Analysis

August 18, 2022

North American Auto Assemblies Shank in July

Written by David Schollaert

North American auto assemblies declined by 17.3% in July after expanding repeatedly in the prior two months. Though the market remains supply constrained due to ongoing parts and supply shortages, production in July was largely impacted by scheduled downtime for summer breaks and model-year changeovers. July’s results were ahead of the same year-ago period.

Disruptions across the North American automotive market have been extensive over the past two years. Driven by a global semiconductor crisis, automakers have dealt with production halts, delays, and inventory shortages.

July 2022 was the ninth straight month that retail inventories closed below 900,000 units, as anticipated improvements in vehicle production volumes failed to materialize. July is yet another month where supply constraints kept vehicle sales artificially low but delivered record transaction prices and dealer profitability.

And while car manufacturers have been resilient, relief from the microchip shortage is not expected in the near term. July’s results are 12.3% below the pre-pandemic period of July 2019.

North American vehicle production, including personal and commercial vehicles, totaled 1.037 million units in July, down from a downward revised 1.253 million units in June.

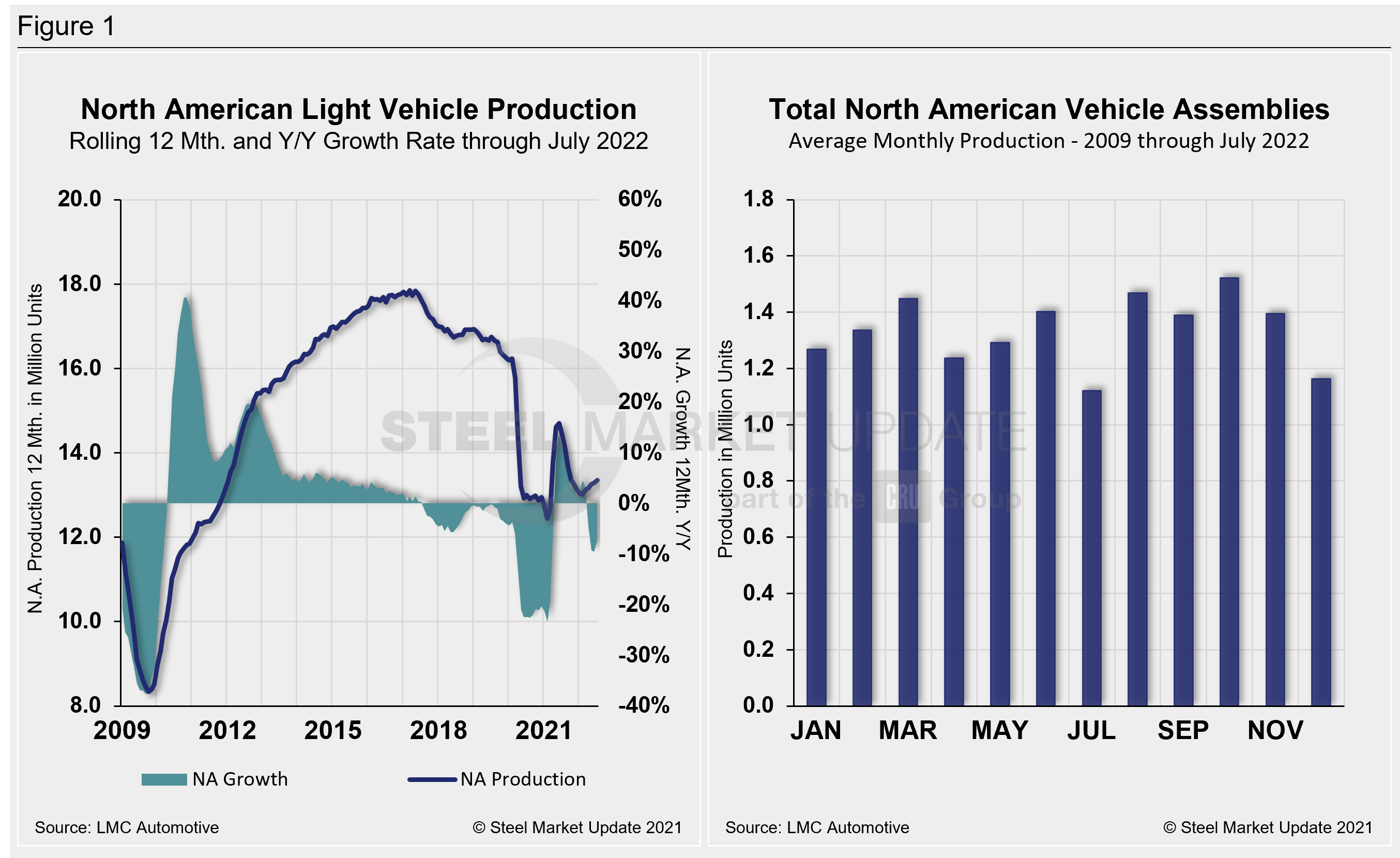

Below in Figure 1 is North American light vehicle production since 2009 on a rolling 12-month and year-over-year growth rate. Also included is average monthly production, including seasonality, over the same period.

