Market Data

September 27, 2022

Worldsteel: Global Steel Production Up Marginally in August

Written by David Schollaert

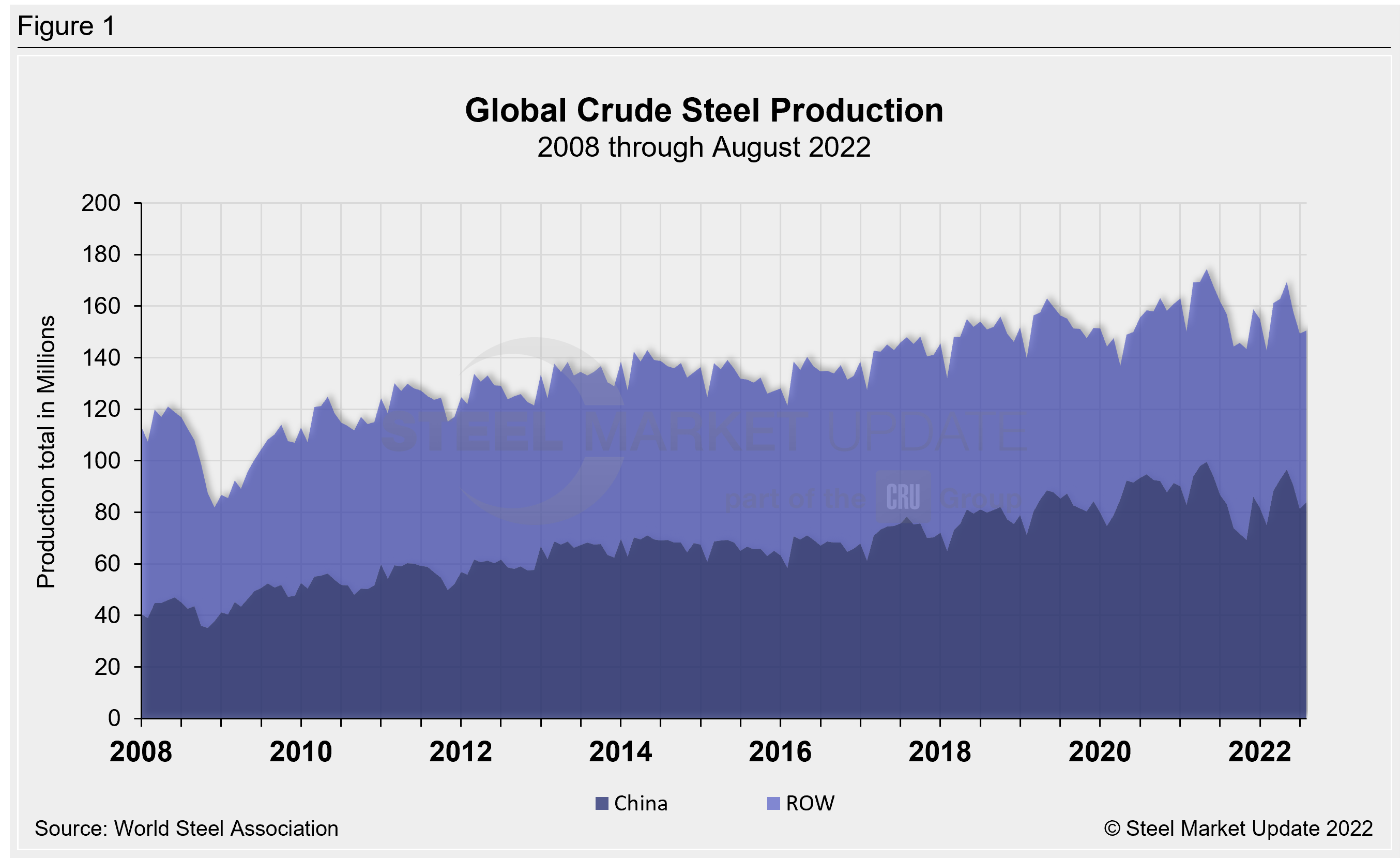

Global crude steel production was estimated at 150.6 million metric tons in August as steelmakers around the world cut back on output by 6.2 million metric tons, or 4%, from the same period last year, the World Steel Association (worldsteel) reported.

Last month’s estimated production was up sequentially, though, edging up by 0.9%, or 1.3 million metric tons, versus July’s total crude steel output.

Ever since reaching an all-time high of 174.4 million metric tons in May 2021, global steel output has been inconsistent. It waned for 11 straight months through February, driven in large part by Chinese cutbacks. Production then rose from March through May, led again by China, pushing global output to its second-highest total in May.

Since then, output worldwide has ebbed and flowed. In August, eight of the top 10 global steel-producing nations saw production output expand or remain even versus July. But when compared to the same year-ago period, eight out of 10 saw production totals decline.

When compared to the pre-pandemic period of July 2019, global crude steel production was down 3%, or 4.6 million metric tons, last month.

China’s steel production in August totaled an estimated 83.9 million metric tons, up 2.5 million metric tons (+ 3.1%) month-on-month (MoM), and up 700,000 metric tons (+0.8%) from the same year-ago period. Worldwide steel production, ex-China, totaled 66.7 million metric tons last month, down 6.9 million metric tons (-9.4%) compared to August 2021. Output was down 1.8% MoM in August, or 1.2 million metric tons less.

Chinese steel output accounted for 55.7% of worldwide production in August, up 1.2 percentage points versus July.

Eight out of the top 10 global steel-producing countries saw production hold or improve MoM in August. China reported the largest total tonnage gain versus July, followed by Russia, (+400,000 metric tons, or +7.3%) and India (+100,000 metric tons, or +1%). Japan, South Korea, Turkey, Brazil, and the US all saw output remain even MoM.

By David Schollaert, David@SteelMarketUpdate.com