Market Data

July 27, 2022

CRU Economics: Dollar Remains King

Written by Filippos Papasavvas

By CRU Economists Filippos Papasavvas and Veronika Akhmadieva, from CRU’s Global Economic Outlook. Contribution from CRU Sr. China Economist Henry Hao.

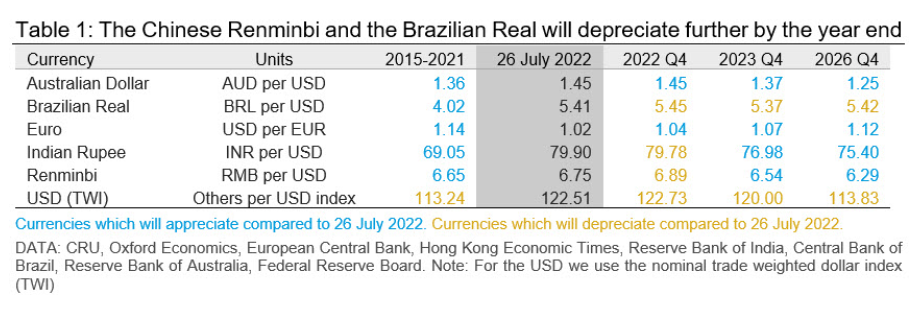

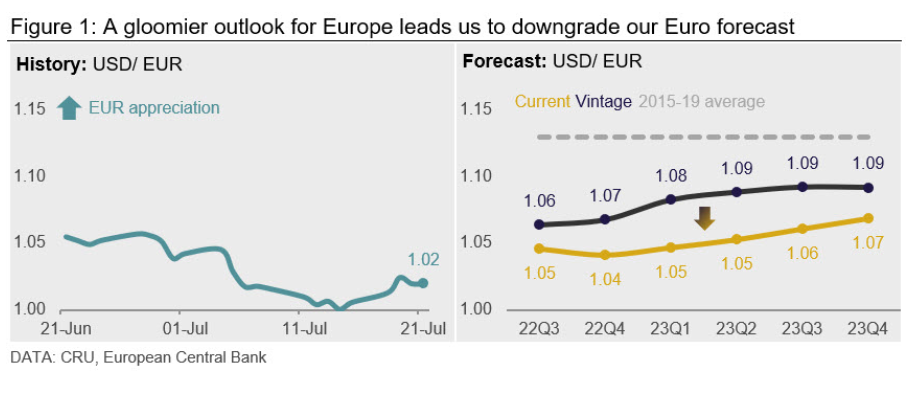

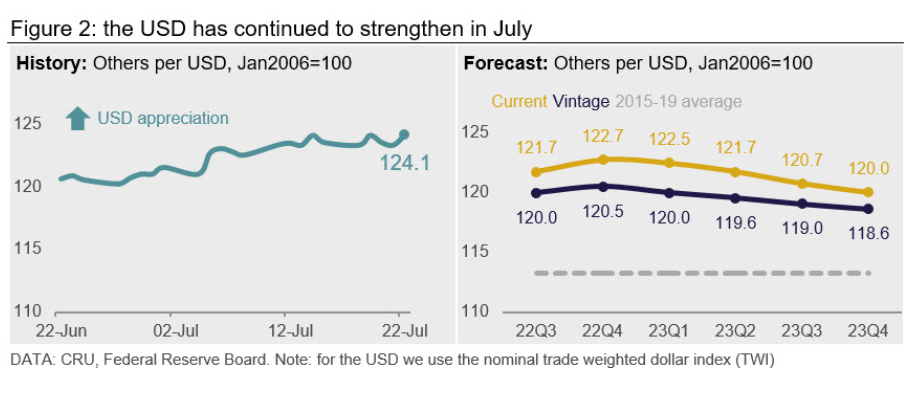

We have further upgraded our US Trade-Weighted Index (TWI) forecast, which we now forecast to average 122.7 in 2022 Q4 from 120.5 previously. The change reflects our more pessimistic outlook for all other major currencies vis-à-vis the dollar, except for the Renminbi (RMB) where the economic re-opening boosted its value. Even so, we still expect the RMB to depreciate in 2022 Q4 from its current level, averaging 6.89.

Pressure on the Aussie is Mounting

The Australian dollar (AUD) has averaged 1.40 against the USD in 2022 Q2, depreciating slightly since Q1. The RBA announced another 50bps rate hike in July, putting the overnight rate at 1.35% and causing a short-lived one-third of a percent decline in AUD relative to the USD. Moreover, the unemployment rate remains low at 3.5% signalling further wage growth ahead.

The unseasonal floods in New South Wales also added upward pressure to persistently high inflation. We do not expect inflation to begin decelerating till 2022 Q4 and forecast an equal size rate hike next month and likely in September. Despite a more hawkish stance of RBA, we do not think it will keep pace with the Fed.

There are also risk factors that are global in nature, such as a slower-than-expected China recovery, bearish market sentiment and lower commodity prices. Overall, we expect the AUD to depreciate against the USD in 2022 H2, averaging 1.45.