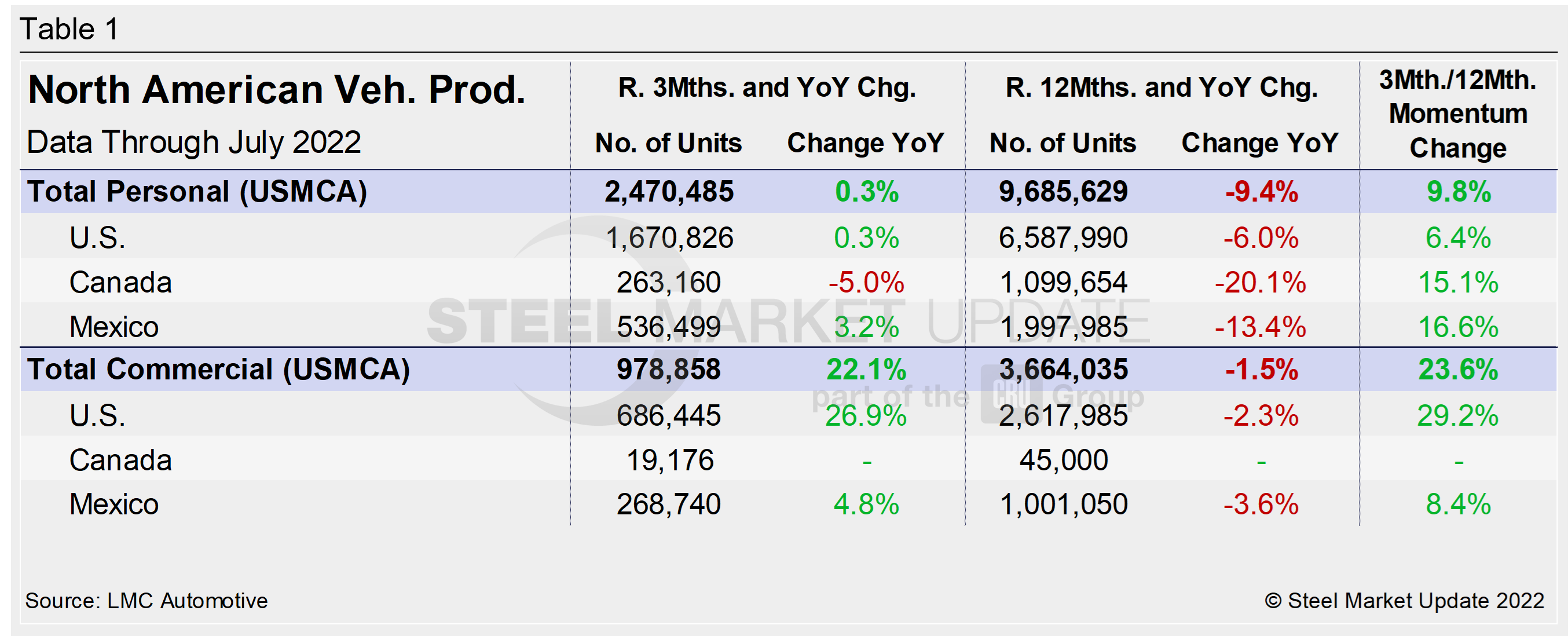

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into US, Canadian and Mexican components, along with the three- and 12-month growth rate for each. On the far right, it shows the momentum for the total and each of the three nations.

The initial recovery from Covid’s early spread was significant, but the effect of the chip and parts shortage has been more extensive due to its prolonged nature. Through last July, growth rates for personal and commercial light vehicles were a solid 25.9% and 11.3%, respectively. But they have since tumbled, owning to the ongoing chip shortage and supply-chain disruptions.

For the three months through July, the growth rate for total personal and commercial vehicle assemblies in the USMCA region is up, and a solid turn from double-digit declines at the start of the year. On the 12 months through July, the story is much different. Both personal and commercial production is down, directly pointing to the extended impact of the continued chip shortage.

