Overseas

September 16, 2022

CRU: European Scrap Prices Stagnate, Buying Activity Remains Low

Written by Rosy Finlayson

By CRU Research Analyst Rosy Finlayson, from CRU’s Steelmaking Raw Materials Monitor

European scrap prices remained relatively unchanged month-on-month (MoM) in September. Buying activity has been slow after the summer holidays despite this being the normal restocking period.

Finished steel mills are reportedly sufficiently stocked at present. Scrap prices in Europe now range between €300 per ton and €390 per ton depending on country and grade.

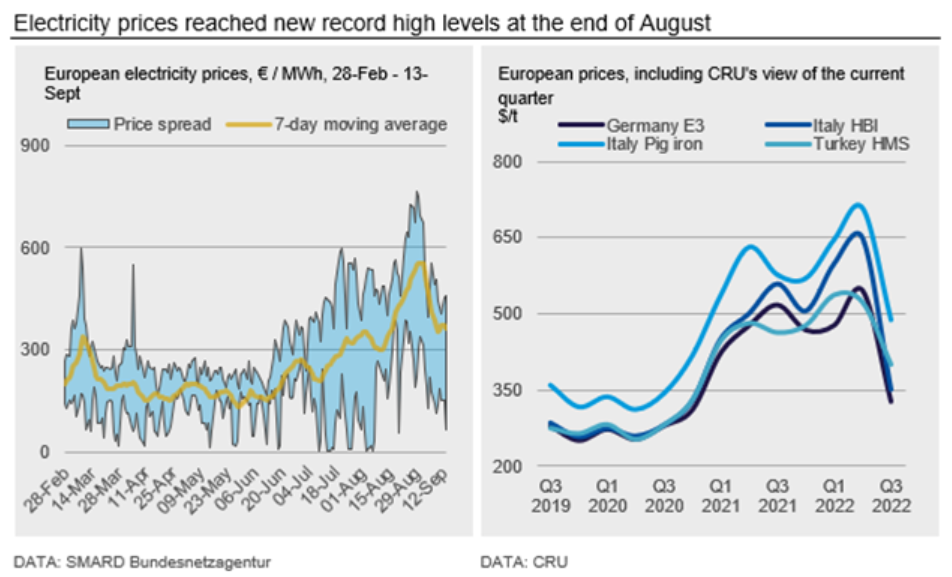

High energy costs remain a major concern for producers. Electricity prices have surpassed record-highs seen at the war’s onset in February amid reduced Russian gas exports and tightening domestic supply. The European seven-day moving average electricity price rallied up €79 per MWh week-on-week (WoW) to the highest recorded levels of €556 per MWh on Aug. 31 following Russia cutting off its main gas pipeline. The rise in electricity prices has led to further increases in processing costs for scrap producers as well as EAF steelmakers.

In Turkey, authorities announced a rise in electricity and gas prices by ~20% for households and ~50% for industrial use at the end of August. Market sentiment remains poor with an inflation rate of over 80% and a worsening US-Lira exchange rate. As a result, Turkish finished steel export prices rose this week as steelmakers, exposed to the risk of high energy costs, attempted to pass through these costs. Meanwhile, scrap prices fell this week as trading activity was thin.

In the EU, electricity prices fell due to the European Commission’s announcement of plans to intervene in the energy crisis at the beginning of September. However, electricity prices remain at a historically high level and are likely to stay at elevated level given that Russia has now announced the indefinite closure of Nordstream 1 gas pipeline.

In response to the continued rise in energy prices, European mills have announced extended outages or began idling facilities and reducing utilisation rates. At present, demand seems only to have become weaker and is continuing to outweigh current supply cutbacks.

Outlook: Macroeconomic Factors to Impact Near-Term Prices

Scrap prices are expected to remain under pressure in the coming months as continued weakness in demand is likely to put pressure on prices. A deteriorating macroeconomic environment, especially the possibility of a recession, will weigh on sentiment. If the situation of high electricity costs continues, it is likely that more EAFs will be idled, and those which are currently idle will see their downtimes extended.

At the time of writing, we have already heard that scrap deals in Turkey are being done at lower prices of around $345 per ton CFR. However, supply tightness could provide some upside risk to prices.

This article was originally published on Sept. 15 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com