Market Segment

July 20, 2022

CRU: SDI Enters Flat-Rolled Aluminum, What Happens Next?

Written by CRU Americas

Steel Dynamics (SDI) this week announced plan to enter the aluminium flat-rolled products market. Pledging a $2.2 billion investment in rolling and recycling operations, SDI seeks to leverage its recycling expertise and technology, alongside its performance culture, to penetrate the underserved domestic can sheet and automotive flat-rolled markets in North America.

With a nearly 30-year history of transforming the steel industry using electric arc furnace (EAF) technology, SDI finds aluminium flat-rolled products an adjacent business where their aluminium scrap processing assets and technology, via their OmniSource operations, presents a natural opportunity to grow and offset any substitution risk to their steel business. The 650,000-tonne-per-year mill operations are targeting can sheet (45%), automotive applications (35%) and common alloy (20%) customers.

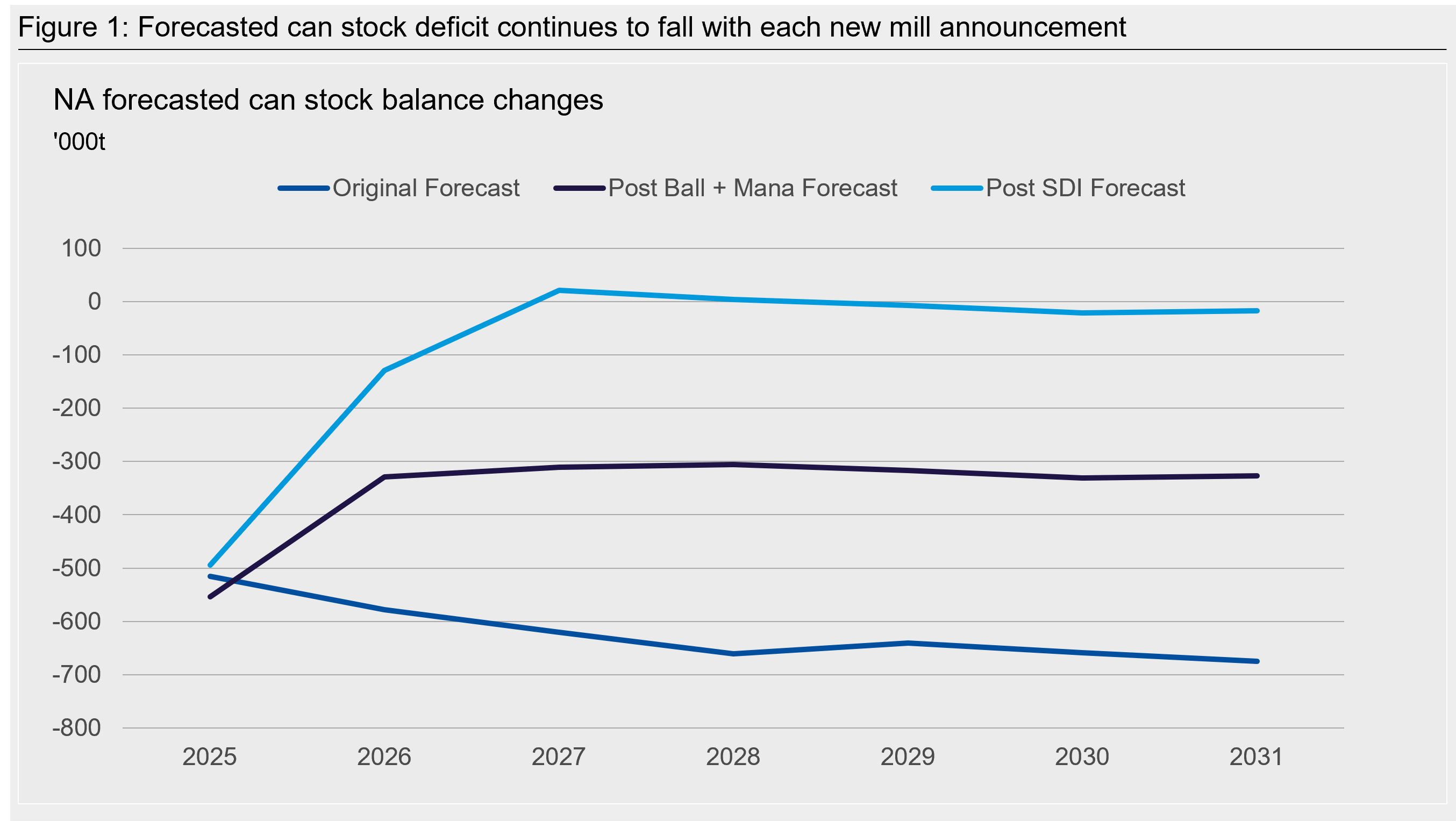

SDI’s steel business already has them connected with automotive and general metal fabrication accounts that cross-over into the aluminium flat-rolled space. New to can making, SDI will need to connect with the North American can sheet customers as domestic demand has outgrown domestic supply. The stopgap import supply measures are expensive for can makers. Import supply chains from Asia and the Middle East are difficult to sustain as transit costs and geopolitical unrest create untenable risk. Yet, today’s import supply sources will not quit the field and cede to these new domestic producers. CRU’s forecast for this new supply volume and our demand forecast for can sheet move from deficit to neutral through 2027 based on the projections provided by Novelis, Manna Capital Partners and Ball Corp. (Manna-Ball), and now SDI.

SDI’s first production will target general fabrication common alloy customers, service centers, and non-exposed automotive applications. These less technical applications will begin to produce the accretive value in 2025 that SDI is using in their investment rationale. Can sheet and automotive body sheet will develop per the requisite qualification process requirements.

Focusing their secondary metals expertise and operational synergies, SDI is planning to build its mill in the US southeast and support it with recycling and slab casting operations in the US southwest and Mexico, where both Novelis and Manna-Ball have found their rationale for a supply base. SDI’s deep secondary metal position sits at the core of this project’s value creation and recognizes perhaps both its strength, and the exposure other aluminum sheet producers have as energy costs curtail some US primary smelting capacity and raise the stakes on secondary metal processing.

As the SDI project progresses, alongside the Novelis Bay Minette and the Manna-Ball Las Lunas mills, CRU will continue to track their operational readiness and forecast the supply-demand balances in these key end use markets. The Aluminum Beverage Can Market Outlook, September 2022, will continue to feature new investments and their global impact.

By Stephen Williamson, stephen.williamson@crugroup.com