Analysis

July 15, 2022

North American Auto Assemblies Increase Again in June

Written by David Schollaert

North American auto assemblies grew by 11.1% in June, expanding for the second straight month. Though ongoing supply constraints continue, North American production has steadily improved since bottoming out last December. June’s results are 7.7% ahead of the same year-ago period.

Disruptions across the North American automotive market have been extensive over the past two years. Supply chain snarls and a global semiconductor crisis have battered the sector, leading to production halts, delays, and inventory shortages.

But car manufacturers have been resilient. Though relief from the microchip shortage is not expected in the near term, June’s results are just 7.3% below the pre-pandemic period of June 2019.

North American vehicle production, including personal and commercial vehicles, totaled 1.314 million units in June, up from a downwardly revised 1.183 million units in May. Automotive assembly totals in North America are still behind pre-pandemic totals. Last month’s total was down 104,045 units from June 2019’s production total.

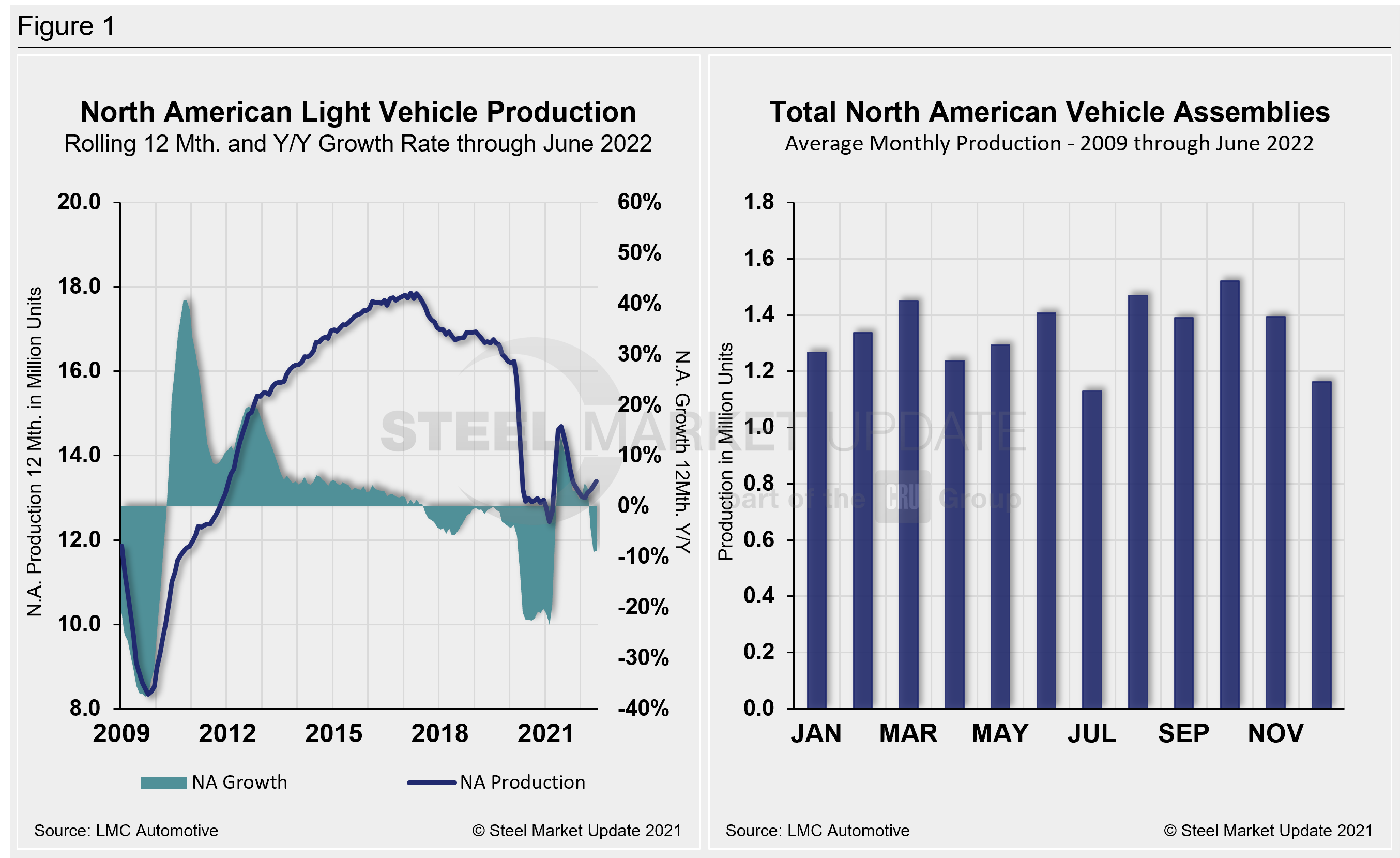

Below in Figure 1 is North American light vehicle production since 2009 on a rolling 12-month and year-over-year growth rate. Also included is average monthly production, including seasonality, over the same period.

