Market Data

September 22, 2022

CRU: China’s Recovery Improves Mildly, But Property Woes Continue

Written by Henry Hao

By CRU Senior China Economist Henry Hao, from CRU’s Global Economic Outlook and China Macro Monthly

China’s economy showed resilience in August, with growth in industrial production, investment, and retail sales shoring up the recovery from the effects of Covid lockdowns and heatwaves.

The worsening property slump, however, continues to drag on the economy and threaten the outlook. Policy stimulus has continued. The Chinese authorities have announced a further RMB1 trillion of funding largely focused on infrastructure spending. Furthermore, the People’s Bank of China (PBoC) has directed policy banks to launch a real estate relief program worth RMB200 billion to support the completion of unfinished housing projects.

However, despite the overall encouraging economic data and more policy support in August, high-frequency economic activity index suggests another slowdown in early September.

China’s Recovery Picks Up Despite Disruptions

China’s economic recovery perked up in August despite the disruptions caused by Covid lockdowns and heatwaves. Fixed-asset investment (FAI) went up by 6.5% year-on-year (YoY) in August from 3.5% in July. Industrial production (IP) edged up to 4.2% YoY in August from 3.8% in July. Retail sales showed a better-than-expected recovery, boosted by strong automotive sales (although base effects also helped), rising by 5.4% YoY in July from 2.7% in July.

The slowing world economy took a toll on Chinese trade as export growth weakened to 7.0% YoY in August, down from 17.8% in July. Import growth also slowed to -0.2% YoY in August, down from 2.5% in July (Figure 1).

Activity Slows Further in Early September

CEIC’s high-frequency economic activity index shows that economic activity slowed further in early September, driven by the Covid lockdowns in cities such as Chengdu and Shenzhen and new travel restrictions implemented until the end of October (Figure 2).

The visit by President Xi and other top officials to Kazakhstan and Uzbekistan for the Shanghai Co-operation Organisation meeting reignited hopes for easing the “zero-Covid” strategy; this was the first time Xi has left China in almost 1,000 days. However, we expect China to maintain its strict approach to managing the pandemic at least until the 20th Party Congress in mid-October.

Adherence to the “zero-Covid” policy will continue to depress consumer spending and the property market, preventing the economy from making a full recovery. However, manufacturing firms have largely been able to keep operations running during lockdowns.

Auto Industries Support Manufacturing

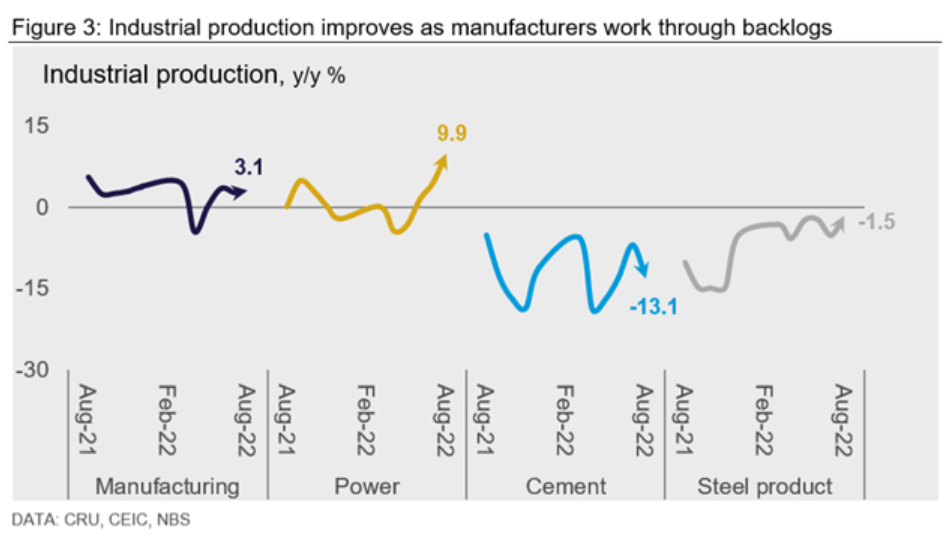

Manufacturing production recovered to 3.1% YoY in August from 2.7% in July, suggesting that the lockdowns in August did not pose a huge impact on manufacturing activity. Despite a YoY decline in major categories linked to construction (such as cement, -13.1%, and steel, -1.5%), auto again proved to be a bright spot.

