Market Data

July 8, 2022

SMU Survey: More Steel Buyers Report Weakening Demand

Written by Laura Miller

This week’s SMU survey results show a big jump in the number of respondents reporting dwindling demand.

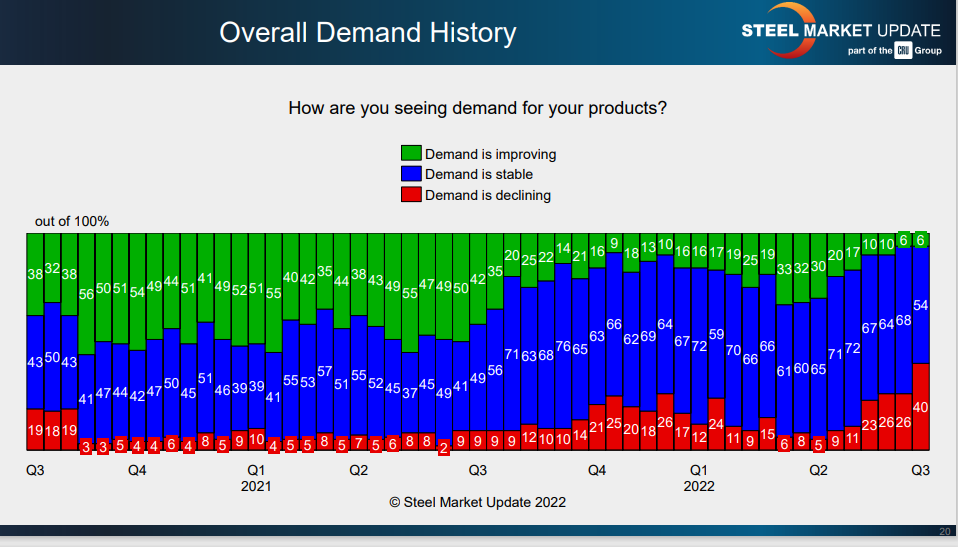

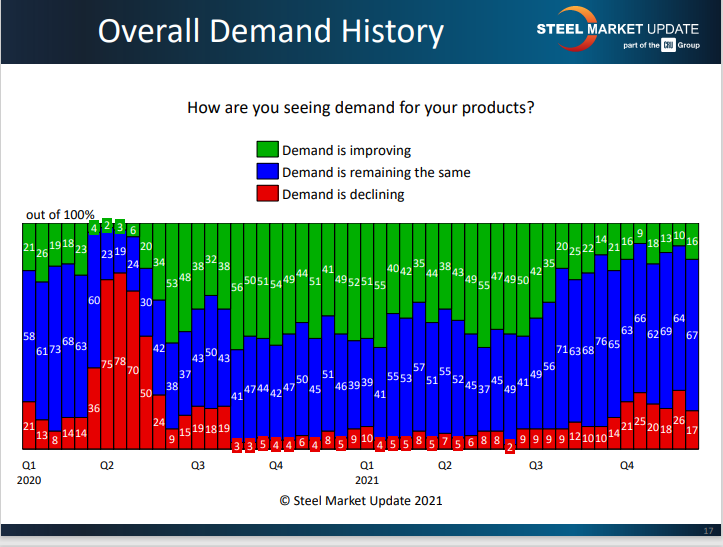

When asked how they are seeing demand for their products, 40% of respondents said demand is declining. That was a jump from the 26% reporting falling demand in the prior two surveys and from only 5% early in the second quarter. (See first chart below.) It is also the highest number of people reporting lower demand since the outset of the Covid-19 pandemic in 2020. (See second chart below.)

Here are some comments from executives from the July 4-6 market survey on how they are seeing demand:

“Our backlog is large but shrinking. Our incoming orders have also declined.”

“Everyone seems to have gotten the message to stop buying.”

“Demand is weak if demand is buying.”

“The smart buyer is only buying what they need to meet immediate requirements.”

“Stable to softening. Auto continues to be slow.”

“Demand is stable now. The construction industry lags the overall market. Other markets are slowing.”

“Order intake will be less in September.”

Declining demand is affecting steel buyers’ sentiment, as SMU’s Buyers Sentiment and Future Buyers Sentiment indices registered some of the lowest levels this week seen since 2020.

By Laura Miller, Laura@SteelMarketUpdate.com