Overseas

August 12, 2022

CRU: Ukrainian Steelmakers Caught in the Crossfire

Written by Chris Bandmann

Steelmakers stand firm in the face of Russian aggression

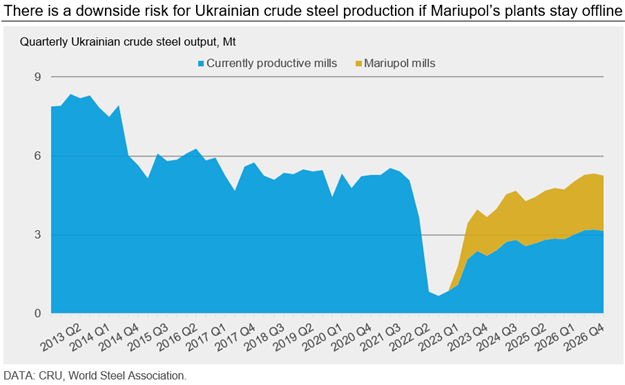

The invasion of Ukraine led to a sharp and sudden decline in steel production as steelmakers hurried to idle their assets in the face of military aggression. In the weeks that followed, some of these producers restarted their facilities – albeit at reduced capacity utilization. As steelmakers laid out their intentions to ramp up production, most were forced to scale back their plans due to logistical constraints and inflated production costs. Furthermore, total Ukrainian steelmaking capacity has received a major blow with the loss of the facilities located in Mariupol – Azovstal and Ilyich – and the outlook for these assets remains uncertain.

Many facilities were idled early in the war, then restarted

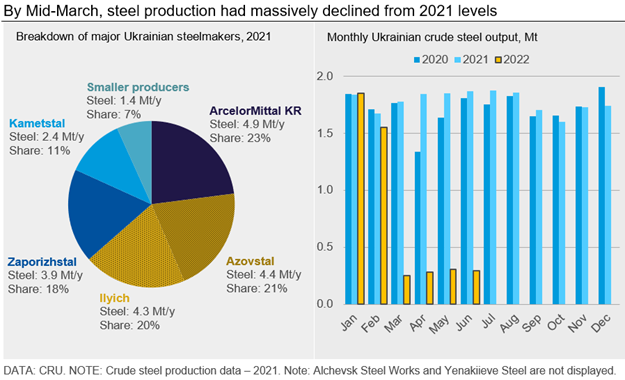

In 2021, Ukraine was the fourteenth largest steel producer by volume, being a key low-cost exporter of pig iron, semi-finished and finished steel products. Ukraine produced approximately 1% (21.4 metric tons) of total global crude steel output last year, including 15.7 metric tons of exported semi-finished and finished steel.

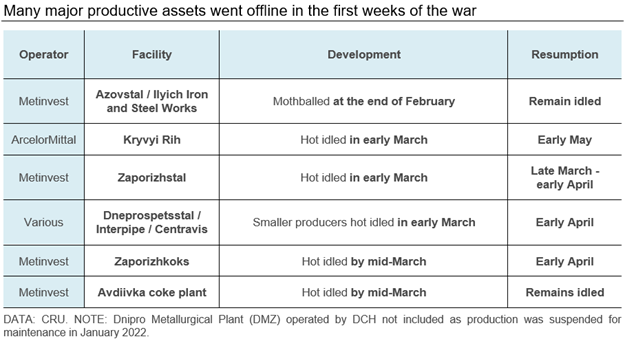

Following the outset of the war in late February, nearly all Ukrainian steelmakers chose to hot idle their facilities or otherwise reduce their operations to technical minimums for at least four weeks due to safety and operational concerns. Collectively, these idled assets produced around 85% of Ukraine’s crude steel in 2021.

Yenakiieve Steel and Alchevsk Steel Works, both located in the Donbas region, have not operated consistently since 2014. The legal owners – Metinvest Group and ISD Group – lost control over the assets in 2017 as the mills were nationalized by authorities of the self-proclaimed breakaway territories of DNR and LNR (Donetsk and Luhansk People’s Republic).

The loss of Mariupol is a blow to Ukraine’s steel industry

The Mariupol facilities – Azovstal and Ilyich – represented a significant fraction of Ukraine’s steelmaking capacity, accounting for 40% of the country’s crude steel production in 2021. While the loss of these plants is a major blow to the Ukrainian steel industry as a whole, it is also particularly devastating for their slab casting capacity.

Around 80% of Ukraine’s slab casting capacity was housed within the Mariupol facilities, the remainder of which is located in Metinvest’s Zaporizhstal facility. Because of this, Ukraine’s ability to produce low-cost slab and finished flat products has been significantly diminished, leading to reduced supply and higher prices for buyers of these products – particularly in the European market.

It is currently uncertain when the Mariupol facilities will return to production. Metinvest has formed a working group to create a reconstruction plan for Azovstal, under the assumption that Mariupol and the plant will be retaken. What is already clear, however, is that the cost of reconstructing the plant, in addition to the rebuilding of civilian infrastructure to support workers, will be very high.

More information on Ukraine’s steelmaking capacity may be found here.