Energy production, ramping up 9.9% in August, proved the drought-induced power shortage to be short-lived. The cut in the auto purchase tax by 50% and various measures to stimulate auto demand provided a strong lift to the auto market. China’s auto production surged by 39% in July while auto sales surged by 28.3% (Figure 3 and Figure 4).

Infrastructure Investment Remains Strong

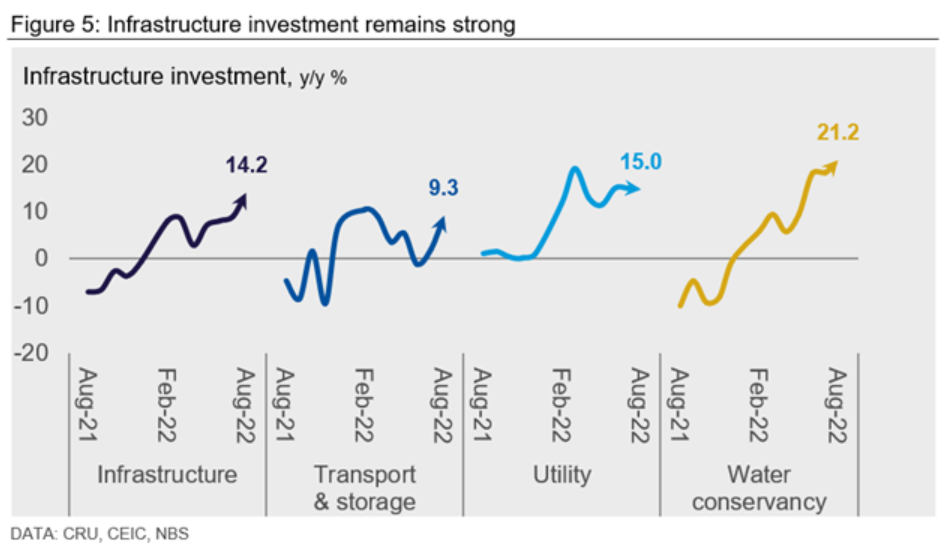

Chinese authorities doubled down on an infrastructure push, dusting off the old playbook to boost the economy amid property woes. The State Council has announced a further RMB1 trillion of funding largely focused on infrastructure spending, including RMB300 billion of policy banks’ investment in infrastructure projects, RMB500 billion of special purpose bonds (SPB) from previously unused quota, and RMB200 billion of special bonds for energy supply.

Hence, China’s infrastructure investment rose to 14.2% YoY in August from 9.1% YoY in July (Figure 5). Looking ahead, we expect China to roll over around RMB950 billion of special treasury bonds in Q3 and Q4 to further sustain the growth in infrastructure spending through H2. Channeling more liquidity into infrastructure projects is China’s most viable move to stabilize the faltering economy, but that will still not be enough to fully offset weaker real estate investment.

Property Remains the Major Drag on the Economy

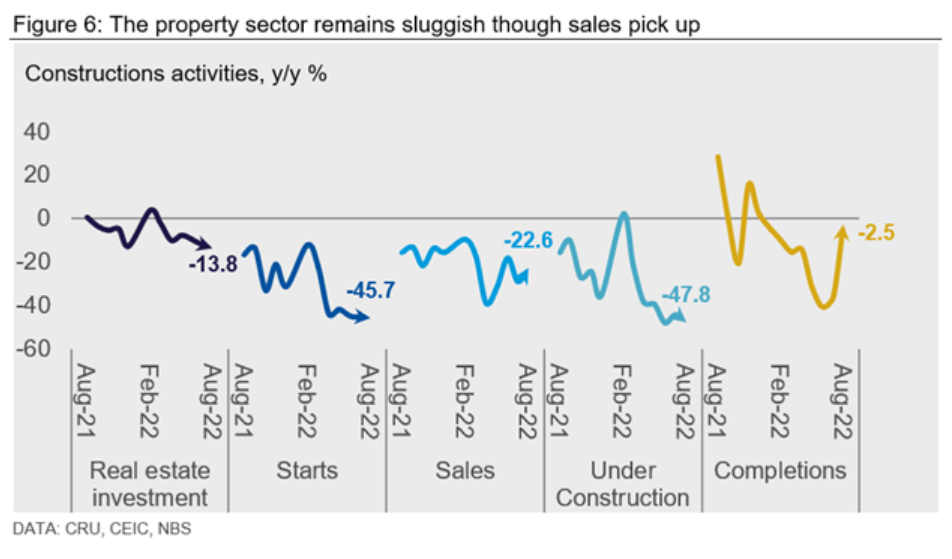

Property woes are still haunting China’s economic recovery. FAI in real estate tumbled another 13.8% in August from a 12.1% decline in July (Figure 6). Construction activities remained in contractionary territory. Starts weakened by 45.7% YoY in floor space terms, and sales of housing dropped 22.6% YoY.