Personal Vehicle Production

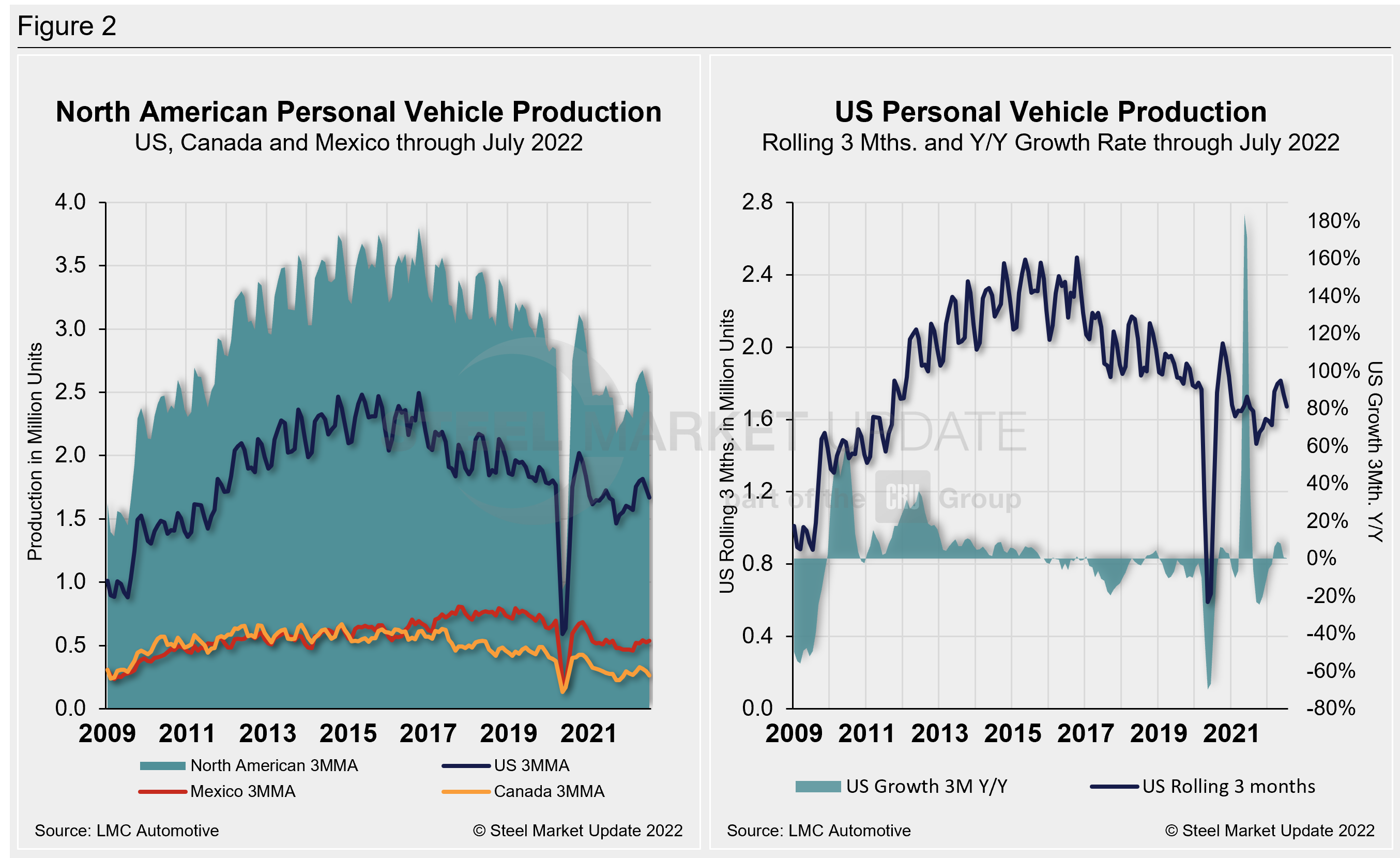

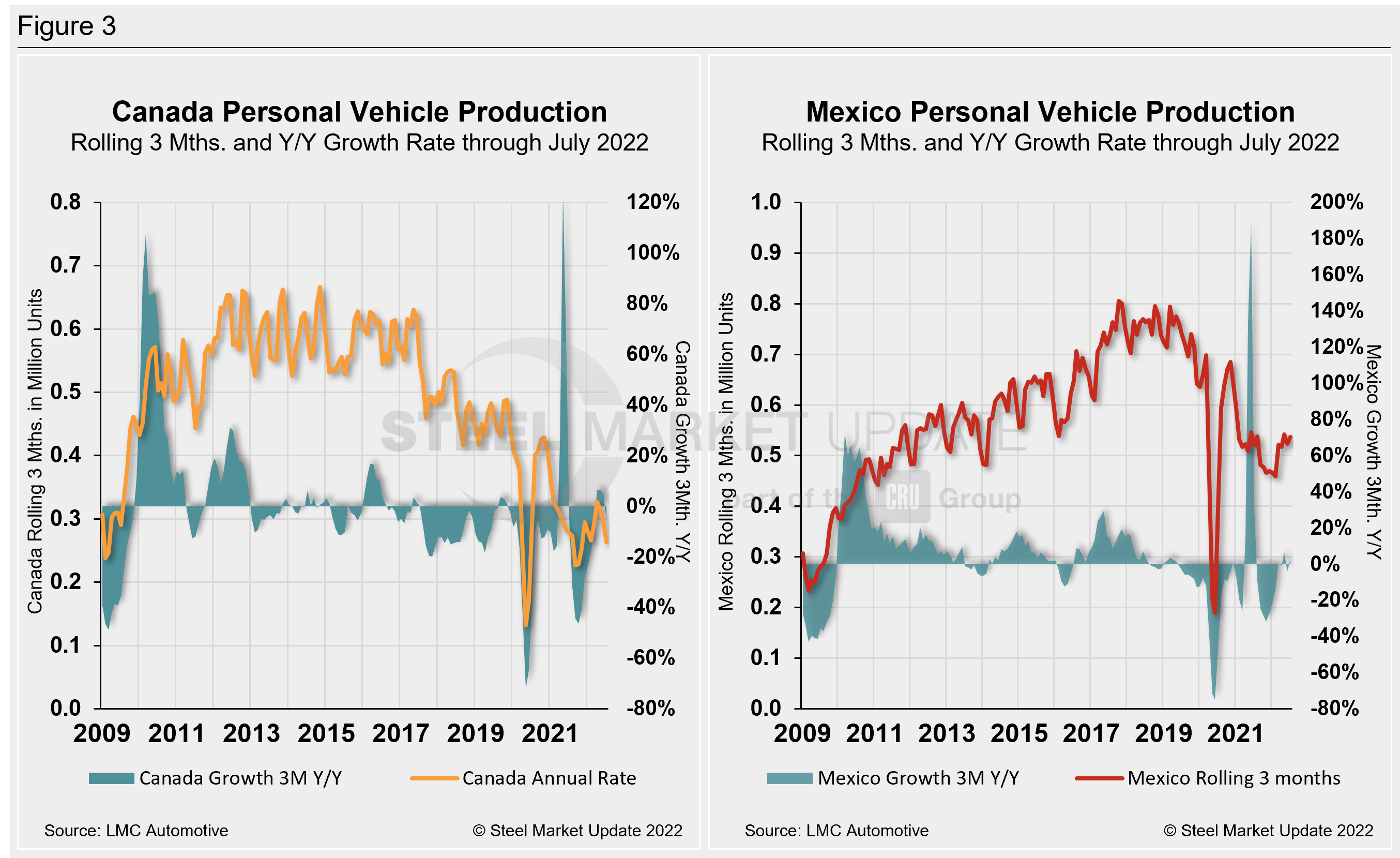

The longer-term picture of personal vehicle production across North America is shown below. The first chart in Figure 2 shows total personal vehicle production for North America and the total for the US, Canada, and Mexico. The production of personal vehicles in the US and the year-over-year growth rate are displayed in the second chart. Figure 3 shows side-by-side the production of personal vehicles in Canada and Mexico and the year-over-year growth rate.

In terms of personal vehicle production, all three—US, Canada, and Mexico—saw MoM declines in July.

The US saw the largest decline in units produced in July versus June, down 114,249 units (-19.7%). Canada saw the greatest percentage change MoM, down 32.6%, or 34,945 units less. Mexico assembled 16,832 fewer vehicles in July when compared to June, an 8.9% decrease MoM.

The annual growth rate across the region in July was mixed. It decelerated in the US and Canada but accelerated in Mexico. Canada saw the sharpest decline, growing at a -5% rate in July, followed by the US at 0.3%, down from 0.8% the month prior. Mexico expanded by 3.2% in July.

Canada’s personal vehicle production share of the North American market slipped slightly for the second straight month to 10.7% in July from 11.6% in June. Mexico’s share rose to 21.7% last month, while the US saw its share of the North American market slip fractionally to 67.6% in July, just 0.3 percentage points lower MoM.

