Market Data

July 22, 2022

WSA: Global Steel Production Fell in June

Written by David Schollaert

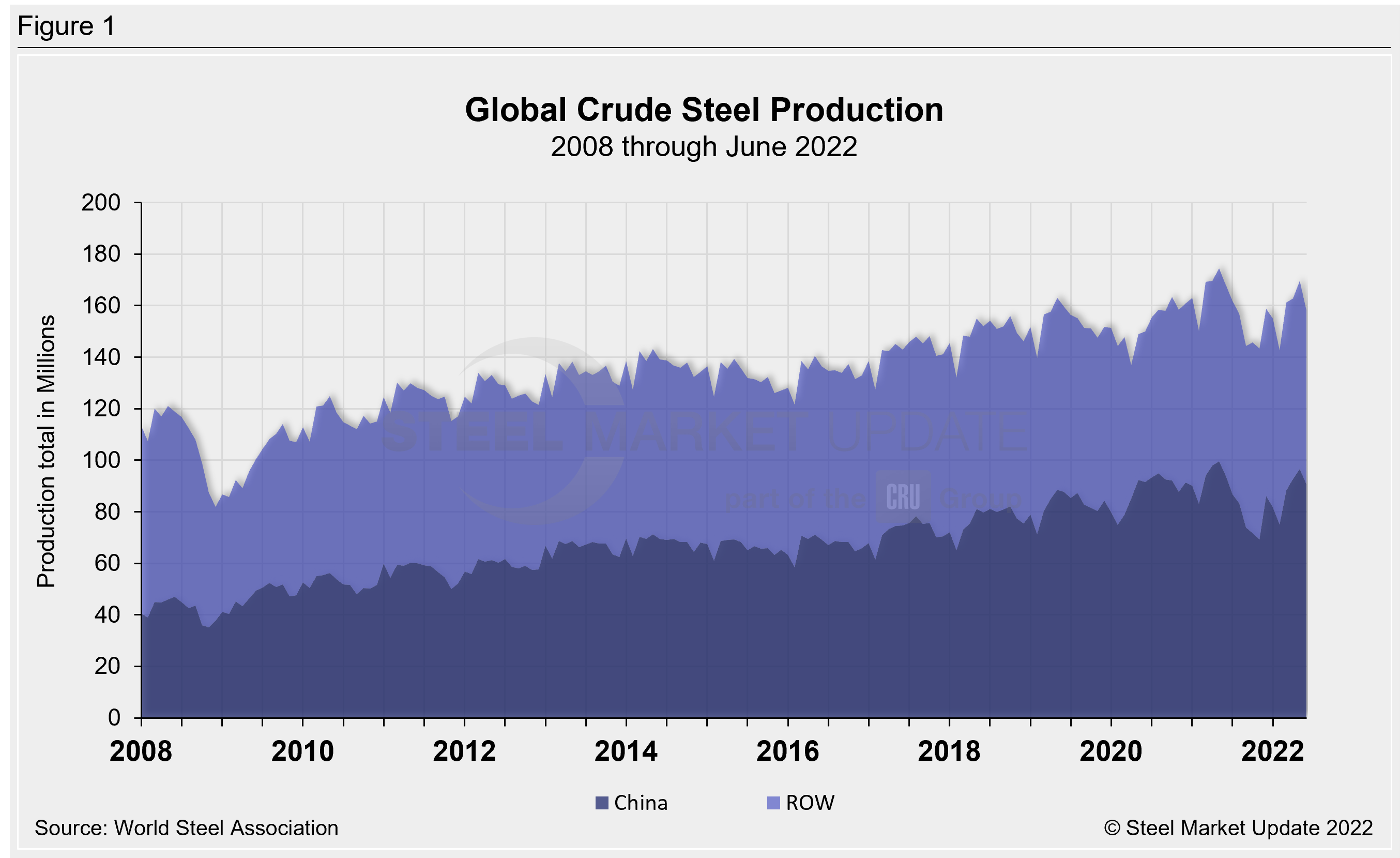

Global crude steel production was estimated at 158.1 million metric tons in June as steelmakers around the world cut back on output by 9.8 million metric tons, or 5.8%, from the same period last year, the World Steel Association (worldsteel) reported.

Last month’s estimated production was also down sequentially, shrinking by 6.7%, or 11.4 million tons, versus May’s total crude steel output.

Since reaching an all-time high of 174.4 million metric tons in May 2021, global steel output had steadily waned through February, driven in large part by Chinese cutbacks. Production then rose March through May, led by China, pushing global output to its second-highest total in May.

June’s decline was a worldwide effort. All top 10 global steel-producing nations saw production output shrink, except for Germany, which was unchanged. When compared to the pre-pandemic period of June 2019, global crude steel production was down 0.9%, or 1.4 million metric tons last month.

China’s steel production in June totaled 90.7 million tons, down 5.9 million metric tons (-6.1%) month-on-month (MoM). Worldwide steel production, ex-China, totaled 64.4 million metric tons in last month, down 6.6 million metric tons (-8.9%) when compared to June 2021. Output was also down 7.5% MoM in June, or 5.5 million metric tons less.

Chinese steel output accounted for 57.4% of worldwide production in June, up just 0.4 percentage of a point versus May.

Nine out of the top 10 global steel-producing countries saw production declines MoM in June. China reported the largest total tonnage lost versus May, followed by Japan (-700,000 tons, or -8.6%) and India (-600,00 tons, or -5.7%). Turkey and the US rounded out the top five decliners, both seeing output shrink by 300,000 tons each MoM.

By David Schollaert, David@SteelMarketUpdate.com