Analysis

August 9, 2022

Dodge Momentum Index Rebounds in July

Written by David Schollaert

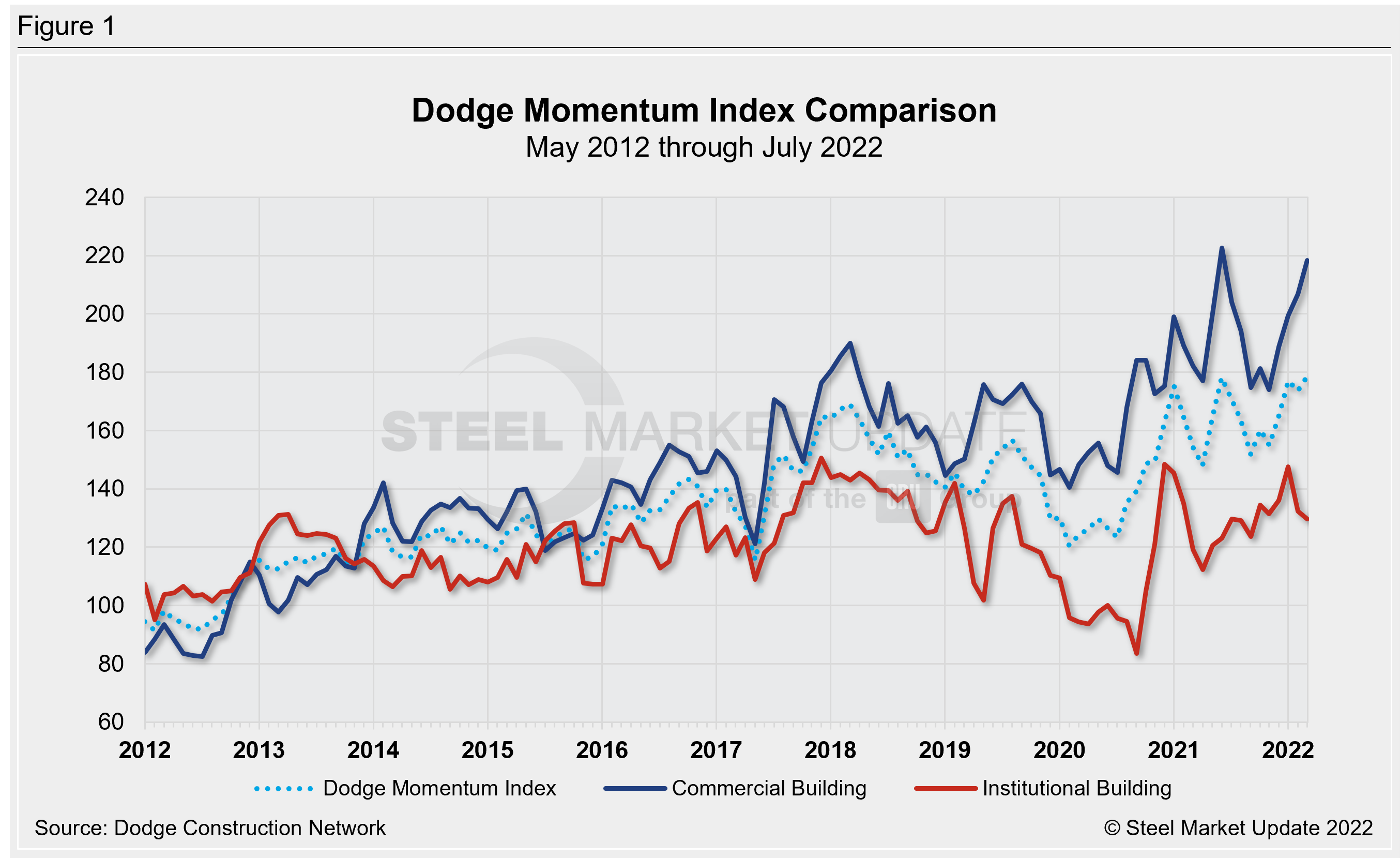

The Dodge Momentum Index moved 2.9% higher in July, gaining ground on the upwardly revised reading for the month prior, according to data and analytics from the Dodge Construction Network. The index registered 178.7 last month, up from 173.6 in June.

The leading index for commercial real estate measures data about planned nonresidential building projects to track spending in the sector. For July, the subcomponents diverged, though, with the institutional component of the Momentum Index slipping 2% while the commercial component increased 5.5%.

July’s increase in the headline index, according to the report, pushed the level of planning above the most recent cyclical high reached in May.

During the month of July, commercial planning was led higher by an increase in data center, office, and warehouse projects. Institutional planning was driven down by fewer education and healthcare projects.

Compared to July 2021, the overall Momentum Index was 8% higher last month. The institutional component was down 3%, while the commercial component was 15% higher on a year-over-year basis.

The report noted that a total of 14 projects with a value of $100 million or more entered planning in July. The leading commercial projects were the $300 million Schnitzer Industrial Park in Sacramento, Calif., the $275 million Parteere 42 mixed-use complex in Miami, Fla., and the $180 million Edgecore Data Center in Sterling, Va. The leading institutional projects were the $500 million Vanderbilt University Medical Center in Nashville, Tenn., a $157 million life sciences building in San Francisco, Calif., and the $150 million Cal Poly Humboldt Craftman’s student housing project in Arcata, Calif.

The headline index has yet to show signs of stress despite growing recession fears, the report said. “This shows that developers and owners remain confident that nonresidential building projects will weather the storm of higher interest rates and a slowing economy,” said Richard Branch, Dodge’s chief economist.

Whether the trend can be sustained over the medium term is unclear, ultimately dictating the pattern for construction starts in 2023, added Branch.

An interactive history of the Dodge Momentum Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com