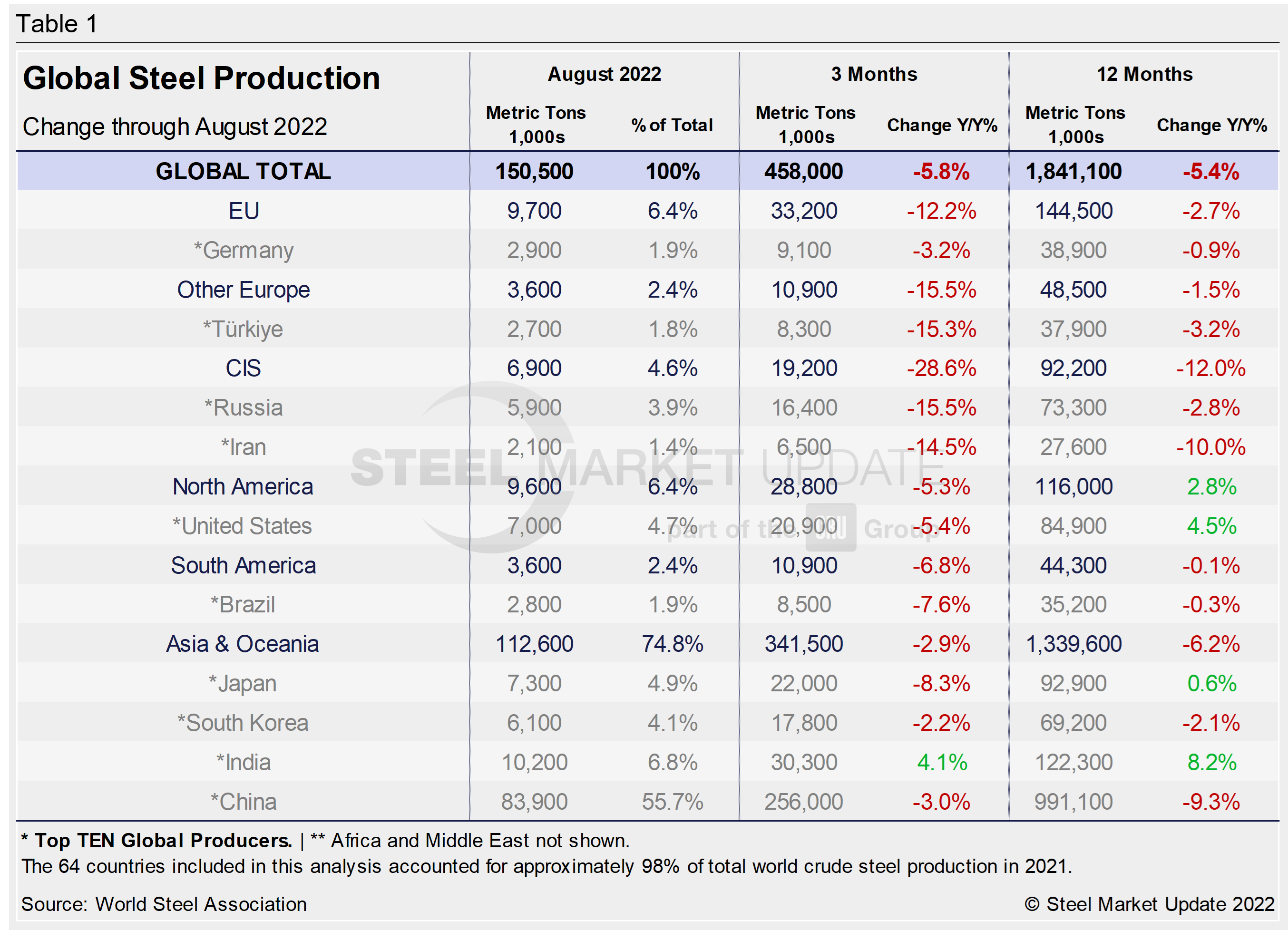

Displayed in the table below is global production broken down into regions. It shows the production of the top 10 nations in August and their share of the global total. It also shows the latest three months and 12 months of production through August with YoY growth rates for each period. Regions are shown in black font and individual nations in gray.

World steel production overall is down in both the three- and 12-month comparisons, a significant deceleration from the 17.9% growth just about one year ago. Despite recent gains, the market has not maintained positive momentum: the three-month growth rate has been lower than the 12-month growth rate for 11 consecutive months now, except for India.

The table shows that North American production was down 5.3% in the three months through August but up 2.8% YoY. The positive momentum in the North American market over the past 12 months indicates that the economy has been steady despite the pandemic and recent inflation. Yet, when compared to the same pre-pandemic period in 2019, present output is down 3.8%.

