Market Data

July 17, 2022

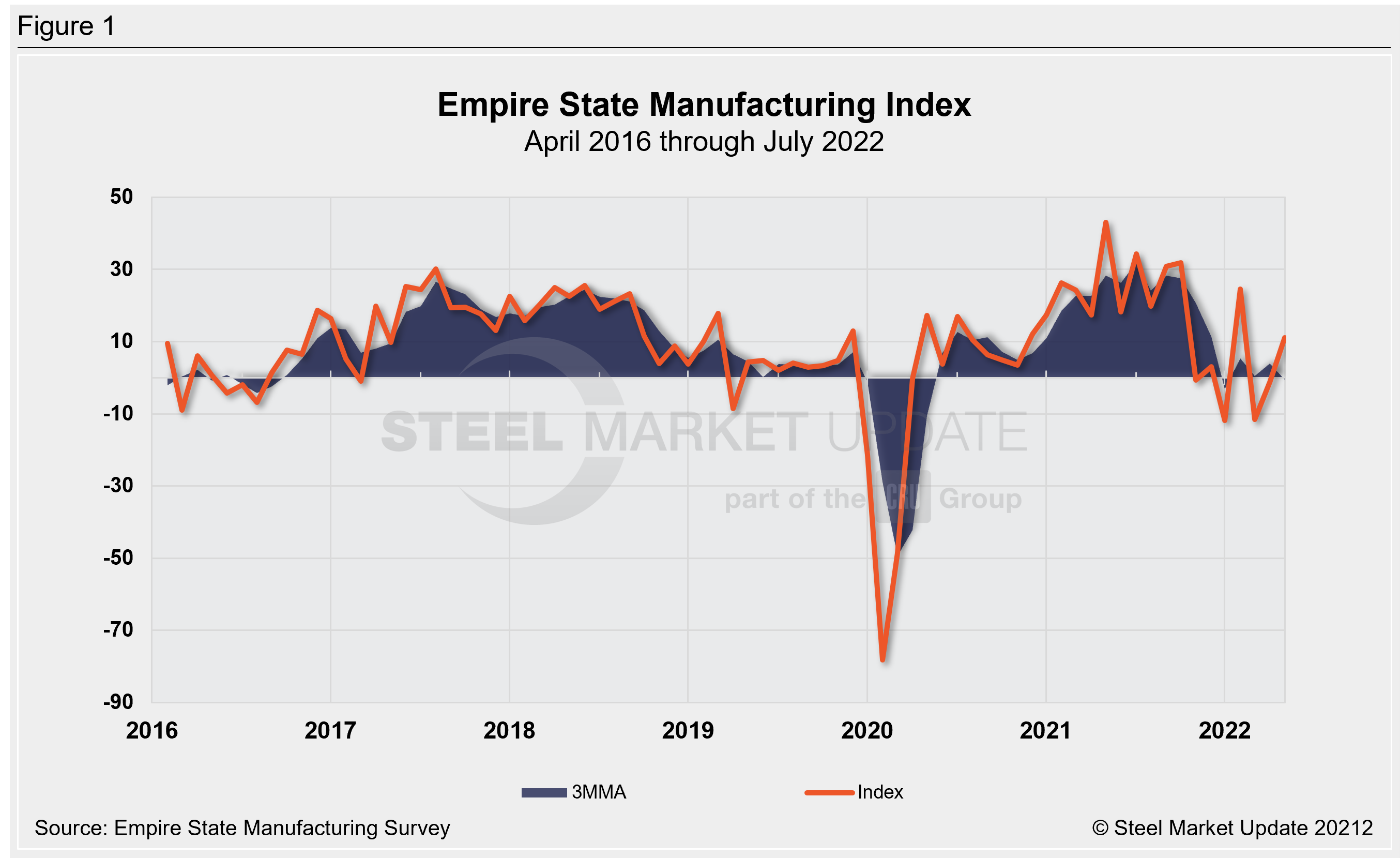

Empire State Manufacturing Improves in July, Outlook Grows Gloomy

Written by David Schollaert

Business activity in the state of New York saw a modest increase in July, following a sideways move the month prior, according to the Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index – a gauge of manufacturing activity in the state – rose 12.3 points in July to 11.1 after being in negative territory for two consecutive months.

The increase was a surprise. Economists had expected a third straight negative reading. (Any reading below zero indicates deteriorating conditions.)

The report provided a few key takeaways. On the one hand, the report said firms turned pessimistic about the next six months as the index of future activity declined a sharp 20 points to -6.2. It is rare for manufacturers to sour sharply on outlook. On the other hand, price pressures, while still elevated, decreased in July. Also, the new-orders index inched up 0.9 points to 6.2 in July. The shipments index surged 21.3 points to 25.3.

Unfilled orders slipped 0.9 points to a reading of -5.2 in July, while delivery times contracted, falling 5.8 points to 8.7. Inventories slipped 2.3 points to 14.8 in July. The prices-received index fell 12.3 points to 31.3, while the prices-paid index fell 14.3 points to a still elevated 64.3.

Employee indexes both fell in July after diverging the month prior. The average workweek index was 4.3 – down 2.1 points versus June’s reading, while employment declined one point to a reading of 18.

Firms were noticeably pessimistic about the next six months, a sentiment expressed only three times in the survey’s history, the report said.

Why the gloom? Orders are not expected to increase, and shipments are expected to be only slightly higher. Delivery times and unfilled orders are expected to decline over the next six months, and expected price increases were lower than in recent months. The capital spending and technology spending indexes fell but remained positive.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com