Product

August 27, 2022

SMU Steel Summit Poll Results: Cautiously Optimistic

Written by David Schollaert

As we’ve done in past years during Steel Market Update’s (SMU) Steel Summit Conference, we sought to gauge the mood of the room, particularly how those in attendance see the steel market developing over the next year.

This year, the 12th annual edition of our Summit, we polled nearly 1,300 attendees about where prices and demand would be come August 2023.

Though certainly not a scientific or analytical discovery process for forecasting purposes – our collective track record is, well, rather laughable – it does serve as an indication of industry sentiment. And we weren’t much better when it came to forecasting or predicting demand.

In all, you could easily make a case that the prior two Steel Summits were marked by historically opposite market dynamics and sentiment. If 2020 marked peak bearishness, 2021 was peak bullishness.

Maybe we should poll when most anticipate the next black swan event? Dr. Alan Beaulieu of ITR Economics has certainly tossed his hat in the ring regarding the next downcycle.

I digress. Let’s get back to the polls. So, without further ado, here are 2022’s Steel Summit poll results:

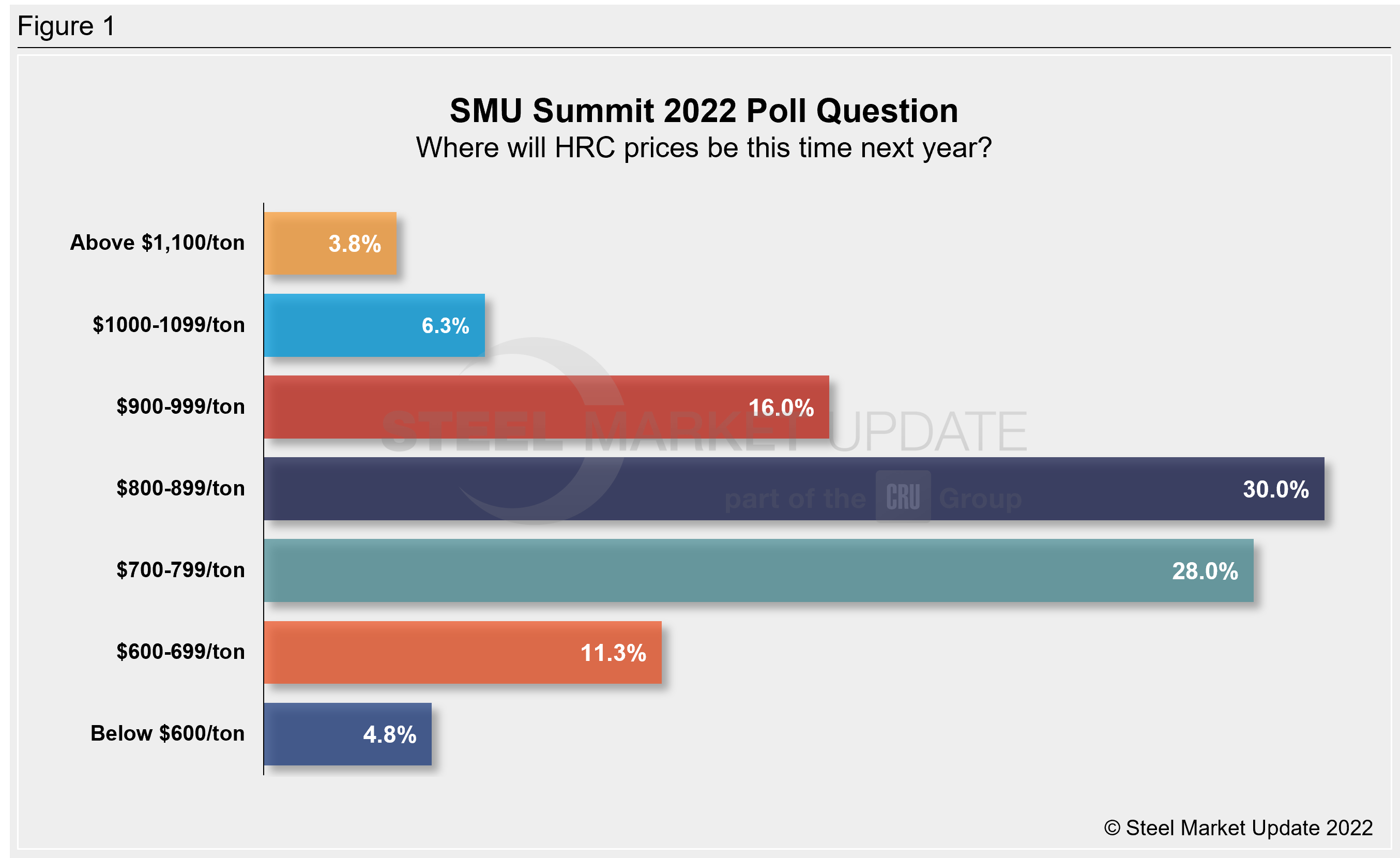

With a nearly 50% response rate from the 1,291 registered attendees at the 2022 SMU Steel Summit, 28% anticipate HRC prices to range between $700-799 per ton this time next year. Nearly a third of attendees expect prices slightly better.

In all, nearly three-quarters of this year’s Summit participants expect HRC prices to vary just $150-200 per ton from where they are now.