China’s Crude Steel Production

China’s monthly steel production was estimated at 83.9 million metric tons in August, up from 81.4 million metric tons the month prior. The 2.5-million-ton monthly gain was the first increase in three months. August’s total is about 15.6 million metric tons below China’s all-time high crude steel output of 99.5 million metric tons in May 2021.

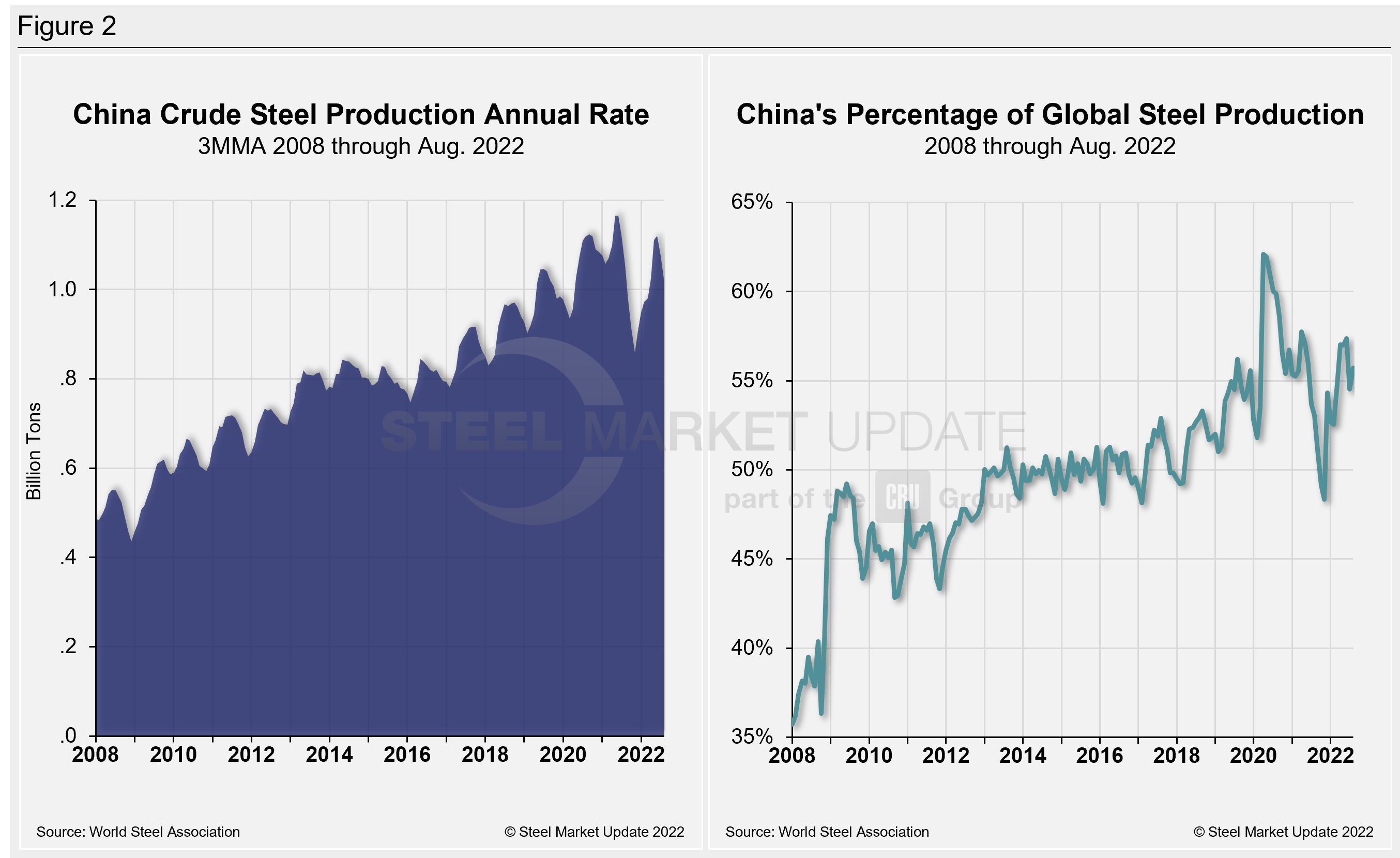

On a 3MMA basis, the annual rate of China’s crude steel production maxed out at 1.166 billion metric tons in May 2021. It has fallen repeatedly since February of last year, reaching its lowest total in November 2021. China’s annual capacity stands at 1.128 billion metric tons. Its annual capacity utilization was marginally higher at 87.9% last month, just 0.1 percentage point above its lowest mark in nearly two years. It’s down from an all-time high of 98.4% last June.