Commercial Vehicle Production

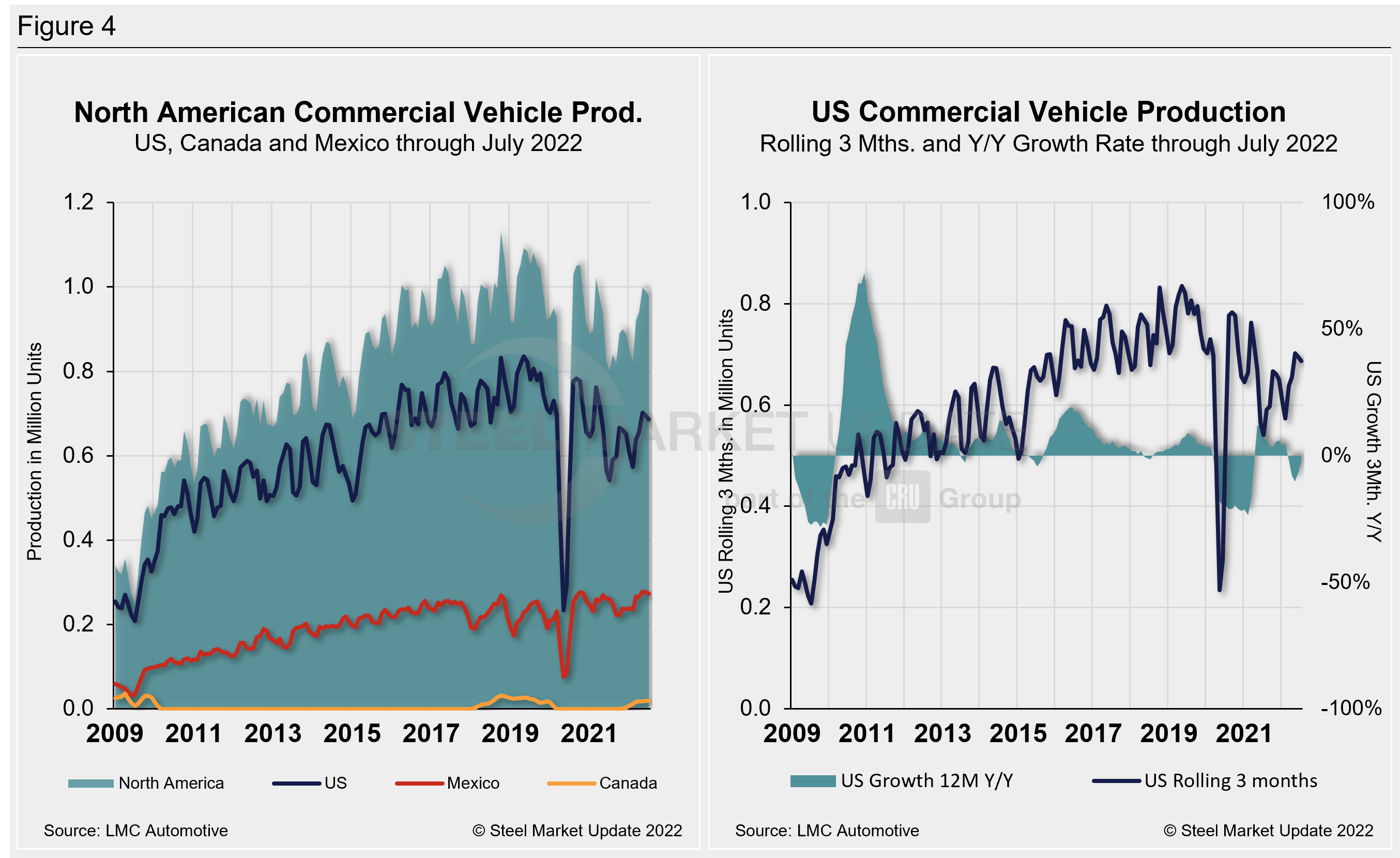

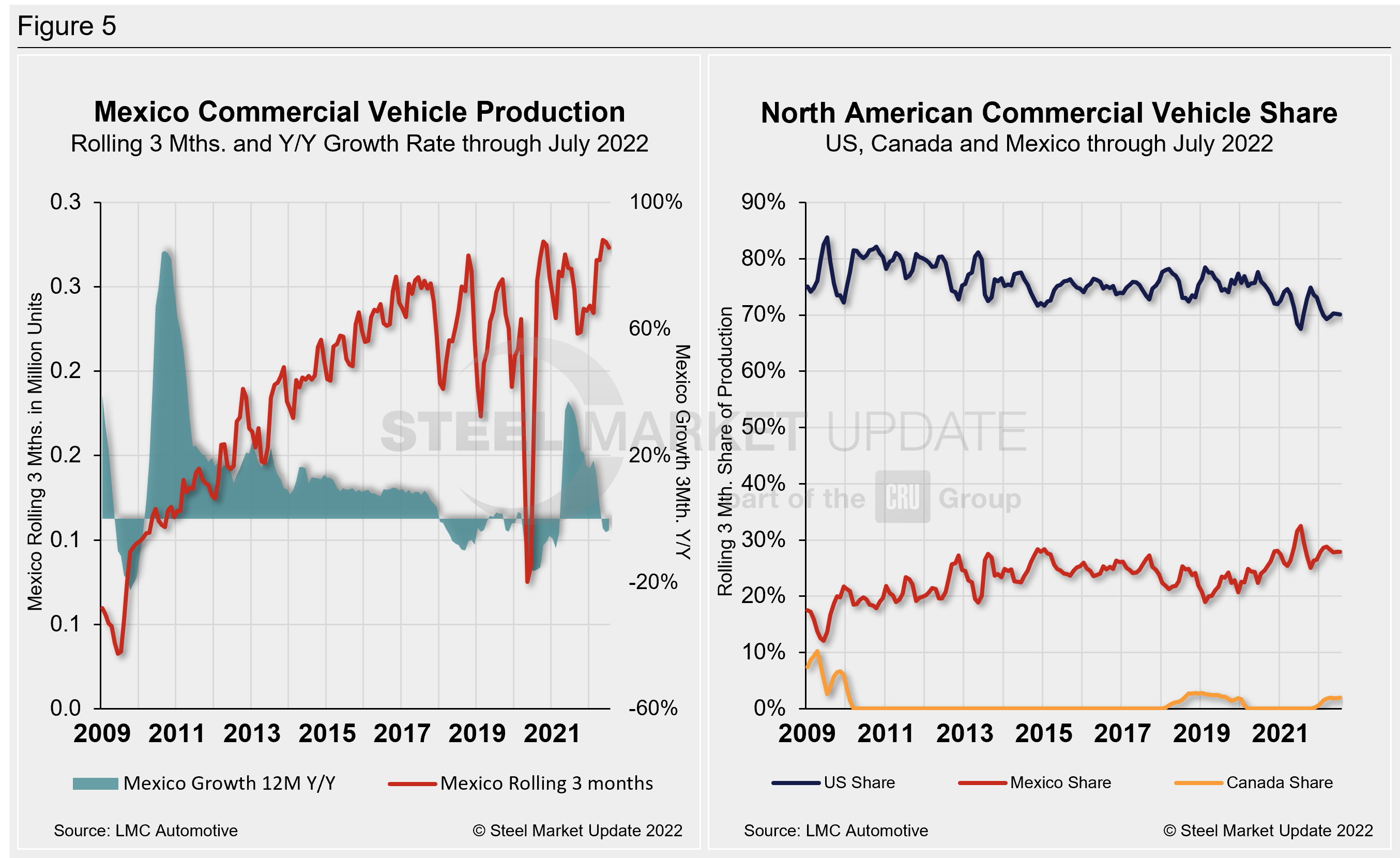

Total commercial vehicle production for North America and the total for each nation within the region are shown in the first chart in Figure 4 on a rolling three-month basis. The production of commercial vehicles in the US and the YoY growth rate are displayed in the second chart. The first chart in Figure 5 shows the production of commercial vehicles and the YoY growth rate in Mexico. The second chart shows the production share for each nation in North America.

Of note for the Canadian automotive sector: July marked Canada’s ninth consecutive month of commercial vehicle production after a 20-month production halt. Canada produced 5,667 light commercial vehicles in July, a 28.1% decline from June’s total of 7,886 units—its highest total since resuming production last November.

North American commercial vehicle production shrank by 14.6% in July to 294,274 units from 3.3% in June. The 50,338-unit loss MoM pushed North American production to its third-lowest monthly total year-to-date. The US saw the greatest unit loss, down 39,640 units (-16.2%), followed by Mexico, down 8,479 units (-9.2%), and Canada, down 2,219 units (-28.1%).

Despite the decline, the annual commercial production growth rate is now -1.5% for the region, an improvement from -5.0% in June. The US share was little changed, but slipped to 70.1% in July, down from 70.2% in June. Canada saw its share increase slightly to 2.0% in July from 1.9% in June. Mexico saw its share stay unchanged at 27.9% in July. Presently, Mexico exports just under 80% of its light vehicle production. The US and Canada are the highest volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the US, Canada, and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included).

By David Schollaert, David@SteelMarketUpdate.com