Government officials have taken some new measures to revive homebuyers’ confidence by ensuring that pre-sale properties will be completed. For example, Zhengzhou city in Henan province recently issued an order for developers to resume all suspended homebuilding projects by early October. The PBoC has directed policy banks to launch a real estate relief program worth RMB200 billion to support the completion of unfinished housing projects. Completions of properties picked up significantly, declining by just 2.5% YoY in August from a 36.0% contraction in July.

It is still uncertain whether these measures will effectively renew homebuyers’ confidence in buying new pre-sale projects, but we do expect the completion of projects to ramp up in the following months. We expect it will take at least another quarter to see a meaningful recovery of the property market.

Credit Growth Remains Below 2020-2021 Levels

The most recent data has shown some improvement in credit expansion as the State Council provides additional fiscal support whereas private demand remains tepid.

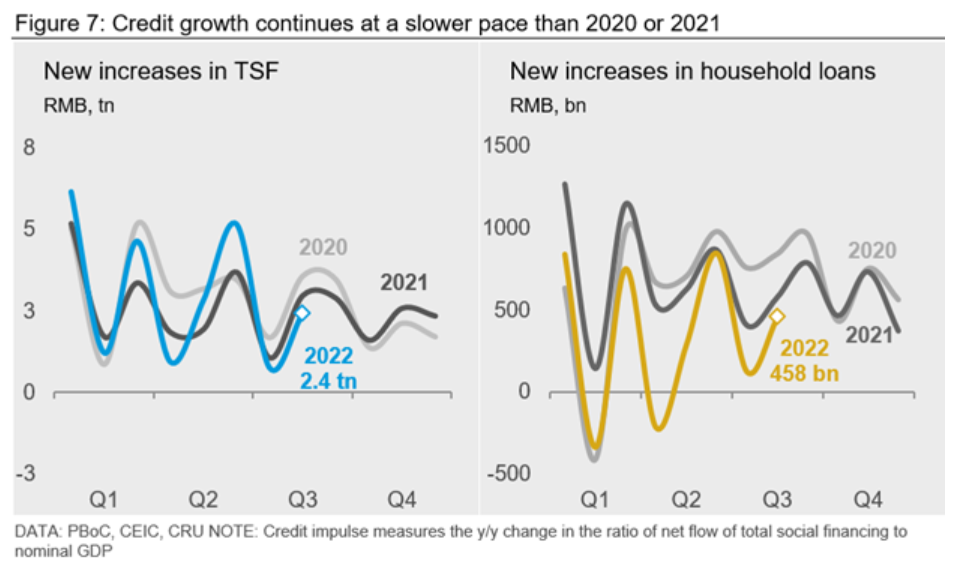

The growth of the broad money supply (M2) accelerated to 12.2% YoY in August from 12.0% in July. However, the growth of the total social financing stock (TSF, the broadest measure of credit) slowed to 10.5% in August from 10.7% in July. Renminbi bank loan issuance in August rose to RMB1.3 trillion, pushing up the flow of TSF to RMB 2.4 trillion (Figure 7, left-hand side).

New household loans (mostly mortgages) fell by 20.4% YoY to RMB458 billion amid a persistent property downturn, even as the PBoC implemented a rare 15-bp cut to the five-year loan prime rate (LPR)–the mortgage benchmark lending rate–in August. (Figure 7, right-hand side).

Looking ahead, the state will continue to play a dominant role in pumping up credit, especially given that Chinese inflation is much lower than in the US or Europe. In addition to policy bank lending, local governments are now allowed to tap into RMB500 billion in unused special bond quotas from previous years in September and October.

Any recovery in private demand, however, will be constrained by the restrictiveness of China’s “zero-covid” policy and low confidence in the property market, with improvements being unlikely until 2023 H2.

If you are keen to hear more about our views on China and global economy, please refer to Global Economic Outlook and/or get in touch with our CRU economists:

This article was originally published on Sept.19 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com