China still produced more than half (55.7%) of the world’s steel in July. Chinese production in August this year was 3.8% below pre-pandemic levels in June 2019.

China’s crude steel production rate and its percentage of global output are displayed side-by-side in Figure 2.

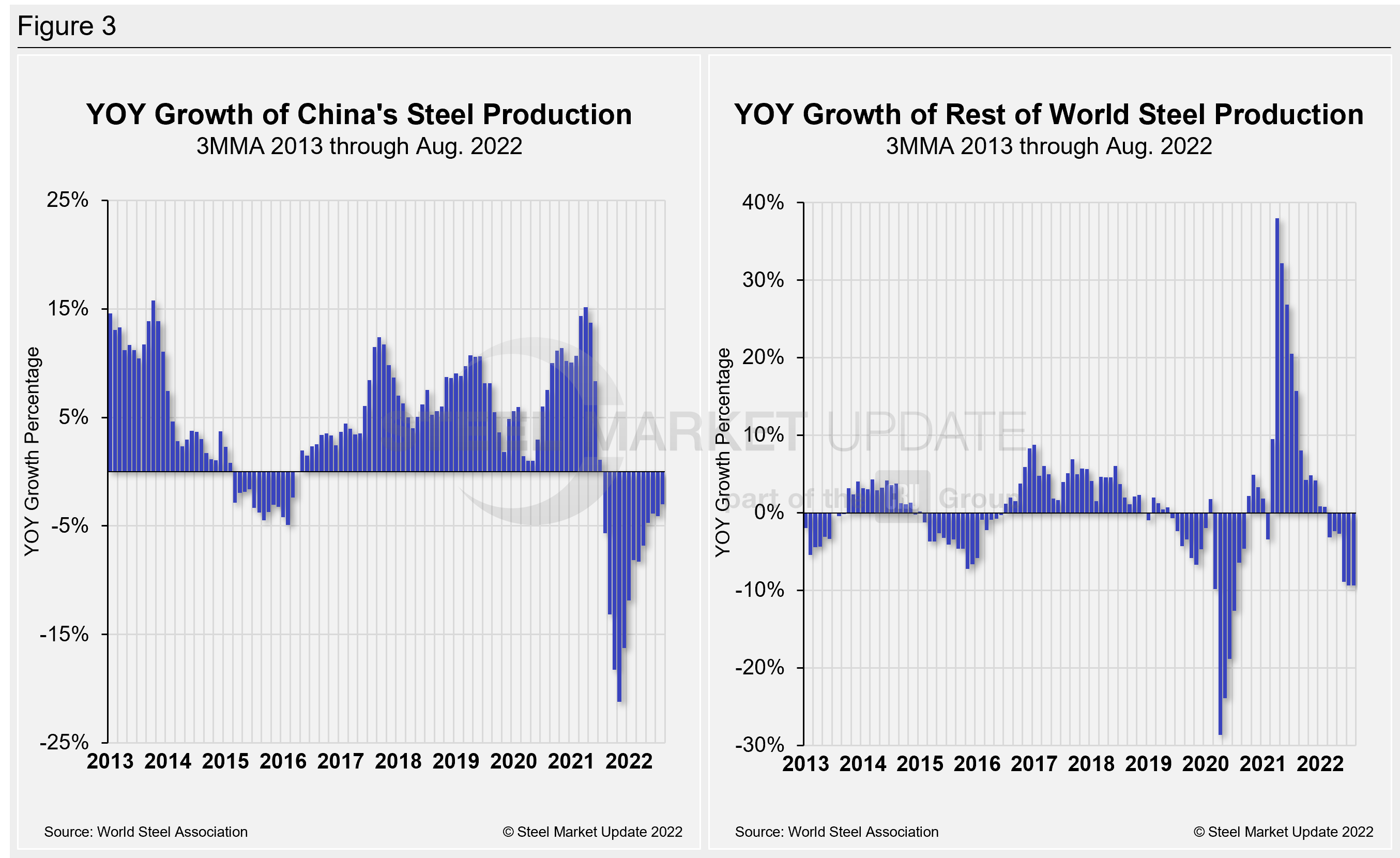

The fluctuations in China’s steel production since January 2013 versus the growth of global steel excluding China, both on a 3MMA basis, are shown side-by-side in Figure 3. From October 2020 through December 2021, the rest of the world’s production rose sharply, reaching a peak of 38.0% in April. Since then, the rate for the rest of the world’s annual production has decreased sequentially to -3.2% in March. In April and May, the percentage improved slightly but shrank back to -9.3% last month. China’s annual growth rate was -3% in August, an improvement from -4.1% in July. Annual growth is nowhere near the +15.1% seen last April.

By David Schollaert, David@SteelMarketUpdate.com