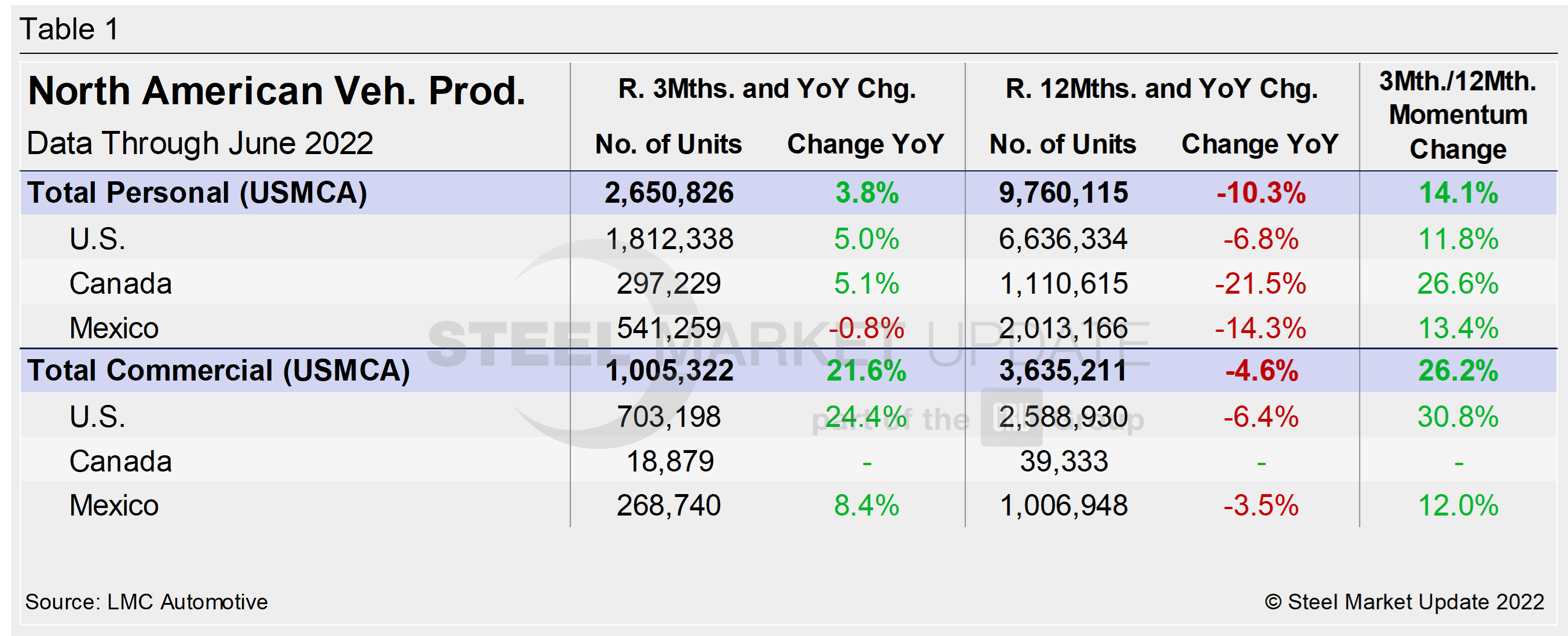

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into US, Canadian and Mexican components, along with the three- and 12-month growth rate for each. On the far right, it shows the momentum for the total and each of the three nations.

Although the initial recovery from Covid’s early spread was noteworthy, the effect of the chip and parts shortage has been more extensive due to its prolonged nature. Through last June, growth rates for personal and commercial light vehicles soared by 156.8% and 127.4%, respectively. But they have since tumbled, owning to the ongoing chip shortage and supply-chain disruptions.

For three months through June, the growth rate for total personal and commercial vehicle assemblies in the USMCA region is up, and a solid turn from double-digit declines at the start of the year. On 12 months through June, the story is much different. Both personal and commercial production is down, directly pointing to the extended impact of the continued chip shortage.

