Market Data

August 16, 2022

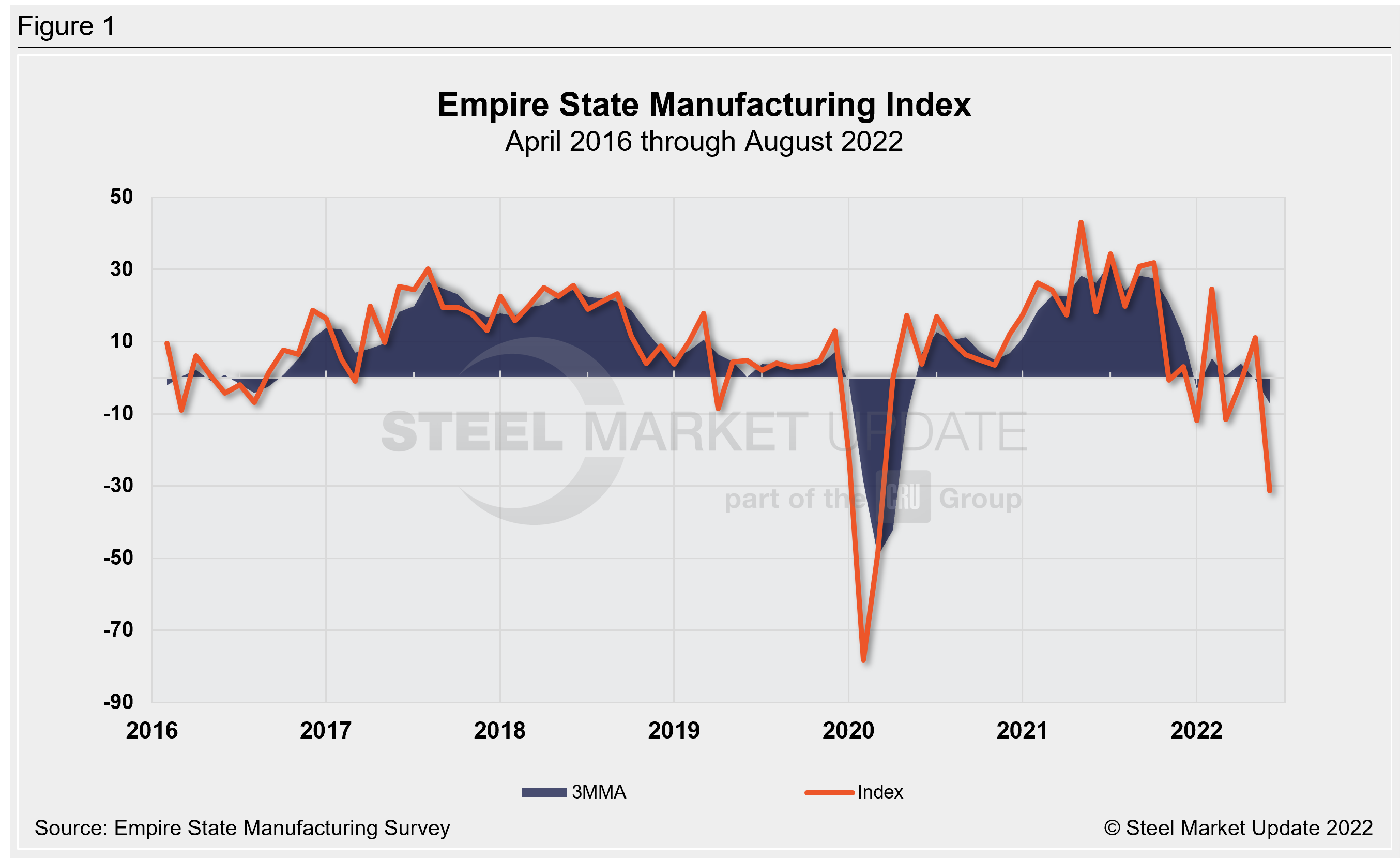

Empire State Manufacturing Plunges in August, Outlook Still Gloomy

Written by David Schollaert

Business activity in the state of New York saw a sharp decline in August, a complete reversal from the modest increase the month prior, according to the Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index—a gauge of manufacturing activity in the state—plummeted by 42.2 points in August to a reading of -31.3, returning to negative territory following a short-lived gain the month prior.

The dive was a surprise. Economists had expected a second straight modest increase. (Any reading below zero indicates deteriorating conditions.)

The report provided a few key takeaways. On the one hand, the report said delivery time held steady for the first time in two years, and inventories edged higher. On the other hand, firms remained mostly pessimistic about the next six months as the index of future activity edged up to a marginal reading of 2.1. Also, the new orders and shipments indexes plunged, down -35.8 and -49.4 points, respectively, while unfilled orders declined by 7.5 points to a reading of -12.7 points in August.

The prices paid index declined 8.8 points to a still elevated 55.5, while the prices-received index edged up 1.4 points to a 32.7 reading.

Employee indexes both fell in August, eroding for the second straight month. The average workweek index was -13.1, down 17.4 points versus July’s reading, while employment declined by 10.6 points to a reading of 7.4.

Firms were again rather pessimistic about the next six months, a sentiment expressed only four times in the survey’s history but for the second straight month, the report said.

Why the continued gloom? Though the indexes for future new orders and shipments were positive, they remained at low levels. And while employment is expected to pick up and delivery times are expected to decline over the next six months, only modest increases in capital spending and technology spending are planned for the months ahead.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com