There were those on either end of the spectrum as well. Roughly 10% are bullish and see prices reaching or exceeding the $1,000-per-ton mark, while less than 5% are rather bearish and see prices coming down below the $600-per-ton mark by the time we meet again next year.

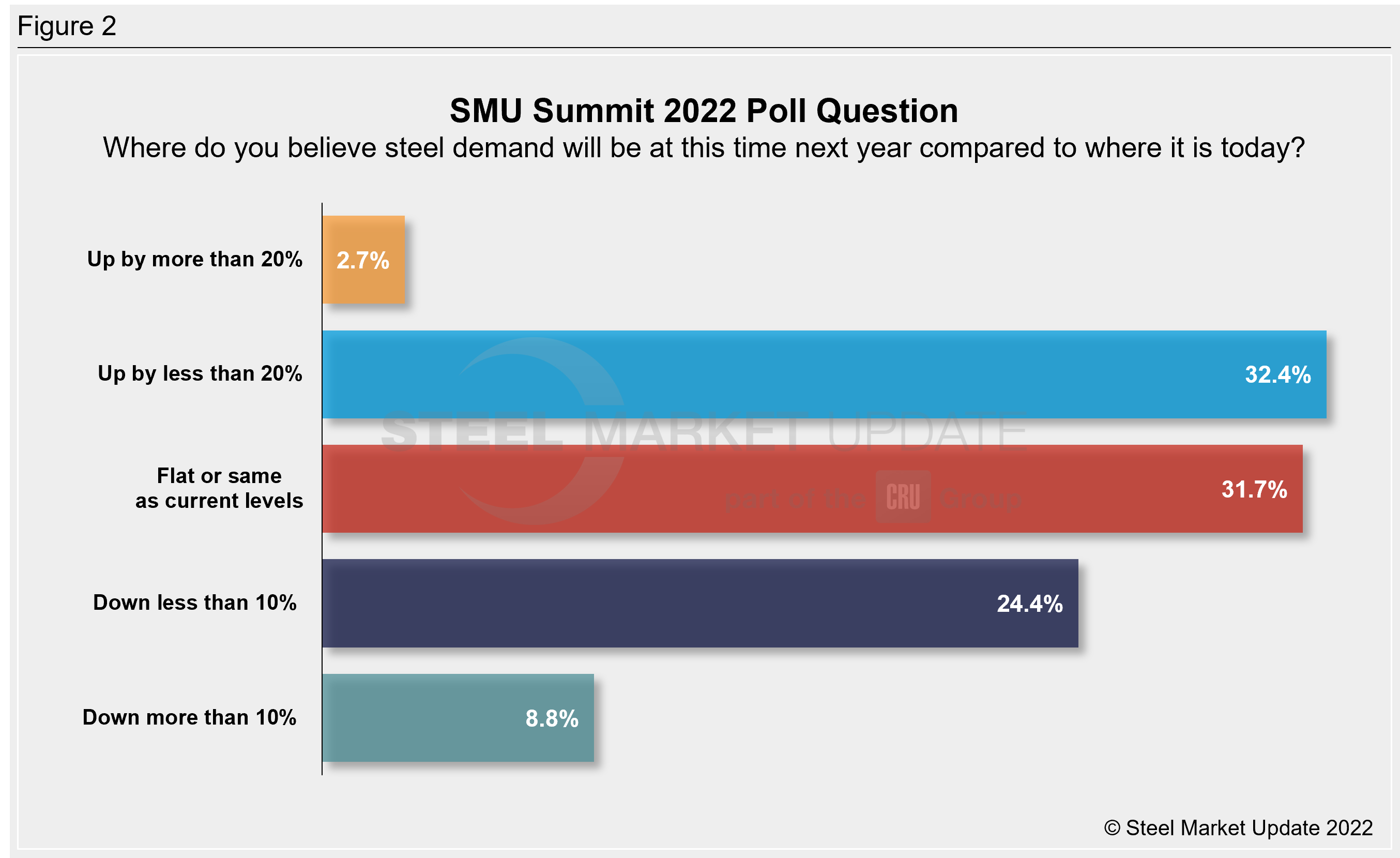

Not surprising – based on the pricing poll results – nearly two-thirds of those who responded, expected demand (Figure 2) to be flat/similar or up by less than 20% come next August.

A solid 24%, though, do expect demand to be down a bit from where it is today. Overall, almost 90% think demand will be somewhat flat, give-or-take, up/down about 10% by the time August 2023 comes around.

I guess only time will tell if our collective track record in predicting HRC prices and steel demand has improved from its dismal recent history. But rest assured, we’ll be certain to compare our most recent results with you versus next year’s reality.

Speaking of next year, mark your calendars for the industry’s premier event of 2023. Plans are already underway for the 13th annual edition of the SMU Steel Summit Conference. It’s slated for August 21-23 at the Georgia International Convention Center in Atlanta, just as we have for the past half dozen years.

If you can’t wait until then, you can always join us and register for the 34th annual Tampa Steel Conference. This industry event is a partnership between Steel Market Update and the Port of Tampa. It will be held between Feb. 5-7, 2023, in Tampa, Fla. It already has the billing as the second-best conference in our industry.

By David Schollaert, David@SteelMarketUpdate.com