Personal Vehicle Production

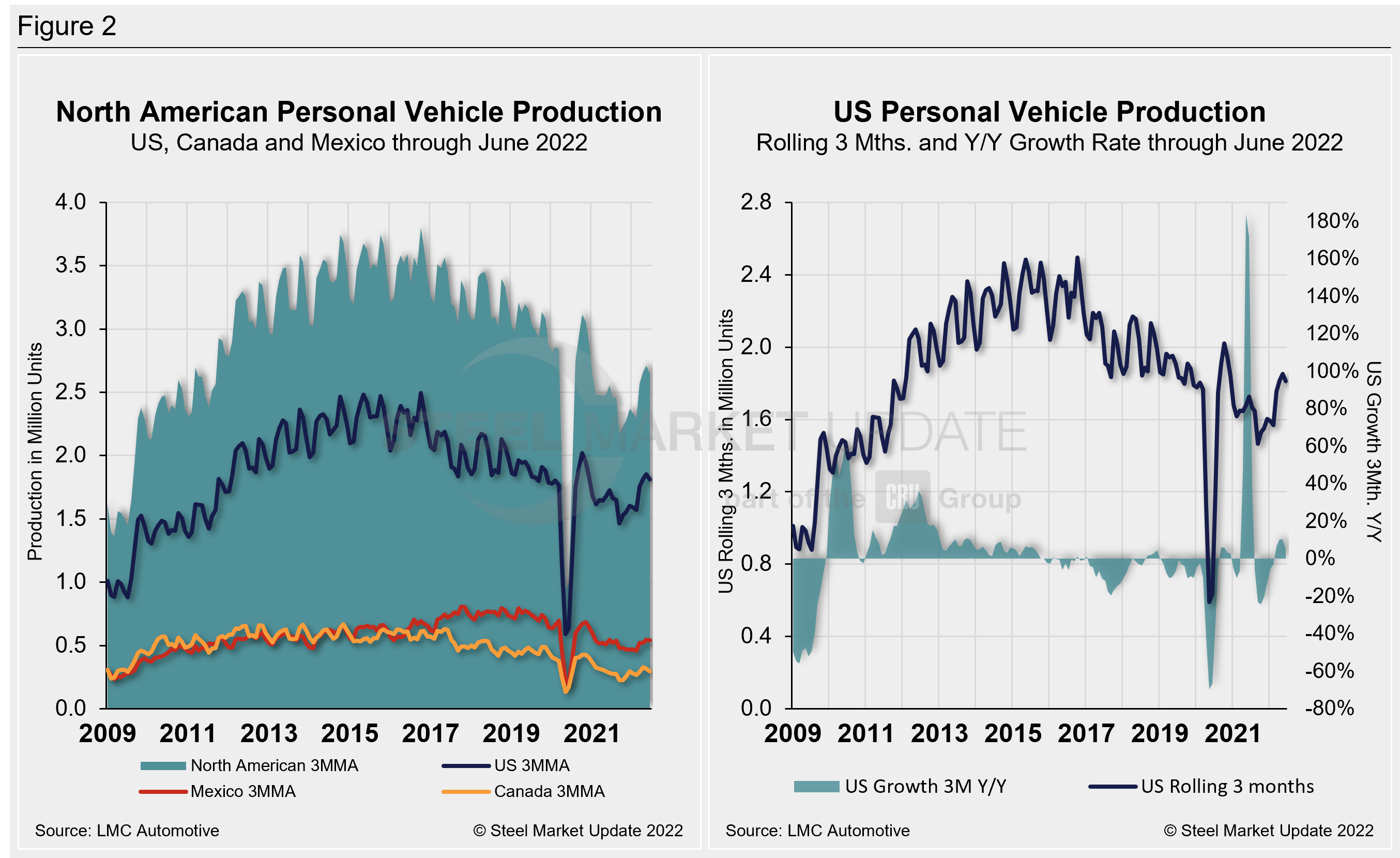

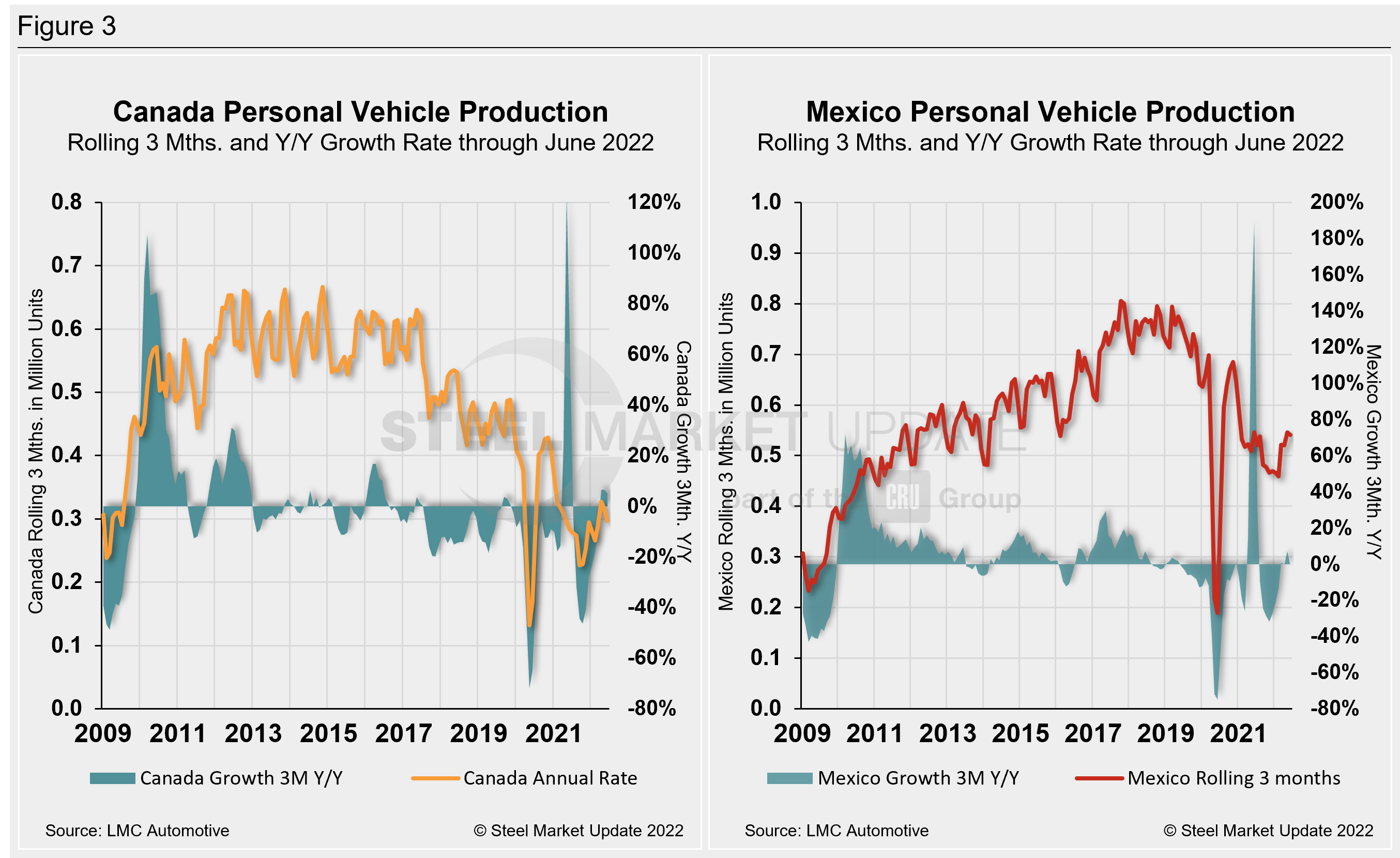

The longer-term picture of personal vehicle production across North America is shown below. The first chart in Figure 2 shows total personal vehicle production for North America and the total for the US, Canada, and Mexico. The production of personal vehicles in the US and the year-over-year growth rate are displayed in the second chart. Figure 3 shows side-by-side the production of personal vehicles in Canada and Mexico and the year-over-year growth rate.

In terms of personal vehicle production, all three – US, Canada, and Mexico – saw MoM gains in June.

The US saw the largest gain in units produced in June versus May, up 67,923 units (+11.7%). Canada saw the largest percentage change MoM, up 27.5%, a boost of 23,085 units. Mexico added 28,852 units in June when compared to May, a 16.5% increase MoM.

The annual growth rate across the region in June accelerated. Canada saw the strongest increase, growing by 3.2% from May to June, followed by the US (+2.5%) and Mexico (+1.8).

Canada’s personal vehicle production share of the North American market slipped slightly to 11.2% from 11.6% MoM in June, while Mexico’s share was 20.4% in June, up from 20.1% the month prior. The US saw its share of the North American market increase fractionally in June, just 0.1 percentage point higher MoM to 68.4%.