The Brazilian Real is Set for Depreciation

Until June, record high commodity prices in 2022 Q2 have been supporting the emerging markets currencies (EMs) such as the Brazilian Real (BRL). However, the trend is now reversing with investors choosing safer alternatives. Moreover, EMs are weakening as the Fed continues hiking the federal funds rate, strengthening the US dollar. On top of that, President Bolsonaro approved a new law that enforces a range of state-level tax cuts, that are likely to cut the government’s annual budget by 0.9% of GDP.

While inflation has most likely peaked in June at 11.9%, investors’ concern over fiscal sustainability will put additional downward pressure on the value of the Brazilian Real. Overall, BRL became the fourth worst performing currency in the world in June, losing 10.1% of its value against the US dollar. BRL averaged 4.92 against USD in 2022 Q2, and we expect it to depreciate to an average of 5.36 in 2022 Q3 and 5.45 by the year end.

Euro Fundamentals Weaken

The Euro depreciated in July, moving from 1.04 on July 1 to 1.02 on July 22 (see Figure 1, left-hand side). This reflected growing worries over the European macroeconomic outlook and a stoppage of gas inflows from Russia. However, with gas inflows from Nord Stream 1 resuming on July 22, this risk is temporarily alleviated, even though a future stoppage remains possible. Moreover, the ECB’s historic decision to raise rates by more than it originally signalled (50 bps instead of 25) offers some limited support to the Euro’s short-term trajectory.

This is also supported by the ECB’s new Transmission Protection Instrument (TPI) program which will be used to contain “disorderly and unwarranted” divergences in member states’ borrowing costs. Given that growing borrowing spreads between Germany and Southern European economies partially contribute to a weaker Euro, the TPI provides upsides to the USD/EUR exchange rate.

In our outlook, we now expect a weaker euro in 2022 and 2023, albeit still appreciating from its current level (see Figure 1, right-hand side). This reflects a considerable upgrade to our European gas price forecast, which negatively impacts Europe’s terms of trade. We have also become more bearish about the Eurozone’s macroeconomic outlook in terms of GDP and industry sectors, with the composite PMI dropping below 50 in July.

Indian Rupee Hits a Record Low Against the Dollar

The Indian Rupee (INR) depreciated by 4.5% against the USD in the past three months as the higher-than-expected US inflation increased the likelihood of more aggressive rate hikes by the Fed.

Historically, US monetary policy has been the most influential element in determining capital flows in emerging markets. Sharp US interest rate hikes have led to capital outflows and currency depreciation in emerging markets. The exodus of foreign institutional investors (FIIs) from India and other emerging markets has exacerbated the depreciating pressure. As the INR depreciated, it will prompt even more FIIs to pull out the capital as they fear the INR will depreciate further.

Meanwhile, the Reserve Bank of India (RBI) has consequently intervened to slow the depreciation of the INR by selling its foreign reserves and encouraging more foreign inflows in the bond market.

We expect the depreciation trend to continue as interest rate differentials are expected to widen, albeit the RBI using its reserves to arrest the sharp decline in the INR. Overall, we expect the INR to depreciate by 5.5% year-on-year (YoY) on average in 2022, with the INR per USD exchange rate standing at 79.78 at the end of 2022, compared with 74.94 a year earlier.

Renminbi Will Remain Weak in 2022 H2

The onshore Chinese Renminbi (RMB) weakened by 4.23% against the USD in the past three months, standing at 6.7483 as of July 26. Domestic economic weakness and a lingering Covid-19 impact will continue to weigh on the RMB exchange rate in 2022. Furthermore, diverging paths for monetary policy between the Fed and the People’s Bank of China (PBoC) would be another major contributor to a weaker RMB this year.

With the PBoC now on hold and the Fed’s more aggressive monetary tightening stance, we expect diverging paths for monetary policy between the two central banks to persist.

While asset valuations look attractive and policy easing could help shore up China’s growth in H2, we think FIIs’ appetite for Chinese assets will not improve significantly as China’s outlook is highly uncertain due to the zero-Covid-19 policy. However, with the Chinese monetary policy set to stay on hold rather than become more accommodative and the local economy recovering, we expect less depreciation pressure to build on the RMB. Hence, we have lowered our forecast of the average RMB per USD exchange rate from 6.71 to 6.69 in 2022, weakening to 6.89 by year‑end.

US Dollar Keeps Gaining Momentum

The dollar kept appreciating in July moving from 121.6 on July 1 to 122.5 on July 26 (see Figure 2, left-hand side). This occurred against both the advanced and emerging market economy baskets, which saw a 2.6% and 1.6% appreciation during the same time window.

The upward trajectory was driven by growing worries about developed economies such as the Eurozone, while emerging markets struggle with higher food and energy prices.

In line with this momentum, we have upgraded our US (TWI) forecast to average 122.7 in 2022 Q4 and 120.0 by 2023 Q4. This will keep it way above its 2015-2019 average value of 113.2 (see Figure 2, right-hand side).

This article was originally published on July 26 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com