Market Data

August 25, 2022

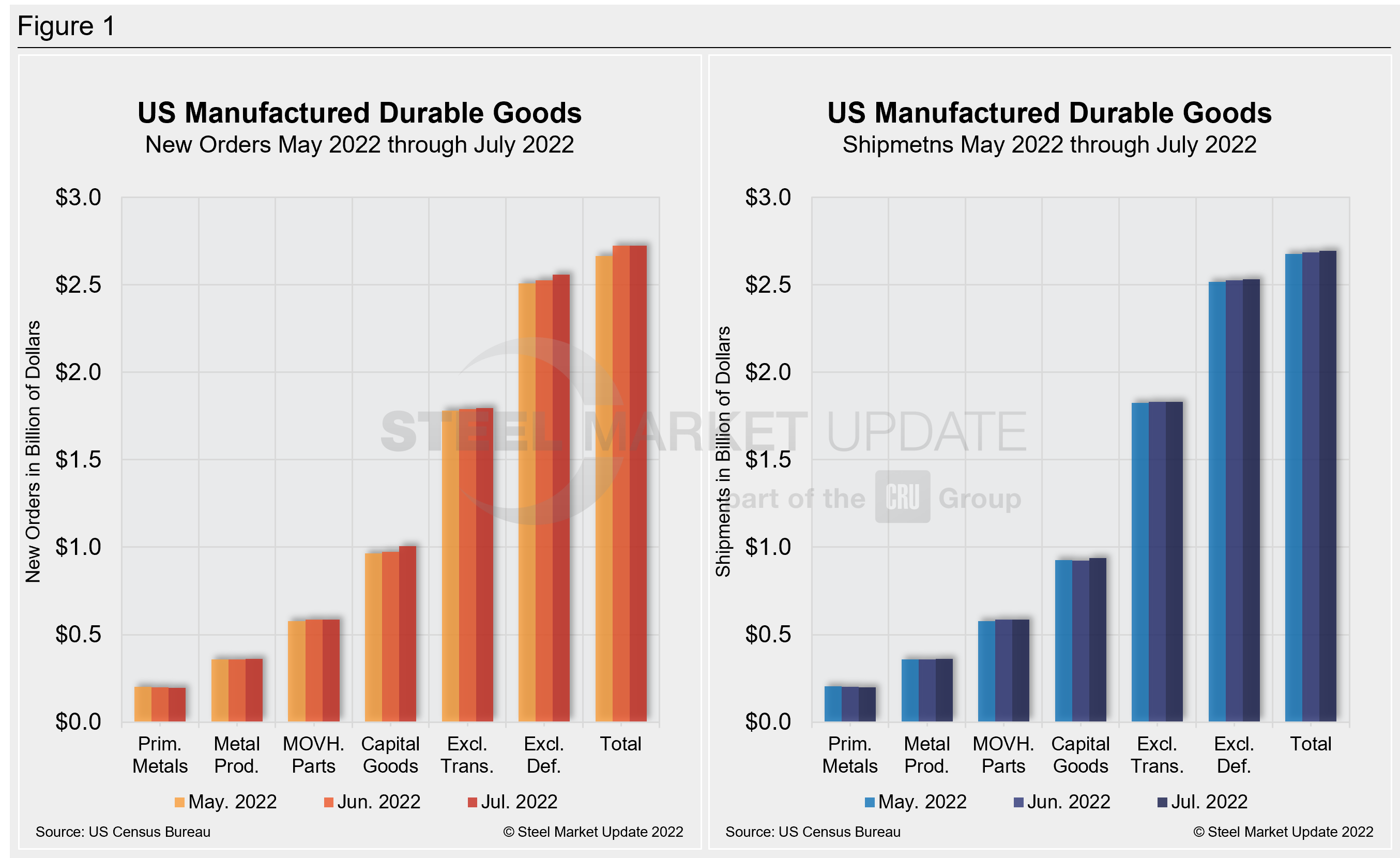

July Durable Goods Stall, Little Changed From June

Written by David Schollaert

New orders for US manufactured durable goods stalled in July, at a seasonally adjusted $273.5 billion last month, virtually mirroring the month prior. But a pullback on orders for long-lasting goods in July might reflect a cooling in demand amid other signs of a slowing US economy.

Last month’s bookings for durable goods were down roughly 0.04% or less than $0.1 billion month-on-month (MoM) – virtually unchanged – following a 2.2% gain a month earlier, according to the Commerce Department. Figures are not adjusted for inflation.

Excluding defense, new orders were up 1.2%, as companies pulled back on orders for big-ticket items in July. The result, some economic forecasts suggest, adds to signs manufacturing demand is cooling.

The value of core capital goods orders – a proxy for investment in equipment that excludes aircraft and non-defense capital goods – expanded by 0.3%. The result was slightly improved from expected gains of 0.2%.

Non-defense orders, excluding aircraft, were up 0.4% versus a 0.9% gain the month prior. The result in July was slightly better than forecasted gains of 0.3%.

Shipments of manufactured durable goods, up 14 of the last 15 months, rose 0.4% to $270.5 billion. That’s after a 0.3% increase in June. Transportation equipment, up nine of the last 10 months, drove the increase, rising 1.1% to $86.3 billion.

Click here more detail on the June advance report from the US Census Bureau on durable goods manufacturers’ shipments, inventories, and orders. See also Figure 1 below.

Revised and Recently Benchmarked June Data

Revised seasonally adjusted June figures for all manufacturing industries were: new orders, $554.3 billion (revised from $555.2 billion); shipments, $550.3 billion (revised from $551.9 billion); unfilled orders, $1,118.7 billion (revised from $1,118.0 billion) and total inventories, $801.5 billion (unchanged from $801.5 billion).

By David Schollaert, David@SteelMarketUpdate.com