Commercial Vehicle Production

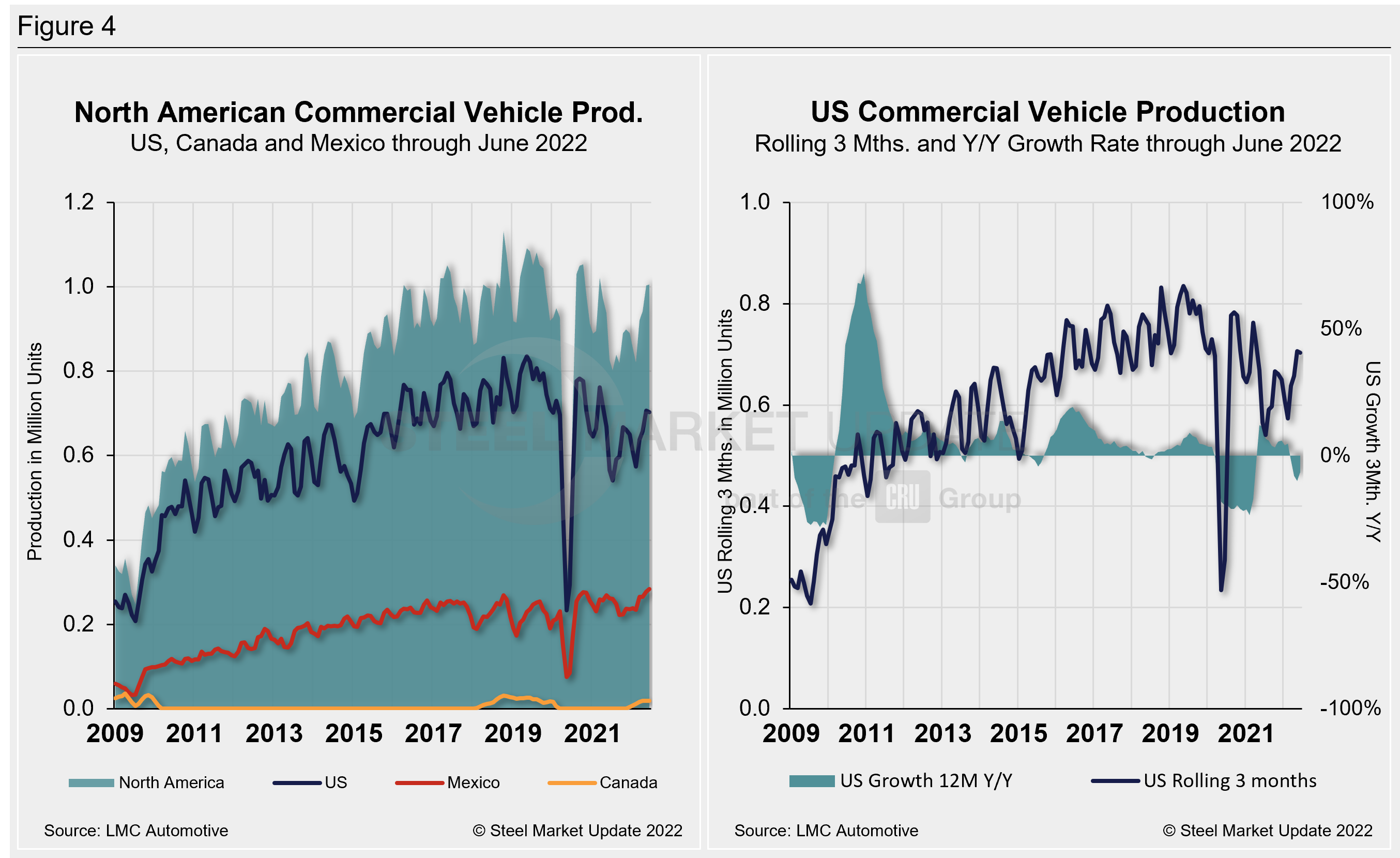

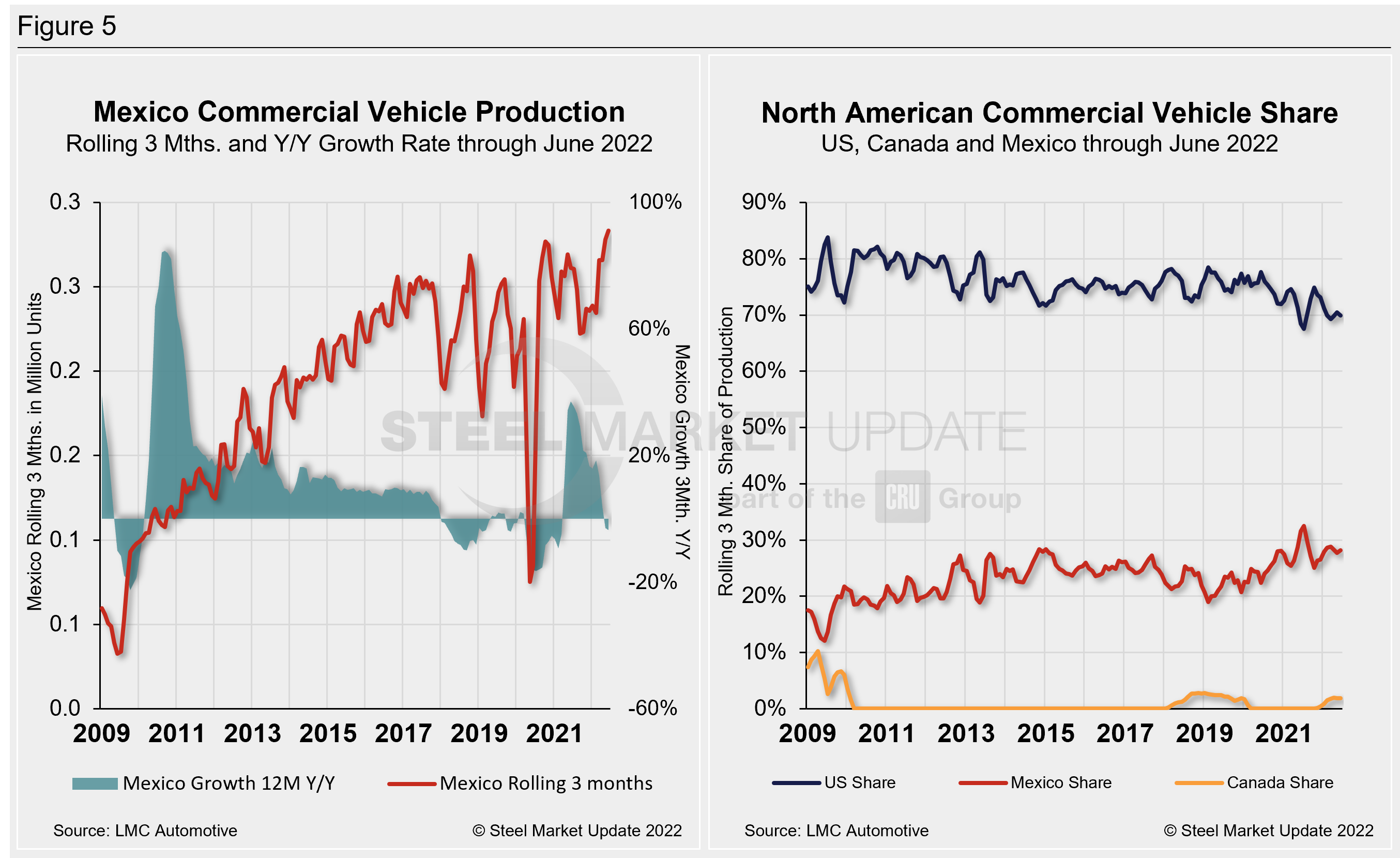

Total commercial vehicle production for North America and the total for each nation within the region are shown in the first chart in Figure 4 on a rolling three-month basis. The production of commercial vehicles in the US and the YoY growth rate are displayed in the second chart. The first chart in Figure 5 shows the production of commercial vehicles and the YoY growth rate in Mexico. The second chart shows the production share for each nation in North America.

Of note for the Canadian automotive sector: June marked Canada’s eighth consecutive month of commercial vehicle production after a 20-month production halt. Canada produced 7,886 light commercial vehicles in June, its highest total since resuming production last November, and a 40.2% increase MoM.

North American commercial vehicle production rose 3.3% in June to 354,385 units from 342,932 units in May. The 11,453-unit gain MoM pushed North American production to its highest monthly total year-to-date. The US saw the greatest unit gain, up 8,355 (+3.5%), followed by Canada, up 2,263 units, and Mexico, up 835 units (+0.9%).

The annual commercial production growth rate is now 24.4% for the region, an improvement from -5.7% in May. The US share was little changed, but slipped to 69.9% in June, down from 70.5% in May. Mexico saw its share increase slightly to 28.2% in June from 27.7% in May, while Canada saw its share stay largely unchanged at 1.9% in June, up just 0.1 percentage point. Presently, Mexico exports just under 80% of its light vehicle production. The US and Canada are the highest volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the US, Canada, and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included).

By David Schollaert, David@SteelMarketUpdate.com