Details on production restarts and current capacity utilization

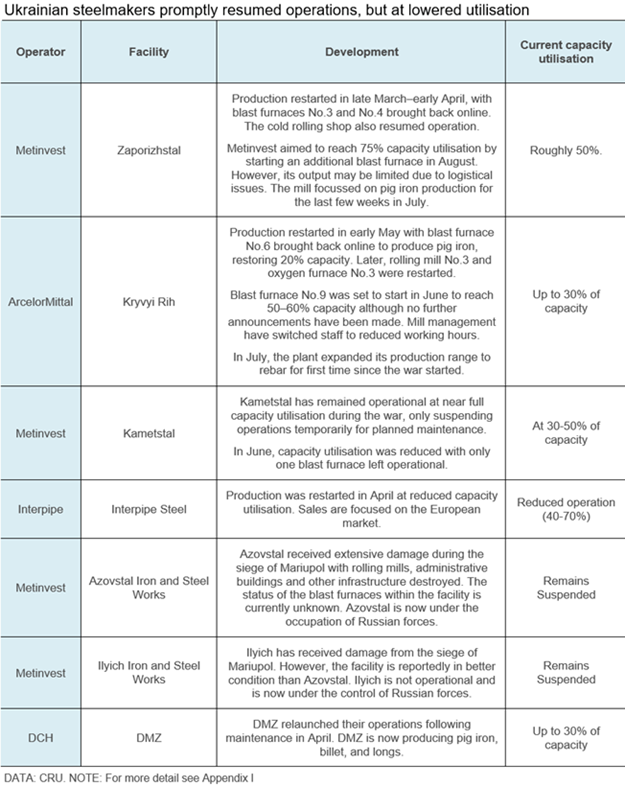

Zaporizhstal: ~ Up to 50% of capacity

Zaporizhstal was the first steelmaker to restart production after the initial suspension, resuming operations at blast furnaces No. 3 and No. 4 in March-April and reaching around 50% capacity utilization across all assets. Both the cold rolling shop and pig iron smelting have been brought back online. In June, management was initially considering starting another blast furnace by August to reach three quarters capacity utilization. However, as of end-June the producer was planning to reduce output as the war continued to create logistical issues for raw material supply as well as exports. The mill now plans to focus output on pig iron in July and August.

ArcelorMittal Kryvyi Rih: ~ Up to 30% of capacity

ArcelorMittal Kryvyi Rih restarted blast furnace No. 6 (1 of 3, ~20% of the capacity) at the start of May to produce pig iron. Later in May, the company resumed wire rod production at rolling mill No. 3; and oxygen furnace No. 3 was restarted in June. ArcelorMittal also planned to restart blast furnace No. 9 in June and reach 50–60% capacity utilization, but there have been no reports that this asset was successfully launched. The plant is currently focused on the production of wire rod and rebar while pig iron production remains suspended.

In July, management announced that it will be switching most of its the staff to two thirds working time as issues with logistics and exports continue to put pressure on profitability.

According to recent announcements in July, the producer has expanded its production range to cover rebar for the first time since the war started.

Kametstal: At 30–50% of capacity

Kametstal has remained operational at almost full capacity throughout the war, only suspending some assets for planned maintenance. However, in late June, Metinvest Group announced that the plant would continue to operate on only one of two BFs, effectively reducing the capacity utilization by half. Its product range has been focused on billets, longs, and sheet over the last months. In July, Kametstal relaunched its only axle rolling mill.

DMZ: ~ Up to 30% of capacity

DMZ relaunched its pig iron, billet, and longs production in April and continues to operate at reduced capacity.

Interpipe Steel: Reduced operation (from between 40% to 70% depending on the product)

Interpipe Steel initially idled their facilities shortly after the outbreak of the war, then resumed production in April and have been operating at reduced capacity since. The plant continues to produce railway equipment and pipes, with output focused on exports to European markets. In an interview for Forbes, the CEO of the company claimed that the plant’s capacity utilization in May–June for pipes was up to 70%, while for railway wheels it was up to 50%.

Azovstal: Suspended

The Azovstal facilities were used to shelter soldiers and civilians during the siege of Mariupol. The plant became a battleground for Ukrainian and Russian forces in April–May, and it sustained severe damage as a result.

Azovstal has 7.3 metric tons per year of crude steel production capacity and forms an integral part of Ukraine’s slab and plate production infrastructure. In 2021, the mill produced around 4.4 metric tons of crude steel, which was roughly 21% of total Ukrainian production.

The future of Azovstal is uncertain as it has been difficult for the owner to assess the extent of the damage. However, Metinvest has set up a working group to create a plan for the reconstruction of Azovstal after control over the plant is regained. According to the early assessment, the rebuilding process will take around three years, during which Ukraine will be missing at least 20% of its crude steel capacity.

Ilyich Iron and Steel Works: Suspended

Ilyich is another large steelmaking plant, which produced around 20% of the Ukraine’s crude steel in 2021. The mill is currently under the control of Russian forces and production remains suspended. The facility was a major producer and exporter of pig iron and sheet products, with almost 40% of the country’s merchant pig iron exports originating from Ilyich in 2021.

The status of Ilyich’s facilities also remains uncertain. However, it has not been as heavily affected by fighting as its neighbor plant, Azovstal, in Mariupol.

Request more information about this topic.

This article was originally published on August 5 by CRU, SMU’s parent company.

By CRU Analysts Chris Bandmann and Christopher Dix

Learn more about CRU’s services at www.crugroup.com